There was a moment of whiplash for traders when silver spiked 6% then dumped 10% within an hour at the end of December. Precious metals are rallying on anticipated Fed rate cuts under new leadership in 2026, the same macro setup that could lift digital assets. Coinbase CEO Brian Armstrong argues Bitcoin actually strengthens the dollar by keeping fiscal policy honest, while California’s proposed billionaire tax has crypto executives warning of mass capital flight.

For anyone focused on the XRP price prediction heading into next year, the backdrop looks pretty solid, with Ripple closing its SEC chapter, stacking $2.7 billion in acquisitions, and falling just 15% against an altcoin market down 42%.

Macro crosswinds shape the XRP price prediction

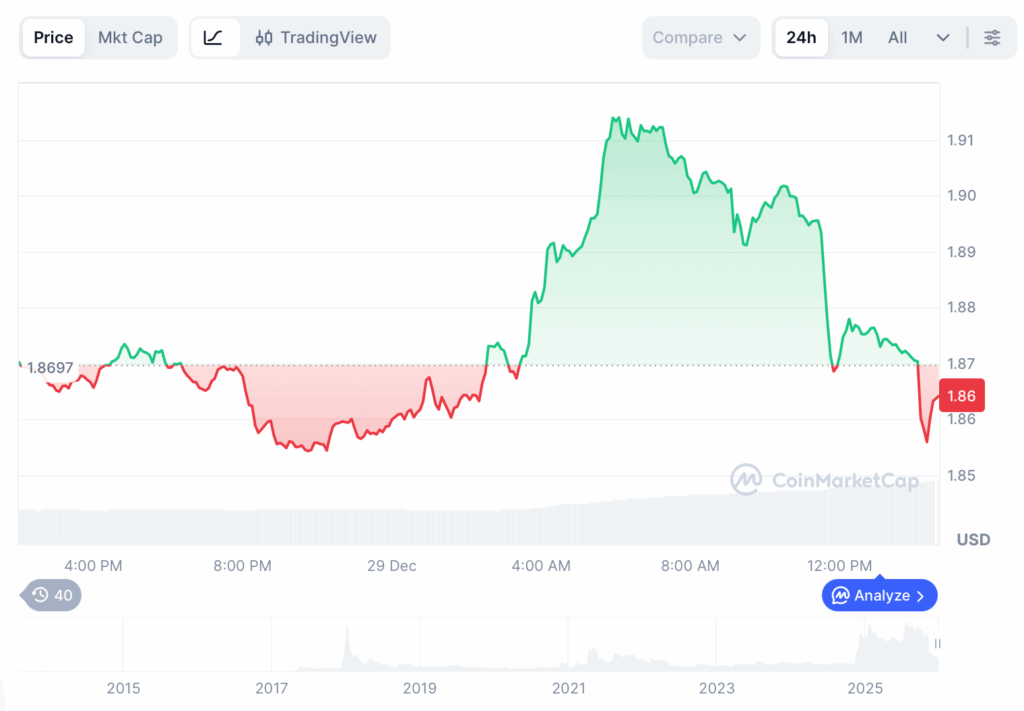

Gold brushed with $4,530 and silver hit $84 before its wild reversal, spiking 6% then dumping 10% within 70 minutes on December 28. The debasement trade is back with force as investors bet against long-term dollar confidence. With a new Fed chair expected in 2026 and rate cuts on the horizon, precious metals and crypto alike are catching bid from macro traders repositioning for looser policy. Bitcoin remains flat over 30 days, but the setup for risk assets looks increasingly constructive.

Coinbase CEO Brian Armstrong argues that Bitcoin actually strengthens the dollar by pressuring fiscal discipline. His stance is that, if inflation outstrips growth, capital flees to BTC, which keeps regulators honest. With US debt climbing above $37 trillion at $6 billion daily, that check-and-balance narrative resonates with institutional allocators weighing XRP price prediction models against macro risk.

Policy uncertainty cuts both directions, though, and California’s proposed 5% billionaire wealth tax drew sharp criticism from Kraken’s Jesse Powell and Bitwise’s Hunter Horsley, who predict capital flight if the measure passes. Norway tried similar measures and watched half its top taxpayers’ wealth leave the country. These crosswinds favor assets with clear utility and jurisdictional flexibility.

Altcoins under the microscope

- DeepSnitch AI

Most retail traders have to find daily ways to clear the hurdle that information reaches insiders first, and that imbalance steers XRP price action just as it does almost every token. DeepSnitch AI is designed to completely unravel that reality, with its surveillance stack of five AI agents watching whale wallets, combing through contracts, reading sentiment shifts, and pushing usable signals to traders before the crowd figures out what’s happening.

Its full launch is fast approaching, but in the meantime, DeepSnitch AI is demonstrating the powerful utility of its platform by shipping tools. Already, SnitchGPT lets those early buyers, who have access to the internal platform, ask plain-English questions about any token and get real-time answers, stitched together through adaptive parsing and multi-source data. Also live already are SnitchFeed and SnitchScan, which sit inside a single intelligence layer where data gets questioned, cross-checked, and turned into instructive information.

Token Explorer breaks down risk with clean visuals, with liquidity depth, holder concentration, and live s all in one, easy view. Gone are the days of tab-hopping and data fatigue, swapped out for questions, swift answers, and clear, decisive directions for how to act.

Staking is uncapped and dynamic, so the larger the pool, the richer the yield across the board.

- XRP

Ripple’s resilience through 2025’s carnage shapes every credible XRP price prediction today. At $1.85, XRP dropped just 15% while altcoins broadly shed 42%, with relative strength rooted in transformed fundamentals. The SEC battle is over. Ripple completed above $2.7 billion in acquisitions across payments, treasury software, and trading infrastructure, and spot investment products now look realistic for any XRP price outlook.

The Ripple forecast hinges partly on Bitcoin’s trajectory. If BTC enters a $250,000 cycle in 2026, XRP’s regulatory clarity and institutional rails could amplify upside disproportionately according to multiple XRP price prediction models.

But while that kind of recovery is a mark of resilience, XRP has too high a market cap for major returns. So, if you’re a trader seeking more substantial gains, it’s worth keeping in mind that DeepSnitch AI has all that same resilience by design, and at a fraction of the market cap, it’s also got far more room to run.

- Cardano

Cardano at $0.365 revisited a major support zone after erasing its election-rally gains, but bulls defended the floor with conviction. This price represents a potential accumulation base for traders betting on broader altcoin recovery alongside any XRP price prediction thesis.

That setup is unfolding against a cautious backdrop. Sentiment remains Bearish, the Fear & Greed Index sits at 24 (Extreme Fear), and ADA logged 11 green days out of the last 30 with 8.01% volatility. These are all conditions that often precede longer consolidation phases rather than clean breakdowns.

Cardano’s methodical development approach appeals to patient holders, though ecosystem growth trails faster competitors. And looking further out, forecasts pointing to a move toward $0.4765 by January 2026 imply roughly 35% upside from current levels, reinforcing the case for steady positioning rather than chasing short-term bursts.

Final thoughts

XRP market trends and every credible XRP price prediction point toward cautious optimism grounded in real progress. But for 100x gains, rather than 2x, DeepSnitch AI is well-timed and trumps large-cap selection by miles.

The platform combines live utility, surging capital, and early-stage pricing, the exact profile that historically produces outsized winners beyond any XRP price outlook.

FAQs

What is the XRP price prediction for 2026?

The XRP price outlook ties closely to Bitcoin’s cycle, and if BTC hits $250,000, Ripple’s regulatory clarity could drive meaningful upside.

Is XRP better than crypto presales per the Ripple forecast?

XRP offers stability and institutional adoption under current forecasts.

What XRP market trends matter most heading into 2026?

Key market trends include spot ETF potential and cross-border payment growth shaping every XRP price prediction.