The founder of an investment institution announced on social media that he is preparing to buy another $1 billion worth of Ethereum. Market data shows that his current position has an unrealized loss of $141 million, but he still firmly believes that the crypto market will usher in an epic bull market in 2026.

Trend Research, a secondary investment institution under Yilihua, started bottom-fishing ETH in early November, when the price was $3,400. So far, it has purchased about 580,000 ETH in total, with a total value of about $1.72 billion and an average cost of about $3,208 per ETH.

Facing an unrealized loss of about $141 million on the current position, he chose to double down rather than stop loss. This high-leverage, strongly bullish operation is becoming a microcosm of the crypto market's expectations for 2026.

1. Aggressive Positioning

● The crypto market has entered a year-end adjustment period, but some institutional investors are showing an unusually aggressive attitude. Liquid Capital founder Yilihua publicly stated on social media that he firmly believes now is the "best ETH buying zone."

● Yilihua reviewed his investment experience in the crypto market. He mentioned that before the "312" event, when bitcoin was consolidating between $7,000 and $8,000, he sold all his bitcoin because he could not withstand the pressure of the bear market.

● Although he successfully avoided the subsequent plunge, he also missed the entire bull cycle where bitcoin soared from the bottom to $69,000. He described this experience as "a huge failure case of missing out on tens of thousands of dollars for the sake of a few thousand dollars."

● Now, Trend Research continues to increase its ETH holdings through leveraged loans, borrowing 887 million USDT from Aave, with a leverage ratio of about 2x. Yilihua said: "This time, it's the same script. We successfully exited at the top before 1011, but this time we choose to keep adding to our positions."

2. Market Outlook

● Industry analysis institutions have a cautiously optimistic tone for the 2026 crypto market outlook. Bankless's top ten predictions believe that bitcoin will break the four-year cycle pattern and reach a new all-time high. If this prediction comes true, it will overturn the historical pattern of peaking one year after each halving since 2013. Even more notably, Bankless predicts that bitcoin's volatility will be lower than Nvidia's.

● Institutional demand is structurally exceeding new ETH issuance. This is mainly driven by the growth of Ethereum spot ETFs and tokenized assets, creating a demand floor that did not exist in early cycles.

● Galaxy Research gave a more specific price prediction: bitcoin has a certain probability of reaching $250,000 by the end of 2026. However, the company also pointed out that there is a high degree of uncertainty regarding the near-term market trend.

3. Structural Transformation

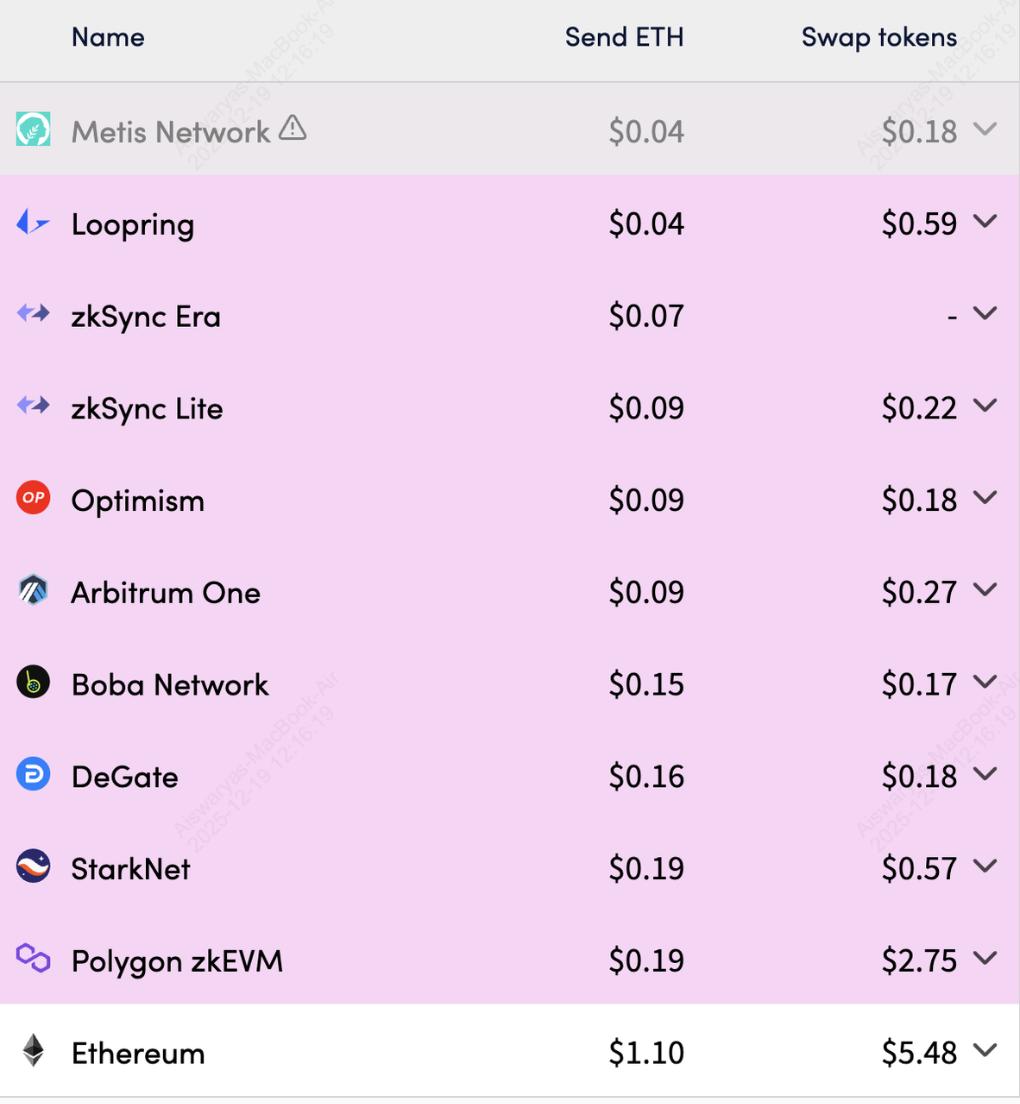

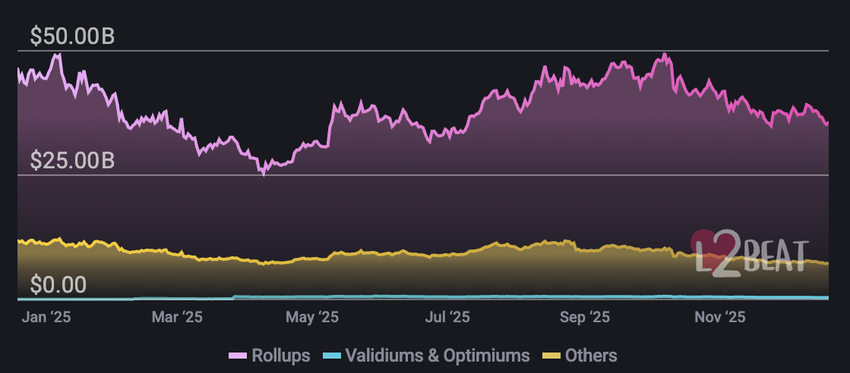

● Ethereum will undergo its most significant structural transformation since the launch of smart contracts in 2026. Layer-2 now handles most retail activities, while Layer-1 anchors settlement, staking, and institutional demand.

● The total value locked in DeFi on Ethereum Layer-1 exceeds $67.8 billion, while funds locked in Ethereum Layer-2 networks are about $43 billion. This highlights a clear separation between settlement and execution.

● Retail activity is increasingly concentrated on Layer-2, while institutional capital enters through regulated Ethereum spot ETFs and tokenized financial products. This positions Ethereum's base layer as the backbone for settlement, staking, and security.

4. The Rise of New Narratives

The driving forces of the crypto market in 2026 are changing. The integration of traditional finance and crypto technology will become the main narrative. BlackRock CEO Larry Fink wrote in The Economist, declaring "We have finally found the use case for blockchain—that is tokenization."

● The year of tokenization is considered a revolution. With the resignation of US SEC Chairman Gary Gensler, cryptocurrencies finally have the regulatory tolerance they need.

● Stablecoin growth has become a force that cannot be ignored. Galaxy predicts that stablecoin transaction volume will surpass the Automated Clearing House (ACH), and stablecoins cooperating with traditional financial institutions will see integration.

● Galaxy research shows that the supply of stablecoins continues to grow at a compound annual rate of 30%-40%, with transaction volumes rising in tandem. Stablecoin transaction volume has already surpassed major credit card networks such as Visa.

5. Risks and Challenges

Although institutions are generally optimistic about 2026, the market still faces multiple uncertainties.

● A Messari report points out that Ethereum is still below the historical high of the previous cycle relative to bitcoin.

● Ethereum continues to maintain a high correlation with bitcoin, behaving more like a leveraged bitcoin proxy rather than an independent monetary asset. The core issue is that many investors see price increases as an opportunity to exit liquidity.

● Benzinga analysis believes that Ethereum faces uncertainty in 2026. The ETH/BTC exchange rate has erased all gains from the previous cycle, and market confidence is at a multi-year low.

● Jeff Ko, chief analyst at CoinEx Research, predicts that in 2026, liquidity will be more concentrated in blue-chip crypto assets, making it difficult for a traditional altcoin season to occur, and the vast majority of altcoins will be left behind.

6. The Institutionalization Wave

2026 may be the year when the crypto market becomes fully institutionalized. Bankless predicts that as institutional demand accelerates, ETF purchases will exceed 100% of the new supply of bitcoin, Ethereum, and Solana.

● Half of Ivy League endowment funds will invest in cryptocurrencies, and the US will launch more than 100 crypto-related ETP products. These predictions collectively depict a year of comprehensive entry by institutional capital, regulatory frameworks, and traditional financial infrastructure.

● Coinbase's institutional division believes that 2026 will see the emergence of the "DAT 2.0" model. This model will go beyond simple asset accumulation, focusing on professional trading, storage, and procurement of sovereign block space, and regarding it as an important resource for the digital economy.

● For crypto-native players, this is both an opportunity and a challenge. The opportunity lies in the exponential expansion of the market size, while the challenge is that the rules of the game are being rewritten by traditional finance.

When asked why he continues to add to his position despite being at a loss, Yilihua responded: "We know there will be a big rally in the end, we just don't know which day it will be." His institution has prepared an additional $1 billion in funds and plans to continue increasing its Ethereum holdings.

Public data shows that Bitmine Immersion Tech currently holds 4.07 million ETH, worth about $11.97 billion; SharpLink Gaming holds 863,020 ETH, worth about $2.54 billion. The total amount of Ethereum held by institutions continues to grow.

Market observers have begun to debate whether this is the starting point of the next bull market, or just another capital game based on leverage and narrative.