Iran Sees Fresh Protests as Rial Collapse Sparks Bitcoin Debate

Quick Breakdown

- Iran’s rial has plunged to record lows, sparking protests in Tehran and forcing the central bank governor to resign.

- Bitcoin advocates argue the crisis highlights crypto’s role as a hedge against currency collapse, despite strict mining regulations.

- Iran’s banking system faces mounting risks, with multiple banks under threat of bankruptcy or dissolution.

Protests broke out across Tehran on Monday after Iran’s currency plunged to historic lows, deepening public anger over economic mismanagement and eroding household savings.

The Iranian rial has now weakened to around 1.4 million per US dollar, marking one of the sharpest currency declines in its history. Many Iranians blame the collapse on poor central bank policies, compounded by sanctions and recent regional conflicts.

Currency crisis fuels public outrage

The protests come just months after Iran’s brief but costly military confrontation with Israel in June, a period during which the rial lost more than 40% of its purchasing power. to the Financial Times, the scale of the decline highlights decades of structural weakness in Iran’s monetary system.

1.42 million rial per dollar

The official rate in the early 1980s was **70 per dollar**

— Alex Gladstein 🌋 ⚡ (@gladstein) December 30, 2025

Alex Gladstein, chief strategy officer at the Bitcoin-focused Human Rights Foundation,

Political pressure intensified further after Central Bank Governor Mohammad Reza Farzin resigned, injecting new uncertainty into an already fragile economic environment.

Bitcoin emerges as a store-of-value argument

Amid the turmoil, Bitcoin advocates have pointed to the crisis as proof that decentralized assets matter. Bitwise CEO Hunter Horsley

While cryptocurrency trading is legal in Iran, regulations around self-custody remain unclear, and Bitcoin mining faces heavy government oversight.

Mining crackdowns and missed opportunities

Despite Iran’s access to heavily subsidized electricity, which could allow Bitcoin mining at an estimated $1,300 per BTC, authorities have cracked down on unregistered miners.

VanEck’s head of research, Matthew Sigel,

Banking sector under growing strain

The currency collapse is also exposing deep fractures in Iran’s banking system. In October, state-owned Bank Melli

Further damaging confidence, Iran’s largest crypto exchange, Nobitex, suffered an $81 million hack in June, after which crypto transaction volumes fell by 11% amid escalating tensions with Israel.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Year in Stablecoins 2025: Record Growth as GENIUS Act Opens the Floodgates

Long-Awaited Spot ETF Application Filed for Surprise Altcoin

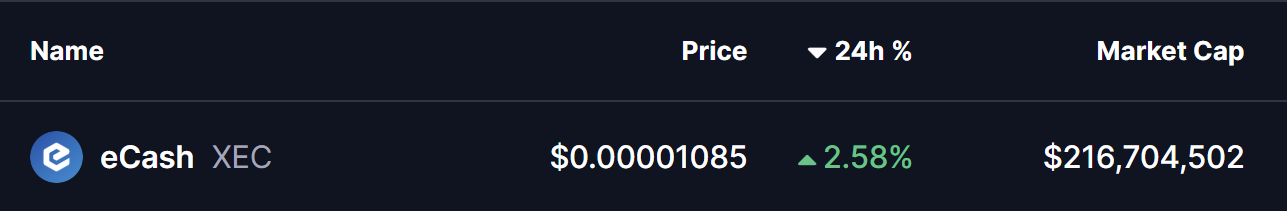

eCash (XEC) To Rise Higher? This Emerging Bullish Pattern Suggests So!

Will Early 2026 See a “Liquidity Bomb” That Sparks a New Crypto Supercycle?