XRP Supply Shrinks As ETFs Absorb Massively Ahead Of 2026

XRP is slowly entering one of the most important structural phases in its history. Price action has been mostly bearish and sentiment across the broader crypto market has been cautious, but on-chain data tells a very different story.

Data from Glassnode shows XRP balances on centralized exchanges falling to around 1.5 billion XRP, their lowest in over a year. This trend is unfolding alongside accumulation from newly launched XRP ETFs, creating conditions that could change the altcoin’s price dynamics heading into 2026.

XRP Exchange Balances Fall To Multi-Year Lows

Data from Glassnode’s XRP balance on exchanges metric points to a clear and persistent downtrend in balances held on crypto exchanges throughout 2025. Earlier in the year, about 4 billion XRP sat on centralized platforms.

Since then, balances have steadily declined, with a particularly sharp drop visible in the fourth quarter of the year. As it stands, exchange-held XRP has compressed toward the 1.5 billion mark, one of the lowest levels recorded in recent years.

This decline has occurred despite the current downtrend in XRP’s price action, meaning that some holders are increasingly opting to move tokens into longer-term custody, even as some others are selling off their holdings. This trend is important for bullish momentum, as falling exchange balances reduce near-term sell pressure and make cryptocurrencies more sensitive to incoming demand.

XRP: Balance On Exchanges (Total)

XRP: Balance On Exchanges (Total)

At the center of this supply contraction are US-based Spot XRP ETFs, which have risen as a powerful new source of demand. Market estimates indicate that about 750 million XRP have been absorbed by the six Spot ETF products since the first one launched in November.

As ETFs continue pulling XRP off exchanges, the pool of liquid supply available to the spot market keeps shrinking. This dynamic does not force an immediate price response, but it changes the balance between supply and demand, and we could the crypto in 2026.

XRP market cap currently at $113 billion. Chart: TradingView

XRP market cap currently at $113 billion. Chart: TradingView

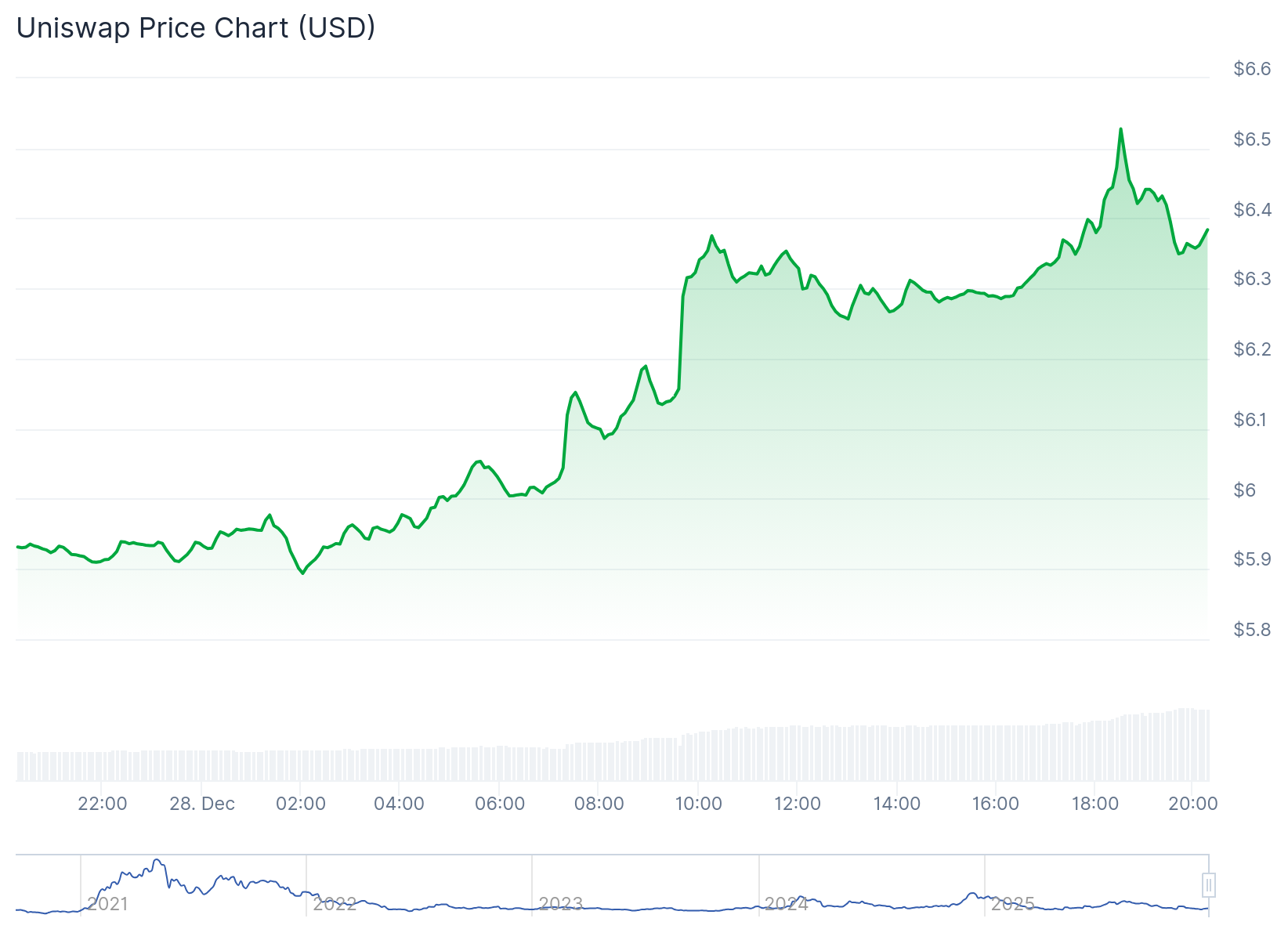

Weekly Chart Points To Exhaustion As XRP Sits On Support

While on-chain data highlights tightening supply, technical conditions are beginning to reflect a similar theme. Crypto analyst Steph Is Crypto recently pointed out that XRP is now sitting on an important horizontal support zone on the weekly timeframe.

The chart shows XRP’s price action is now compressing into the $1.90 to $2.00 range after an extended decline from mid-2025 highs near $3.50, placing XRP back at a level that previously acted as a launch point earlier in the cycle.

Furthermore, the weekly Stochastic RSI is now in extreme oversold territory and this means that selling pressure has already done much of its work.

XRP/US Dollar Weekly Chart. Source: @Steph_iscrypto On X

XRP/US Dollar Weekly Chart. Source: @Steph_iscrypto On X

Steph’s analysis noted that turning points tend to form when downside momentum is exhausted and there is little energy left for sellers to continue pushing price lower. Based on this, traders can expect XRP to transition into bullish momentum in early 2026.

Featured image from Gemini, chart from TradingView

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Husky Inu AI (HINU) Completes Move To $0.00024394

XRP Holds $1.6963 Support as Triple Bottom Signals Potential Reversal

Why WeTransfer co-founder is building another file transfer service