Ethereum Pauses Mid-Range As Market Awaits A Clear Signal

According to Cryptowzrd’s latest technical outlook, Ethereum ended the session with an indecisive close, offering little clarity on immediate direction. With the weekend likely to bring thinner liquidity, patience remains key as the focus shifts to waiting for a cleaner structure and a more reliable scalp opportunity to emerge.

Tight Ranges Signal Indecision As Volatility Wanes

Cryptowzrd went on to explain that Ethereum’s daily candle closed indecisively, mirroring the lack of clear direction seen across the broader market. ETHBTC also ended the session without conviction, reinforcing the idea that momentum remains muted for now.

The uncertainty extended to the higher timeframes as well, with the weekly candle closing indecisively across most ETF and CME charts. This type of price behavior suggests hesitation among market participants, making it challenging to establish a strong directional bias in the near term.

According to the update, healthier price action from ETHBTC will be required before Ethereum can develop a clearer trend. That process may take time, as the pair often leads Ethereum’s relative strength and overall structure.

Source:

Chart from CryptoWzrd on X

Source:

Chart from CryptoWzrd on X

At the time of the post, Ethereum was trading close to the $2,800 support target zone. Holding this area maintains the broader structure, while a stronger bullish push in the future could open the door for a move toward the $3,700 resistance region.

For now, the focus shifts to the lower time frame charts over the weekend, where short-term scalp opportunities may emerge. However, expectations remain measured given the indecisive conditions and typically lower liquidity during weekend sessions.

Range-Bound Action Keeps Ethereum Traders On The Sidelines

In a conclusive summary, the analyst observed that the intraday chart remains characterized by choppy and sluggish price action. The market is currently confined to a narrow range, lacking the decisive momentum required to establish a clear trend. This period of consolidation suggests a “wait-and-see” approach is necessary as the asset stabilizes between its immediate boundaries.

Specific price triggers have been identified to determine the next major move. A break below the $2,880 support level would likely signal a shift toward further bearish decline, whereas a move above the $3,060 resistance would open the door for sustained upside and new long opportunities.

Ultimately, the analyst emphasizes the importance of patience, noting that the current market environment requires a more mature chart structure before the next high-probability trade can be executed. Until the price breaks out of this intraday range and develops a more defined pattern, the strategy remains defensive to avoid the risks associated with the current volatility.

ETH trading at $2,934 on the 1D chart | Source: ETHUSDT on

Tradingview.com

ETH trading at $2,934 on the 1D chart | Source: ETHUSDT on

Tradingview.com

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altcoin Market at Make-or-Break Levels: 5 High-Risk Buys as Dominance Nears Potential +40% Move

Asia is quietly building a counterweight to the dollar stablecoin empire, and the West isn’t ready

Bitcoin 4-Year Cycle Is Dead: Famous Crypto Trader Explains What Happens Next

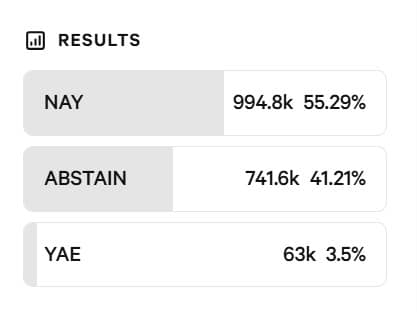

Aave DAO votes down brand control plan as altcoin falls by 14% – Explained