China’s Rich Are Repricing Property Against Bitcoin — and Housing Is Losing

By:BeInCrypto

Affluent Chinese investors are increasingly questioning whether luxury real estate still deserves its long-held status as a safe store of value. Viral discussions on Chinese social media now show 6066 million ($414,000$455,000) homes in Shenzhen Bay being weighed directly against Bitcoin, Nvidia stock, and BNB. Not as symbols of status, but as competing assets in a global portfolio. Crypto vs Concrete: Why Chinas Wealthy Are Questioning the Value of Owning Homes The shift is striking, with Shenzhen Bay having long been considered one of mainland Chinas most prestigious and resilient property markets. Yet recent posts suggest that even this enclave is no longer immune. One widely shared account described touring a 66 million property while warning a friend that its value could fall to 30 million within three years. According to the post, prices in the area have already dropped by nearly 50%. Further downside is expected if a broader financial crisis hits. Houses themselves dont have intrinsic value; buying a house must be viewed from an investment perspective, the user wrote, citing commentary attributed to TRON founder Justin Sun. When placed into a broader asset pool alongside globally liquid instruments such as Bitcoin, Nvidia shares, and BNB, the conclusion, the poster argued, becomes pretty clear. Other investors echoed the anxiety. One user admitted to taking on a 60 million mortgage in Shenzhen, saying they were unsure whether to be happy or uneasy. Indeed, took on a 60 million mortgage, Shenzhen CITIC City Opening Xinyue Bay. My mood doesnt know whether to be happy or uneasy, the user stated. Another joked about becoming a house slave. They noted that only paying in full spared them the full psychological burden of debt. Still others urged caution, pointing to high mortgage rates, rising housing supply, and the risks of concentrating capital in a single illiquid asset. Beyond price declines, the debate reflects deeper concerns about liquidity and political exposure. Investors argue that high-end properties have become increasingly difficult to exit quickly and are increasingly visible to regulators. Buying a home worth 100 million or more can invite tax scrutiny and investigations. This adds layers of risk during periods of policy tightening. In contrast, crypto and global equities are viewed as easier to hedge, trade, and move across borders. Hong Kongs Property Premium Is About Freedom, Not Returns This comparison also reframes why Hong Kong property continues to command a premium. According to one post, the appeal lies less in expected returns and more in trading money for freedom. European real estate, which can offer residency or passport pathways for far less capital, was cited as another example of property serving mobility rather than prestige. Mainland luxury housing, by contrast, was portrayed as offering neither strong returns nor optionality. Some investors likened the current housing market to Chinas A-share equities. Domestic assets, they argued, tend to fall during geopolitical stress but fail to rally when global markets rise meaningfully. Real estate, particularly in Shenzhen Bay, appears to exhibit this asymmetry. It is vulnerable during downturns, yet stagnant during risk-on periods. The implications extend beyond property. Crypto is no longer being framed primarily as a speculative bet, but as a strategic tool for capital preservation and flexibility. Younger investors, largely priced out of luxury housing, are opting out altogether. They favor digital assets and international equities, which offer clearer risk profiles and easier access. Repricing luxury real estate against Bitcoin and global equities signals a structural shift in Chinese wealth management. As capital mobility becomes paramount and political scrutiny intensifies, liquid global assets are increasingly displacing property as the preferred vehicle for preserving value. How regulators respond, and whether property prices stabilize, may shape Chinas domestic markets. It could also influence the next phase of global crypto adoption in the country.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Most supply chains won’t be ready for transparency | Opinion

Crypto.News•2025/12/30 15:39

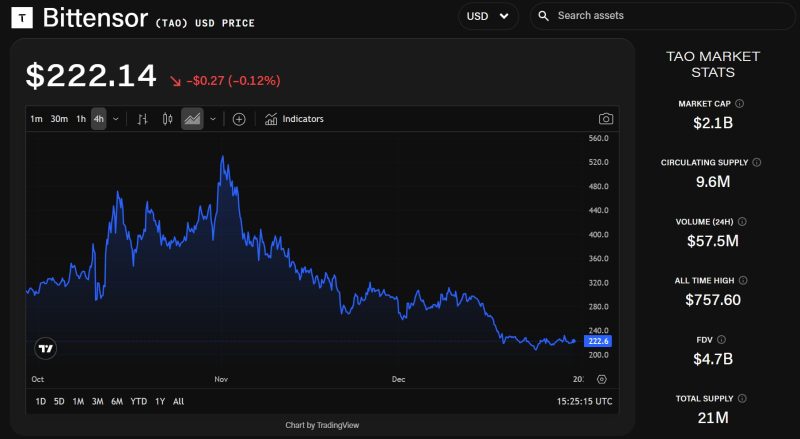

Grayscale files for spot Bittensor ETF following network's first halving event

The Block•2025/12/30 15:33

Blockchain Losses Soar to $2.93B Despite Fewer Incidents in 2025

Coinomedia•2025/12/30 15:27

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$88,588.77

+1.08%

Ethereum

ETH

$2,981.04

+1.52%

Tether USDt

USDT

$0.9989

+0.01%

BNB

BNB

$859.97

+0.79%

XRP

XRP

$1.87

+0.10%

USDC

USDC

$0.9996

+0.01%

Solana

SOL

$124.5

+0.63%

TRON

TRX

$0.2850

+1.06%

Dogecoin

DOGE

$0.1243

-0.02%

Cardano

ADA

$0.3527

-3.68%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now