- APT fell to $1.56, tracking broader crypto market weakness and reduced holiday trading activity.

- Strong support held at $1.56, while resistance near $1.63 limited upside attempts.

- Low volume and tight ranges keep Aptos price action uncertain in the short term.

Aptos — APT, has slipped back into focus as price action tightens across the crypto market. The APT token declined to $1.56 while broader market sentiment weakened. Traders now face low volume, firm support, and persistent resistance. Holiday conditions reduced participation, yet technical levels continue shaping near-term expectations. With volatility compressed and momentum muted, APT remains at a critical decision point where direction depends on renewed activity.

APT Follows the Broader Market Lower

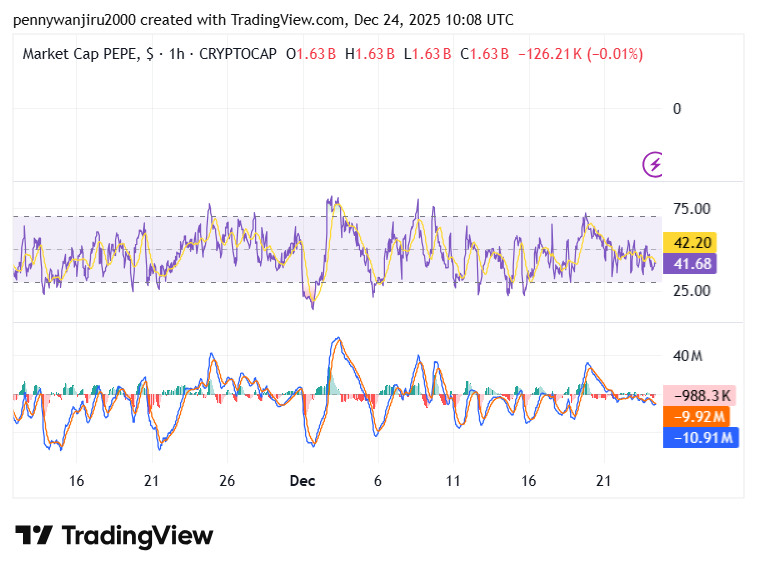

APT posted a 1% decline over the past 24 hours, settling near the $1.56 level. The move aligned closely with weakness seen across major cryptocurrencies. The 20 index also dipped, confirming a broader risk-off environment. Thin liquidity during the holiday period reduced conviction from both buyers and sellers, leading to cautious positioning. Trading activity stayed confined within a narrow $1.56 to $1.62 range.

This tight structure reflected uncertainty rather than panic selling. Buyers repeatedly defended the $1.56 zone, suggesting confidence around that level. Sellers maintained control near $1.63, preventing any meaningful upside continuation.Intraday volatility remained limited near 3.6%, reinforcing the absence of strong directional pressure. Price swings stayed shallow even during brief volume surges.

Market participants appeared content waiting for clearer signals before committing capital. This hesitation kept price action orderly but stagnant. Volume trends highlighted the same cautious tone. Overall APT’s trading activity dropped 11% below the 30-day average. Such conditions often appear during holiday periods when participation declines. Lower liquidity allowed isolated orders to influence short-term price movement without creating follow-through.

Support Holds as Traders Watch for a Breakout

Technical levels continue to dominate short-term analysis for APT. Support near $1.56 remains the primary defense zone for buyers. Repeated holds at this level strengthened confidence among range-focused traders. A breakdown below that area would likely trigger a retest of $1.52. Recent price action revealed a developing double-bottom pattern near $1.52 support. This formation often signals seller exhaustion after extended pressure.

Previous rebounds from that zone carried price back above $1.56. Such behavior points to quiet accumulation beneath the surface.Resistance near $1.63 continues capping upside attempts. Another supply area sits between $1.58 and $1.585, where selling interest has emerged. A sustained move above that zone would require stronger participation. Volume confirmation would play a critical role in validating any breakout.

Selective accumulation also appeared despite subdued conditions. Several volume spikes exceeded 46,000 tokens within short windows. These moves suggested strategic positioning rather than broad enthusiasm. Demand, however, remains insufficient to drive a sustained rally.