Date: Fri, Dec 26, 2025 | 10:28 AM GMT

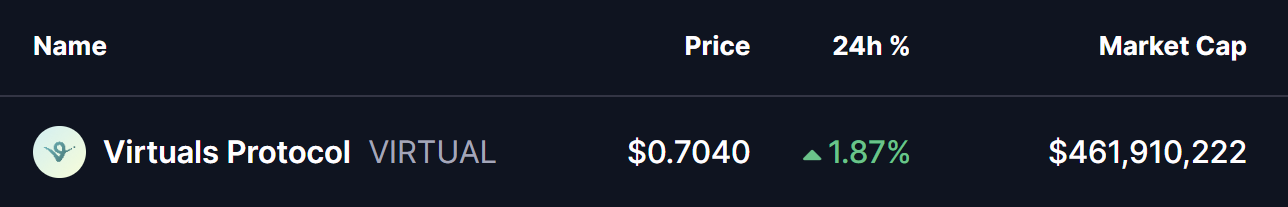

The broader cryptocurrency market is showing modest strength, with both Bitcoin (BTC) and Ethereum (ETH) trading in the green. This steady performance from the majors has helped stabilize overall market sentiment, allowing several altcoins to begin forming constructive technical structures including Virtuals Protocol (VIRTUAL).

VIRTUAL is currently trading slightly higher on the day, but the real story lies beneath the surface. The daily chart structure is beginning to hint at a potential shift in momentum, suggesting that sellers may be losing control as buyers quietly step back in.

Source: Coinmarketcap

Source: Coinmarketcap

Falling Wedge Pattern Signals a Possible Reversal

On the daily timeframe, VIRTUAL is trading within a clearly defined falling wedge pattern. This structure is widely recognized as a bullish reversal formation, typically developing when selling pressure gradually weakens while price continues to make lower highs and lower lows within converging trendlines.

After several weeks of persistent downside, VIRTUAL found support around the $0.6518 level. This bounce marked an important reaction low and helped price recover toward the $0.7040 area. As seen on the chart, price is now pressing close to the wedge’s upper boundary, indicating that buyers are starting to challenge the prevailing downtrend.

VIRTUAL Daily Chart/Coinsprobe (Source: Tradingview)

VIRTUAL Daily Chart/Coinsprobe (Source: Tradingview)

The compression within the wedge suggests that a decisive move may be approaching, with volatility likely to expand once price breaks out of the structure.

What’s Next for VIRTUAL?

A confirmed breakout above the falling wedge resistance, followed by a successful retest, would significantly improve the bullish outlook for VIRTUAL. In such a scenario, the first major area of interest lies near the 50-day moving average, currently positioned around $0.9469. This level also aligns closely with prior price congestion, increasing its technical importance.

Beyond that, the projected measured move from the wedge points toward a potential upside target near $0.962. Reaching this zone would represent a gain of more than 37% from current price levels, making it a notable recovery move if momentum accelerates.

On the flip side, failure to break above the wedge resistance could keep VIRTUAL range-bound. In that case, price may revisit the lower boundary of the wedge, where buyers would need to defend support to prevent a deeper retracement.