Ethereum’s [ETH] price looks shaky, but its foundation remains strong.

Behind the short-term pressure, the network is dominating DeFi. ETH is leaving exchanges, so the available supply is decreasing.

What makes this moment stand out, however, is who is stepping in. Institutional players are increasing exposure, even during times of caution.

Price and investor behavior are moving apart. However, that gap may close soon.

Ethereum is hard to ignore

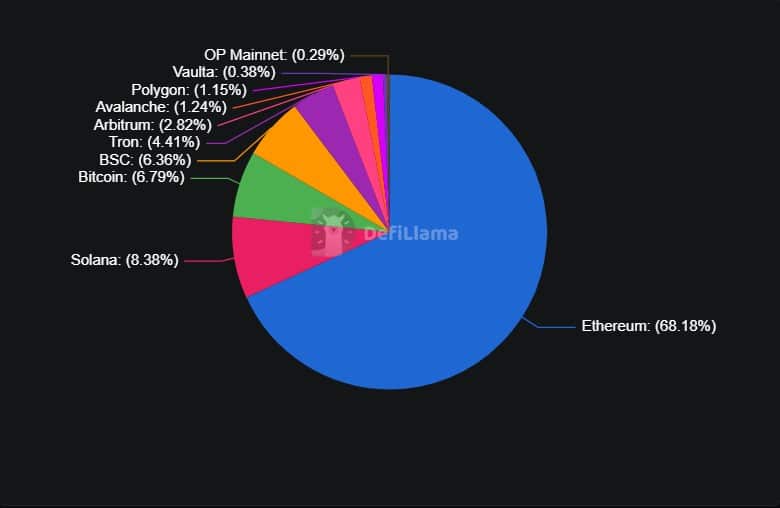

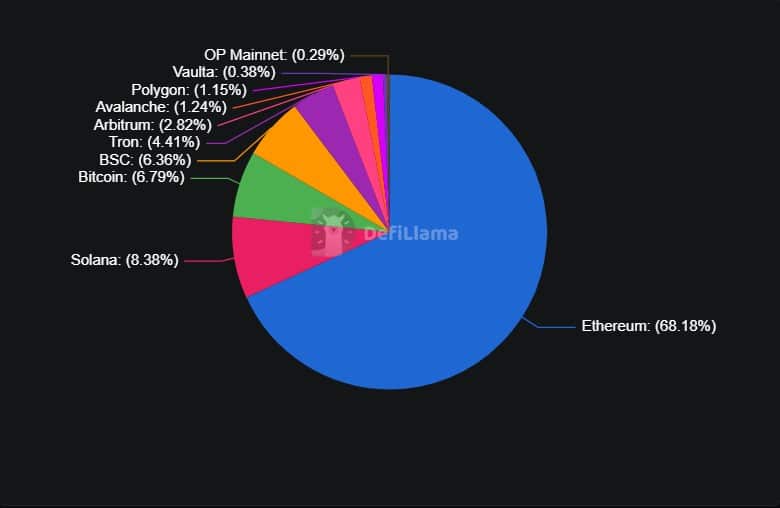

The network now holds nearly 68.2% of global DeFi TVL, with over $69 billion deployed on its smart contracts.

That is more capital than Solana [SOL], Tron [TRX], BNB Smart Chain [BNB], Bitcoin [BTC], Avalanche [AVAX], and every other chain combined.

Source: DeFiLlama

The network’s edge goes beyond DeFi alone. It also hosts more than $191 billion in stablecoins and controls half of the tokenized euro market.

For institutions, this matters because stablecoins are issued where security and reliability are strongest, and Ethereum remains the preferred settlement layer.

Big hands are in!

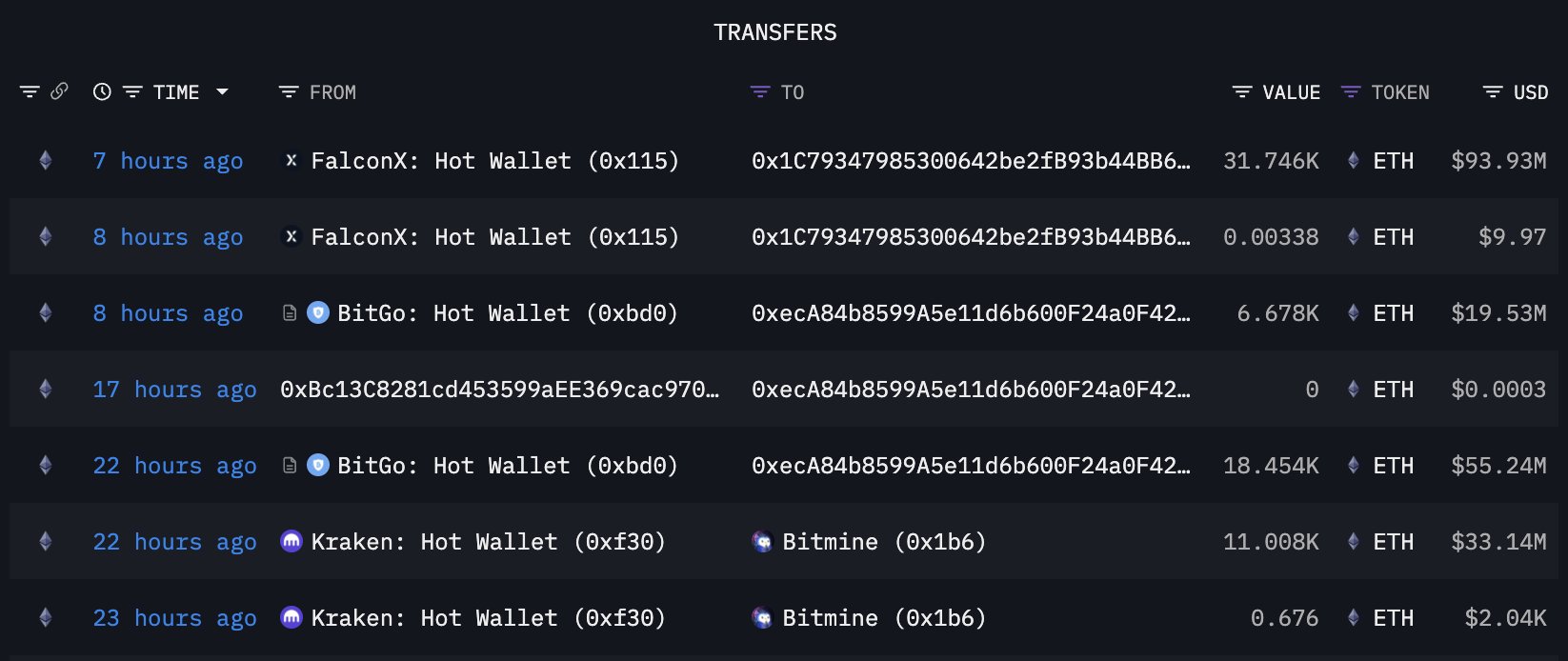

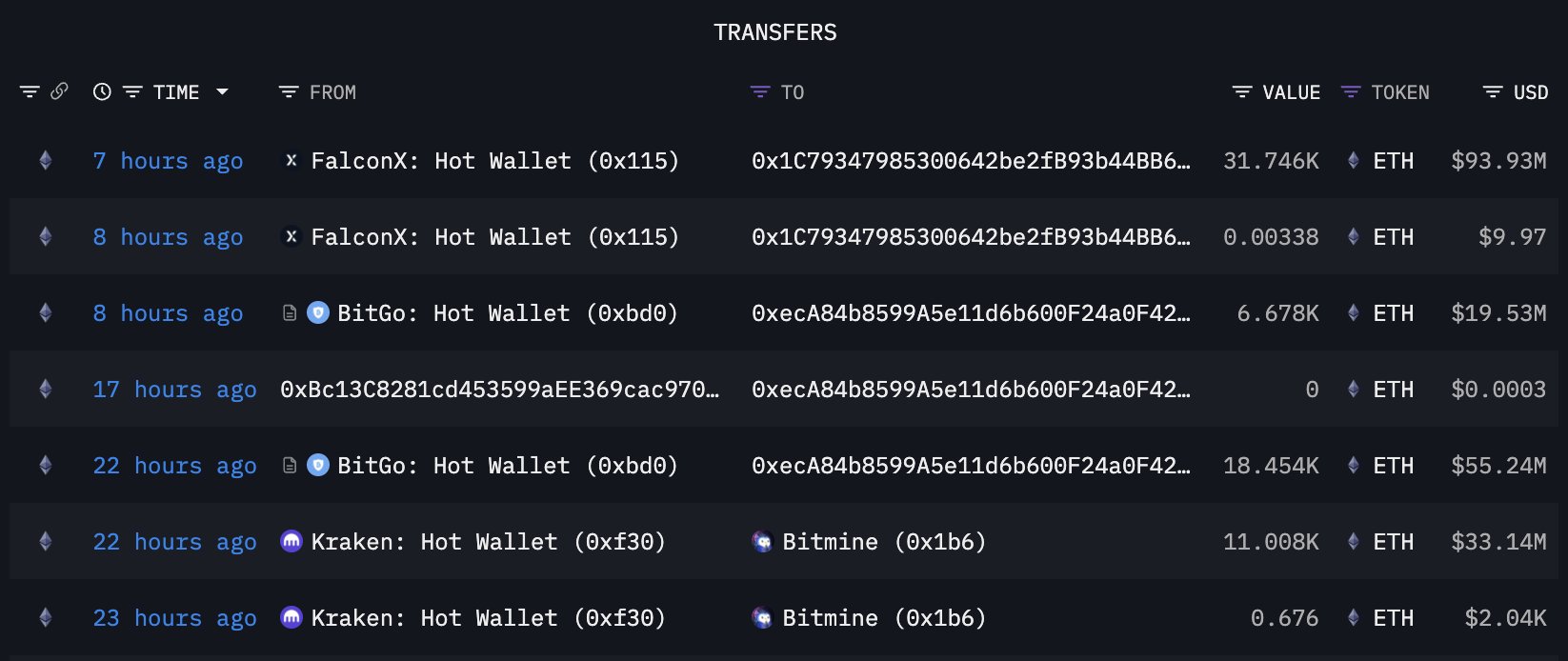

Source: X

That dominance is translating into real buying, with institutions moving fast to increase exposure. In the past 24 hours alone, Tom Lee’s Bitmine purchased nearly 68,000 ETH, worth over $200 million.

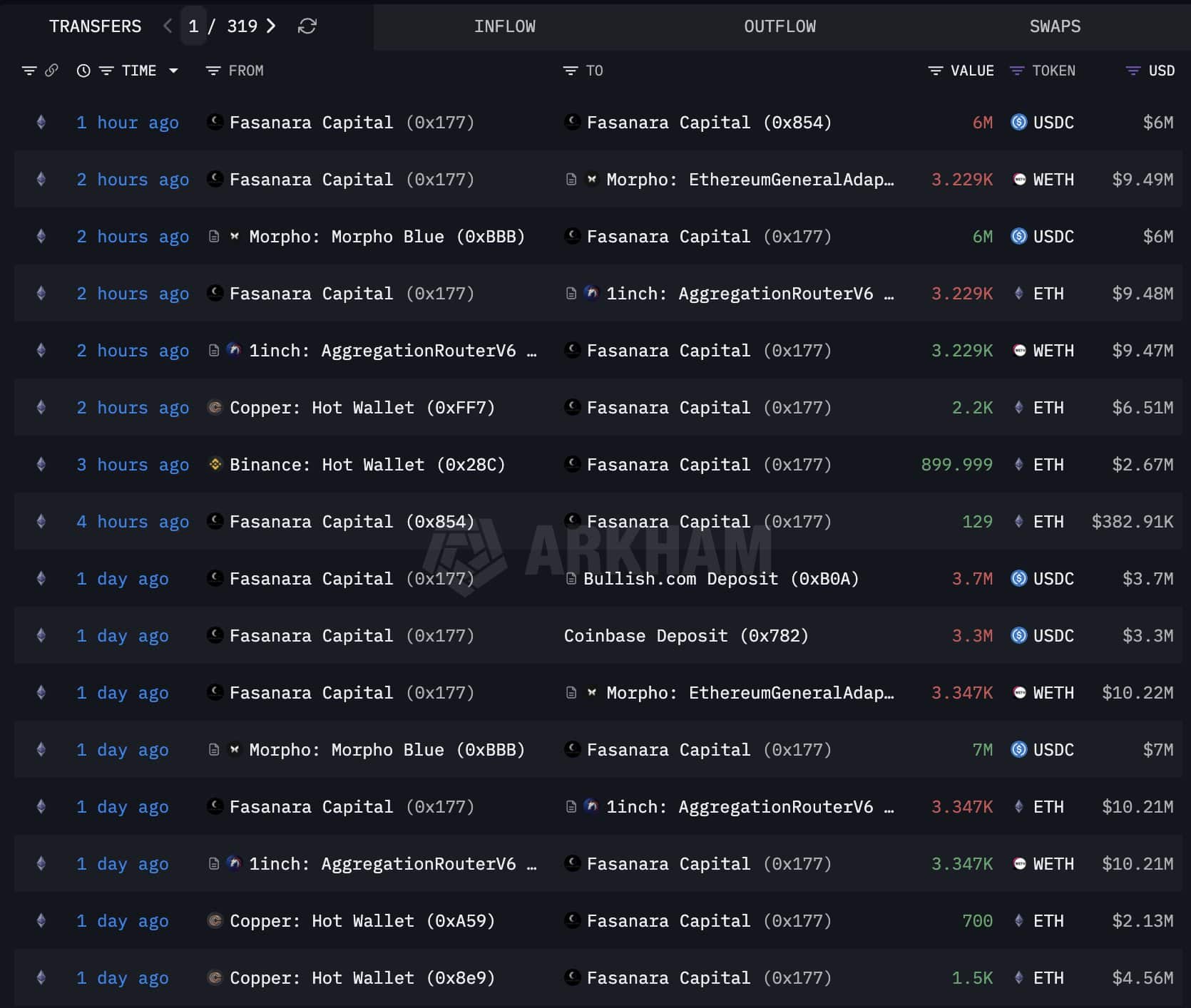

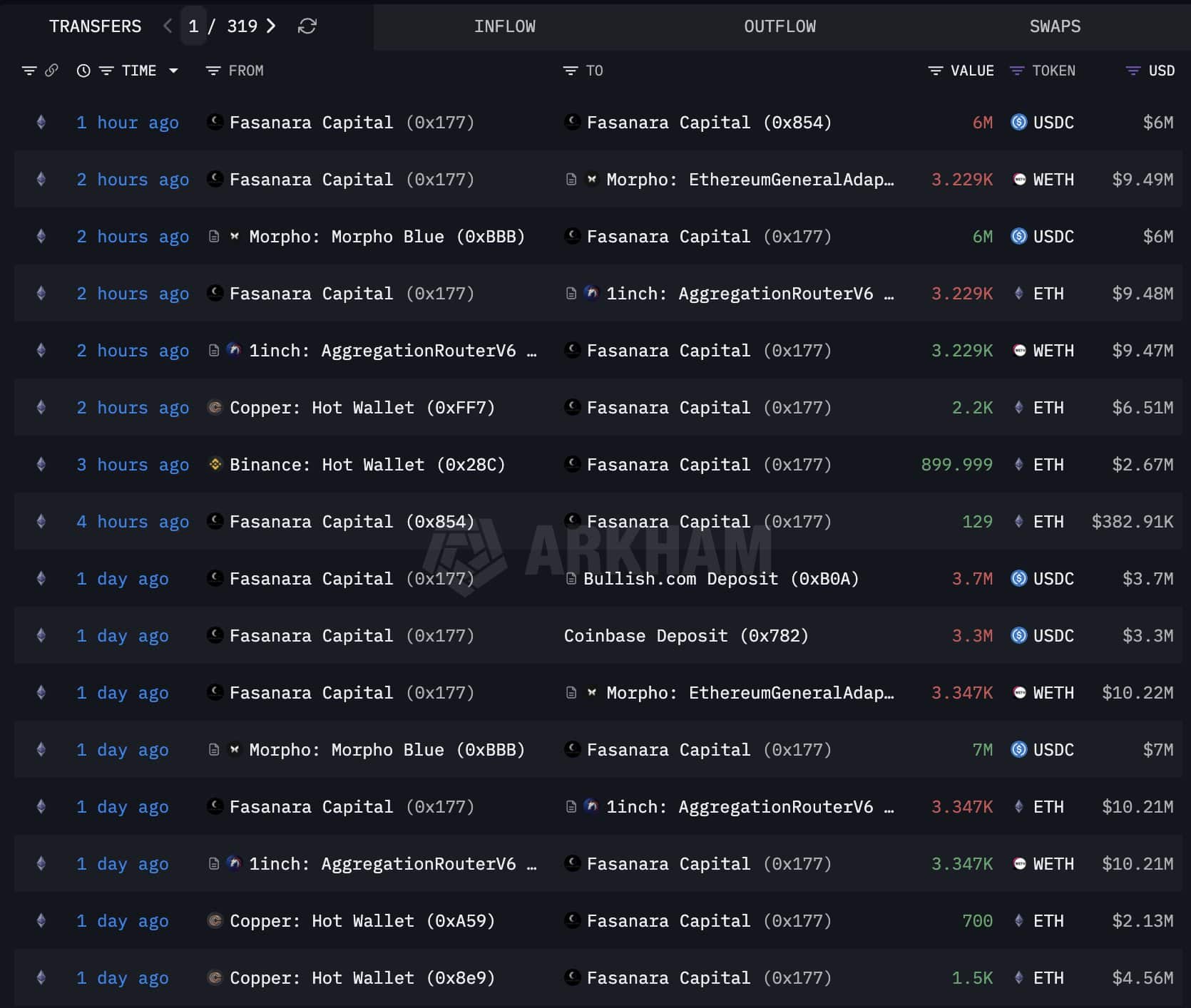

Source: X

Fasanara Capital followed a similar path, buying ETH, depositing it into DeFi protocols, and borrowing against it to buy even more. This is active positioning.

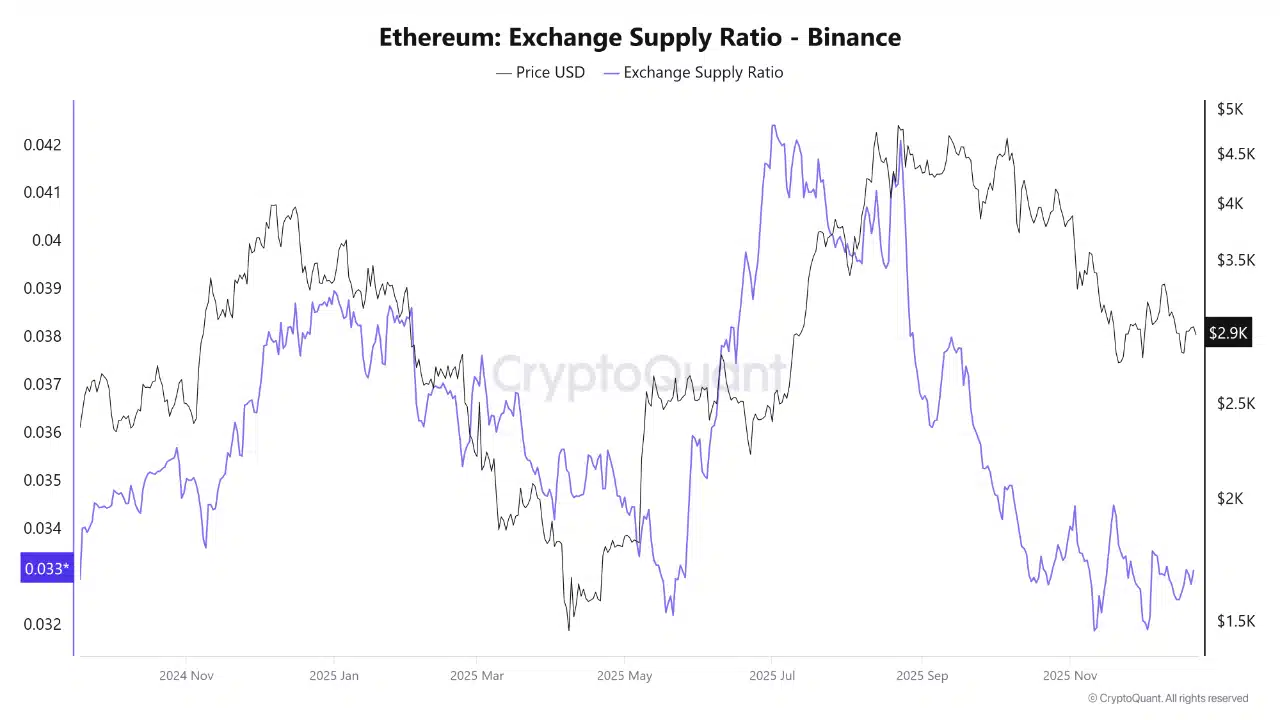

A supply shock is taking shape

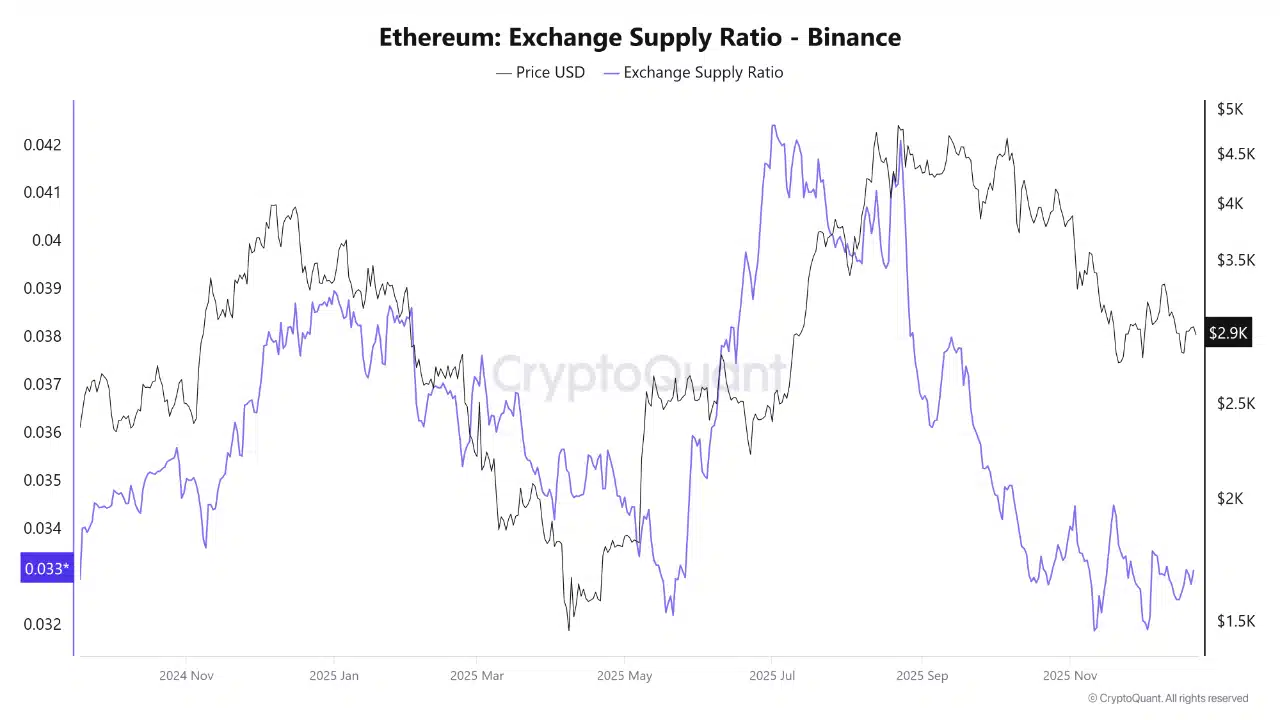

Source: CryptoQuant

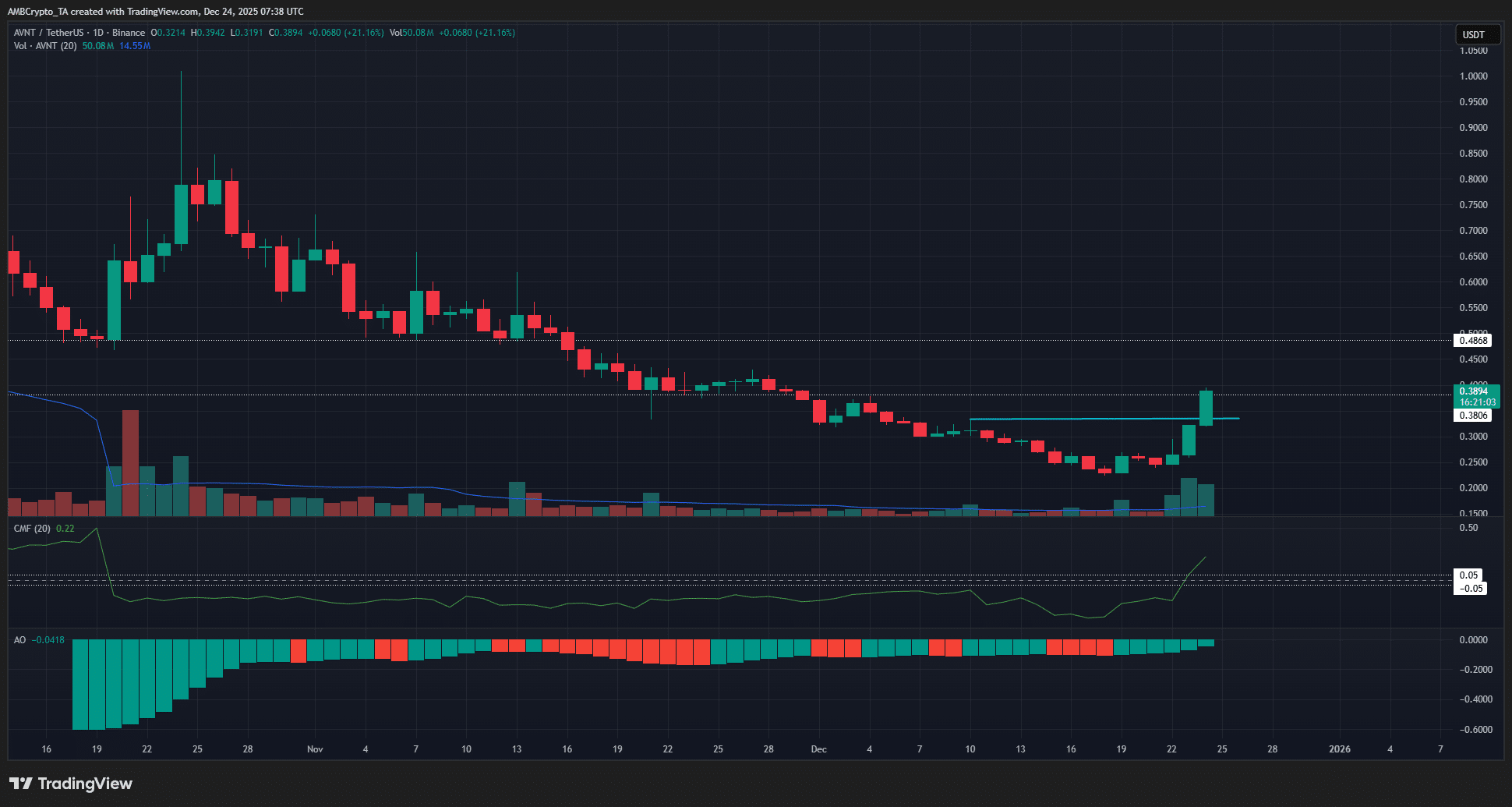

All this buying is happening at a delicate moment for ETH’s price. Ethereum is trading under technical pressure, stuck below key resistance levels with support near $2,800. On its own, it looks fragile, too.

Source: CryptoQuant

But, Ethereum’s exchange supply ratio on Binance has fallen to 0.032, the lowest since September 2024. Simply put, less ETH is sitting on exchanges ready to be sold.

With this clash, if buyers continue to defend support, a tight supply could quickly flip the narrative.

Final Thoughts

- Ethereum controls 68%+ of DeFi TVL. Institutions buy even while price struggles.

- Falling exchange supply and $200M+ ETH buys could cause a supply-driven rebound