Ethereum Longs Surge as BTC OG Insider Whale Tops Hyperliquid’s Long Positions Across ETH, BTC, and SOL

The BTC OG Insider Whale boosted SOL long exposure by 208,000 coins (about $27m), lifting SOL holdings to roughly $61.8m and leaving a ≈$55.5m floating loss. ETH remains the dominant long, near $603m with a $46.6m unrealized loss. The total mark-to-market sits around $742m, ranking top in long exposure for ETH, BTC, and SOL on Hyperliquid.

CZ Counterparty holds an ETH long near $166m, floating loss ≈$15.5m, avg $2,947, liquidation $2,690. The XRP long sits near $71m with about $17.6m in floating losses, and total float losses around $30.4m, making it the top XRP long and second-largest ETH long on Hyperliquid. Pension-usdt.eth runs 3x ETH longs at about $87.6m notional, avg $2,967, liquidation $1,664, floating loss ≈$1.5m.

Ultimate Short trimmed BTC shorts to about $43.8m, posting a $12.1m floating profit and a liquidation price near $102k. About $57m was closed this month, with stop-profits at $67.2k–$76.2k. Copycat Air Force Front pivoted to hedging, closing several shorts and growing a $7.8m hedge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

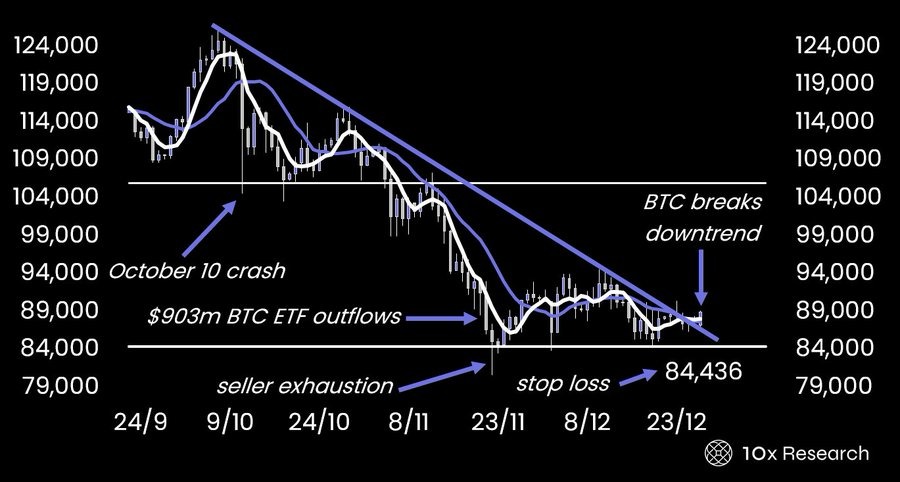

Bitcoin Breakout Alert: 10x Research Sees Multi-Week Rally Pushing BTC To $110K

Lithuania Declares War on Unlicensed Crypto Firms as MiCA Enforcement Begins

Silver Climbs to New ATH of $75.34 as Gold and Platinum Smash Unprecedented Highs, What Does This Mean for Bitcoin?

Best AI Crypto: Trend Research Accumulate ETH While DeepSnitch AI Nears $900k in Presale Revenue As Bonus Offers Attract Investors