Ethereum’s “Second-Level” Evolution: From Fast Confirmation to Settlement Compression, How Is Interop Eliminating Waiting Time?

If you frequently shuttle between Base, Arbitrum, or Optimism, you must have experienced a subtle sense of "disconnection."

Although a single L2 transaction can almost be finalized in seconds, when you try to transfer assets from chain A to chain B, you often have to wait several minutes or even longer. This is not because L2 itself is not fast enough, but because, in the traditional process, a transaction involving cross-layer and cross-chain must go through a lengthy and rigorous path:

L2 sequencer ordering → submit to L1 → L1 reaches consensus and finality, in short, under the current Ethereum architecture, L1 finality usually requires two Epochs (about 13 minutes). This is undoubtedly necessary for security, but for interoperability (Interop), it seems excessively slow.

After all, according to Ethereum's grand vision, there will be hundreds or even thousands of L2s in the future. They should not be isolated execution islands but should work together as a whole. The key question is whether this waiting time can be minimized.

It is precisely in this context that the Ethereum Interop roadmap, in the Acceleration phase, clearly proposes three highly coordinated improvement directions: Fast L1 Confirmation Rule, Shorter L1 Slots, and Shorter L2 Settlement.

It can be said that this is not a scattered optimization, but a systematic reconstruction around "confirmation, rhythm, and settlement."

I. Fast Confirmation Rule: Give the System a "Trustworthy Answer" Before Finality

As we all know, under the current Ethereum architecture, the mainnet block interval is about 12 seconds. Validator nodes vote on the current chain state at each slot, while finality lags behind by several slots.

In short, even if a transaction has been included in a block, the system still needs to wait a long time to be sure it will not be reorganized or rolled back. Currently, it takes about two Epochs (about 13 minutes) before a transaction is considered irreversible. For most on-chain financial scenarios, 13 minutes is undoubtedly too long.

So, can we give applications and cross-chain systems a "fast enough and trustworthy" confirmation signal before finality arrives? This is exactly what Ethereum's Interop roadmap explicitly proposes in Project #4: Fast L1 Confirmation Rule.

Its core goal is very straightforward: to allow applications and cross-chain systems to obtain a "strong and verifiable" L1 confirmation signal within 15–30 seconds, without having to wait for the full 13 minutes required for finality.

Mechanistically, the fast confirmation rule does not introduce a new consensus process but reuses the attester votes that occur in every slot in Ethereum's PoS system. When a block has already accumulated enough and sufficiently distributed validator votes in the early slots, even if it has not yet reached the finality stage, it can be regarded as "extremely unlikely to be rolled back under a reasonable attack model."

Simply put, this level of confirmation does not replace finality, but provides a strong confirmation explicitly recognized by the protocol before finality. For Interop, this is particularly critical: cross-chain systems, intent solvers, and wallets no longer need to blindly wait for finality, but can safely proceed to the next logic step within 15–30 seconds based on protocol-level confirmation signals.

Currently, the preconfirmation promoted by the Based Rollup narrative plays an important transitional engineering role in this direction. Its logic is also very simple, as the name suggests. Imagine:

When we buy train tickets on 12306, once we select the itinerary and place the order (sign the transaction), the ticketing system first gives a preconfirmation message, telling you that the ticket purchase (corresponding to each transaction) has been accepted and is entering the subsequent confirmation process. At this point, we can start planning the trip, packing, etc. Only when the ticket is finally confirmed with the carriage and seat (transaction published to L1) is the ticket purchase and seat reservation officially completed.

In short, in Based Rollup, preconfirmation is a promise to include the transaction in a block before it is officially submitted to L1 for confirmation, which is equivalent to giving the user an initial confirmation signal, letting the user know that the transaction has been accepted and is being processed.

"I'll give you a strong verbal commitment first, and final confirmation will follow later." Through this layered confirmation logic, the Ethereum Interop roadmap is actually finely dividing different trust levels between "security" and "speed," building as smooth an interoperability experience as possible.

II. Shortening L1 Slot: Accelerating Ethereum's "Heartbeat" Cycle

Complementing the "consensus-level logical reconstruction" of the fast confirmation rule is a more fundamental and physically meaningful change—shortening the slot duration.

If fast confirmation is like issuing an IOU before consensus is finally reached, then shortening the L1 slot time is directly shortening the ledger's "settlement cycle." In the Interop roadmap, Project #5's phased goal is very clear: to compress Ethereum mainnet's slot time from the current 12 seconds to 6 seconds.

This seemingly simple "halving" will actually trigger a chain reaction throughout the network. This is easy to understand: the shorter the slot, the faster the pace of transactions being included in blocks, distributed for validation, and observed for confirmation, resulting in lower overall protocol layer latency.

The impact on users' real experience is also direct, including faster perceived confirmation for L1 interactions (such as ETH transfers), a tighter rhythm for L2 state submissions to L1, and even the combination of shorter slots and fast confirmation rules essentially forms "near real-time on-chain feedback," meaning that DApps, wallets, and cross-chain protocols in the ecosystem can better build a "second-level confirmation experience."

For cross-chain interoperability protocols, shorter times also mean a leap in capital efficiency. Currently, cross-chain bridges or market makers must bear the risk of "in-transit" funds for several minutes or even longer when handling asset transfers between different chains. To hedge against volatility during this period, they have to charge higher fees.

When the L1 settlement cycle is shortened and the capital turnover speed is doubled, the occupation of in-transit capital will be significantly reduced. The result is obvious: lower friction costs, lower user fees, and shorter arrival delays, which will greatly incentivize developers and users to return to the secure L1 settlement layer, rather than relying on fragile third-party relays.

Of course, doubling the "heartbeat" frequency is by no means easy. Multiple working groups at the Ethereum Foundation are advancing this complex project in parallel:

- Network analysis: Research teams (including researchers like Maria Silva) are conducting rigorous data analysis to ensure that shorter slots do not cause serious reorg risks due to network latency or put centralization pressure on home nodes with poor bandwidth;

- Client implementation: This is a comprehensive underlying reconstruction involving both the consensus and execution layers. Notably, this work is independent of EIP-7732 (native staker-builder separation, ePBS), meaning that regardless of ePBS progress, the heartbeat acceleration plan can proceed independently;

Overall, when 6-second slots are combined with the fast confirmation rule, Ethereum is expected to truly have "near real-time on-chain feedback," enabling dApps and wallets in the ecosystem to build unprecedented second-level confirmation experiences.

III. Shortening L2 Settlement Cycle: Making Assets "Withdraw Instantly"

In the Interop roadmap, Project #6: Shorter L2 Settlement is the most controversial, but also the most imaginative part.

Under the current architecture, Optimistic Rollups usually rely on a challenge period of up to 7 days, and even ZK Rollups are limited by the pace of proof generation and verification. To be fair, this design is impeccable in terms of security, but at the interoperability level, it brings a real problem:

Assets and states are "time-locked" between chains. This not only raises cross-chain costs but also significantly increases the rebalancing burden for solvers, ultimately reflected in higher user fees. Therefore, shortening the settlement cycle is regarded as one of the key levers for Interop to scale. The main engineering directions currently include (see also "ZK Route 'Dawn Moment': Is the Ethereum Endgame Roadmap Accelerating?"):

- ZK real-time proofs: With hardware acceleration and recursive proofs maturing, proof generation time is being compressed from minutes to seconds;

- Faster settlement mechanisms: For example, introducing a secure 2-out-of-3 settlement model;

- Shared settlement layer: Allowing multiple L2s to complete state changes under unified settlement semantics, rather than "withdraw—wait—deposit";

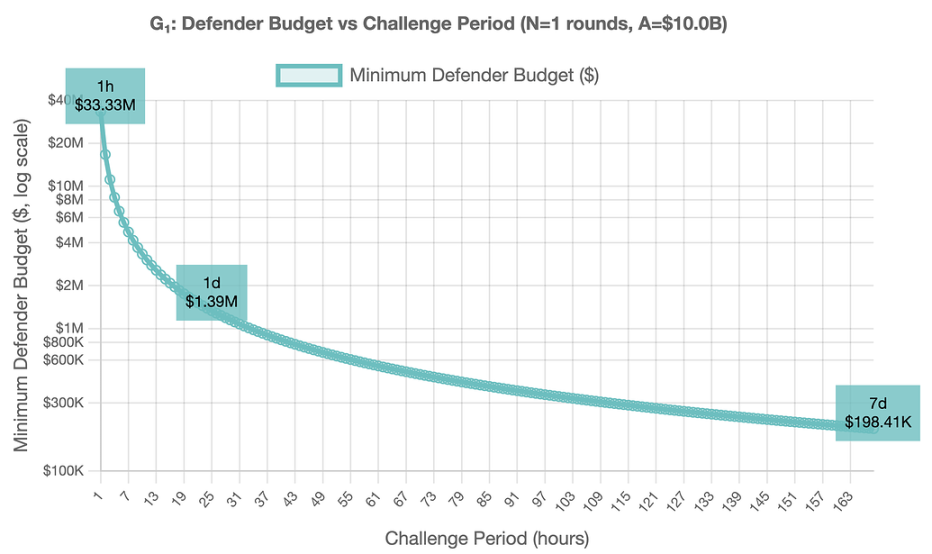

Of course, in the discussion of Interop, an unavoidable core question is: if, in order to achieve faster cross-chain confirmation, the settlement challenge period is compressed from the traditional 7 days to 1 hour, will this leave room for attackers to exploit?

Theoretically, this concern is not unfounded. Unlike "strong censorship" (validators colluding maliciously), what is more worthy of vigilance in reality is precisely this kind of soft censorship attack led by block builders: attackers do not need to control consensus, they only need to continuously outbid defenders to prevent key transactions from being included on-chain.

Interestingly, the only systematic economic analysis of such scenarios currently comes from Offchain Labs' paper "Economic Censorship Games in Fraud Proofs," published in February 2025. The paper constructs three models, from most pessimistic to relatively optimistic, assuming:

- G¹ model: Block content is entirely determined by the highest bidder;

- G¹ₖ model: Some validators always build blocks locally;

- Gᵐ model: Multiple validators jointly decide block content, and as long as one party chooses the defender's transaction, it is included.

In real engineering, since validators may choose empty slots (miss slots), some designs may even degrade to the more pessimistic G¹ scenario. Therefore, the paper chooses to analyze from the worst-case perspective.

Based on this premise, researchers have proposed a highly practical defense idea—a "small bet for big gain" delayed defense mechanism. The core logic is that defenders have the right to "one-click delay," meaning defenders do not need to complete all complex error-checking processes in a short time, but only need to successfully submit a key transaction.

The purpose of this key transaction is very clear: once it is on-chain, it will automatically extend the challenge period from 1 hour back to the traditional 7 days. For example, when a defender finds an abnormal L2 state, he does not need to complete all complex error-checking processes within 1 hour. He only needs to successfully submit a special transaction to L1, which is like sounding an air-raid siren, instantly extending the challenge period back to the traditional 7 days.

This also means that attackers are forced into a highly asymmetric war of attrition. To prevent this transaction from being included on-chain, attackers must continuously pay a higher priority fee than defenders in every block, and this confrontation must be maintained throughout the entire challenge period.

The quantitative results given in the paper are also very straightforward. According to calculations, if a well-funded attacker is prepared to spend $10 billions on a sustained censorship attack, then:

- In a 1-hour window, defenders only need a gas budget of $33 millions to fight back;

- If the delay mechanism is successfully triggered, extending the challenge period to 7 days, the defender's counterattack cost can even plummet to around $200,000;

In other words, this is a crucial structural advantage: the attacker's cost is additive, while the defender only needs to succeed once in getting on-chain.

It is precisely this huge cost-to-attack vs. cost-to-defend ratio that ensures that even if the settlement cycle is greatly compressed, Ethereum still has strong robustness in economic security.

For Interop, this is also crucial, meaning that fast confirmation and shorter settlement cycles do not necessarily come at the expense of security, and that with reasonable system design, second-level cross-chain and economic security can indeed coexist, at least providing the most solid underlying confidence for Interop to achieve second-level cross-chain.

Final Words

Some may wonder, why go to such lengths to optimize a few seconds or minutes of delay?

In the geek era of Web3, we were used to waiting, even thinking that "waiting" was a premium that had to be paid for decentralization. But on the road to Web3 mass adoption, users should not—and do not need to—care about which chain they are operating on, nor should they have to calculate L1's finality logic.

Fast confirmation, 6-second heartbeat, and asymmetric defense mechanisms are essentially doing one thing—erasing the variable of "time" from the user's perception.

As the author has often said recently: the best form of technology is to make complexity completely disappear in ultra-fast confirmation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Betting on a Dovish Fed: Why Polymarket Hold Odds Just Crashed to 8%

Uniswap Price Rises Following Approval of UNI Fee Switch Plan

Shiba Inu Faces Uncertain December: Will It Break the Cycle?

HYPE price prediction – Why ‘trapped shorts’ could be key to next price breakout