-

Bitcoin’s volatility has just increased, with the price trading above $89,000, driven by options expiry, which usually results in a cleaner move

-

The upcoming weekend could play a vital role in shaping the Bitcoin price action in 2026, as it seems to be largely dependent on the weekend liquidity

After maintaining a choppy trade for a few days, the Bitcoin price rose slightly but failed to sustain above $89,000. Meanwhile, due to the pullback, the volatility seems to have risen as the token is heading into the weekend at a sensitive point. Besides, it has moved past the current options expiry after days of consolidation, which is a structural event that quietly changes the price behaviour. With the liquidity thinning over the weekend, it would be interesting to watch how the BTC price rally could unfold ahead of the year-end trade.

Bitcoin Compressing Near Key Levels

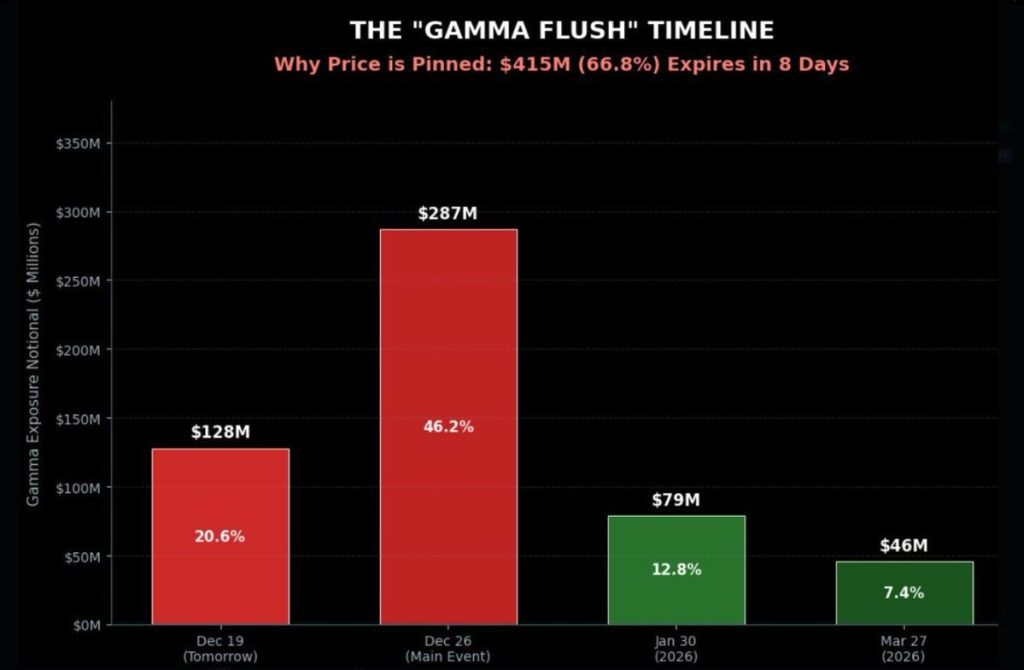

Bitcoin’s tight consolidation is largely gamma-driven, not a lack of interest. Nearly $415M of total gamma exposure (about 67%) sits in near-dated expiries, with December 26 alone accounting for roughly $287M. This concentration has kept BTC mechanically pinned, muting follow-through on both breakouts and pullbacks.

As price moves within this window, dealer hedging absorbs momentum, reinforcing range-bound trade. That explains why recent attempts to break key levels have stalled quickly. Once the December 26 expiry passes, this gamma concentration falls sharply, with exposure rolling into much smaller January and March buckets. This unwind does not create selling pressure. Instead, it removes the structural force suppressing volatility.

Post-expiry, Bitcoin shifts from a gamma-pinned environment to a flow-driven one. Range breaks are more likely to extend, but direction will depend on spot demand, volume, and acceptance, not options mechanics.

- Also Read :

- Solana Price Analysis: Is SOL Setting Up for a Bullish Correction or Another Leg Lower?

- ,

Bitcoin Price Prediction for Weekend: Can it Reach $90,000?

Bitcoin is entering a decisive phase after a sharp sell-off earlier this month, followed by stabilisation near the $88,000–$90,000 zone. The daily chart shows BTC attempting to base after losing the $100,000 psychological level, with price now moving inside a clearly defined ascending channel. With the December 26 options expiry behind us and weekend liquidity thinning, traders are closely watching whether this consolidation turns into a sustained recovery or another volatility-driven move.

Technically, BTC is trading within an ascending channel, suggesting short-term structural recovery rather than trend reversal. The mid-channel region near $88,500 is acting as a pivot. DMI shows a weakening trend strength, with +DI and -DI converging, pointing to consolidation. Meanwhile, CMF has slipped below zero, indicating cautious capital flows. A daily close above channel resistance could open upside toward $94,000, while a breakdown below channel support risks a drop toward $85,000.

What to Expect From Bitcoin Price Action This Weekend

With Bitcoin trading inside a narrow range and options-related constraints now fading, the weekend is likely to act as a volatility test rather than a trend-defining move. If the BTC price holds above the $88,000–$89,000 support zone and attracts fresh spot volume, the structure favors a gradual push toward $92,000, surpassing $90,000.

However, failure to defend this area could trigger a quick downside sweep, amplified by thin weekend liquidity. With this, the Bitcoin price may remain consolidated within the pattern below the average range of the channel.

FAQs

Lower liquidity means fewer orders are available to absorb large trades, which can exaggerate price moves. This often leads to sharper swings that don’t always reflect a true change in market sentiment.

Short-term traders and market makers feel the impact first, as price becomes more sensitive to real buying and selling. Long-term holders are less affected unless volatility triggers broader trend changes.

Early-week institutional flows and macro news can reinforce or fade any weekend move. Strong follow-through on Monday often determines whether a breakout was meaningful or temporary.