Analyst Says XRP Price On The Verge Of Bearish Breakdown

The XRP price has been bearish all through December, with key support zones failing to hold through the growing sell pressure. While the altcoin hovers around the $1.80 price level, recent on-chain evaluation shows that the XRP price could be in a precarious situation.

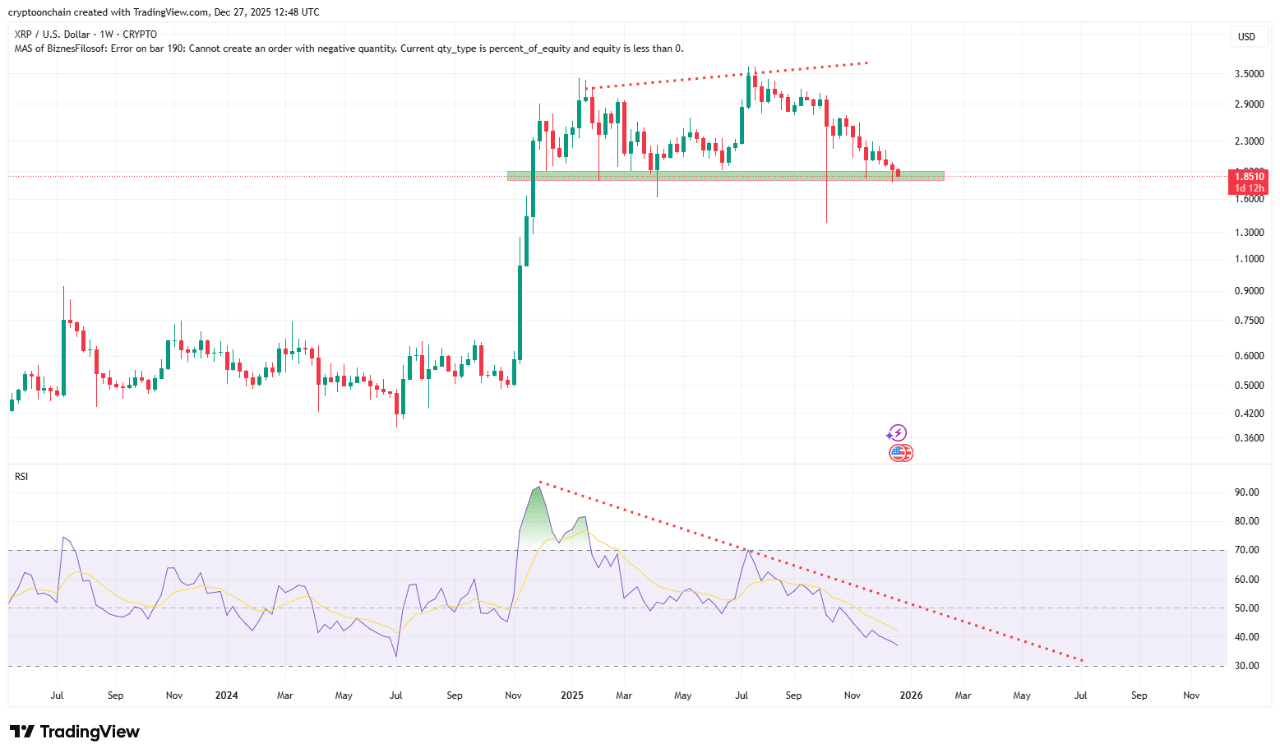

Bearish Divergence Materializes Between RSI And XRP Price

In a Quicktake post on the CryptoQuant platform, market analyst CryptoOnchain highlighted that there is a convergence of both technical and on-chain events, which reveal an imminent bearish phase for the XRP price.

The analyst first pointed out that the XRP price is painting an unsettling picture on its weekly chart, basing this hypothesis on the technical context. While the XRP price hovers near recent highs, indicating intentions to recover previous levels, its momentum tells a contrasting story.

CryptoOnchain explained that a bearish divergence has formed between the Relative Strength Index (RSI) and the XRP price. So, as the XRP price appears to target recent highs, the RSI has taken on a clear downturn, creating lower highs progressively.

Usually, this type of divergence indicates weakening buying strength and dwindling momentum. Interestingly, historical data reveal that this pattern has often preceded significant price corrections.

Source: CryptoQuant

Source: CryptoQuant

At the same time, the XRP price happens to be retesting the psychological and technical key level at $1.80. The market quant explained that in the event that $1.80 fails to hold, the altcoin could quickly see the beginning of an unbridled dump.

Looking at the broader technical context, it becomes apparent that any significant upside attempt depends on improving momentum.

Open Interest On Binance Cascades To New Low

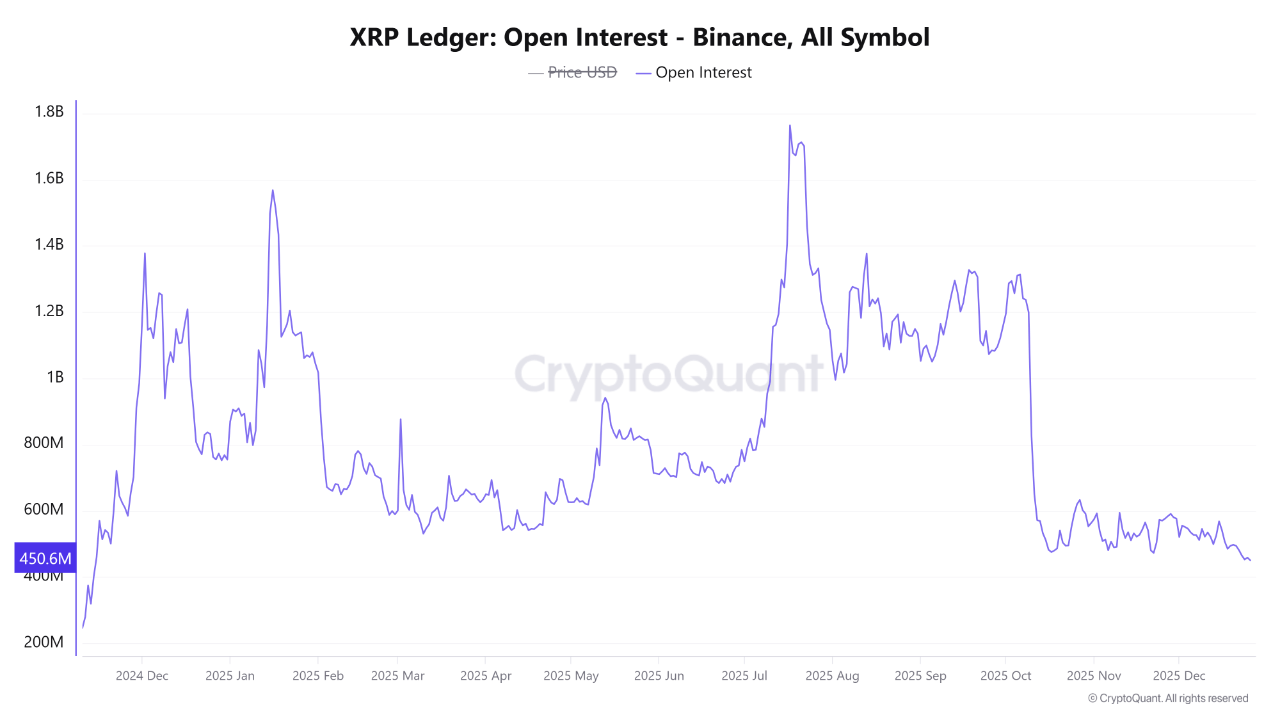

CryptoOnchain also cites a shocking development underneath the surface. The relevant indicator here is the Open Interest, which tracks the total value of all outstanding XRP derivatives contracts (on Binance) that have yet to be closed, settled, or liquidated at a given time.

Source: CryptoQuant

Source: CryptoQuant

XRP’s open interest recently fell to as low as $450 million, a point marking the lowest level since November 2024. A sharp decrease in Open Interest typically points out that there’s been a significant efflux of leveraged capital from the futures market.

This kind of unchecked contraction suggests that XRP traders are either forcefully exiting the market or abandoning their positions out of fear. Moreover, the decline in Open Interest alongside weakening price momentum paints a narrative on investor interest; it shows that market participants are stepping back due to a lack of conviction, rather than positioning for upward continuation.

With these signals converging to expose a strong bearish scenario for XRP, market participants are advised to act with caution, as the $1.80 key level’s defeat could mean serious trouble for the token’s price. As of this writing, XRP is valued at approximately $1.87, with a 1.5% price jump in the past 24 hours.

The price of XRP on the daily timeframe | Source: XRPUSDT chart on

TradingView

The price of XRP on the daily timeframe | Source: XRPUSDT chart on

TradingView

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Michael Saylor Signals New Bitcoin Moves as 2025 Predictions Dive

Hacked Cryptocurrency Platform Issues Statement and Latest Updates

Deepsnitch AI Vs Bitcoin Hyper as Privacy Trends Spark Hunt for High-Utility AI Tokens

IMF Says Brazil’s System Is Working—So Why Is Crypto Booming Without a Crisis?