- Central Bank says bitcoin mining brings value inflows that help stabilize the ruble rate.

- Officials accept mining as a macro factor despite limits from legal gray zones today.

- Lawmakers plan bank-led crypto trading to pull mining flows into oversight systems.

The Central Bank of Russia has acknowledged that Bitcoin mining now contributes to the stability of the ruble, signaling a shift from its historically strict opposition to digital assets. Governor Elvira Nabiullina made the remarks in an interview with RBC, describing mining inflows as an auxiliary factor supporting the national currency.

The statement signals a practical change, as Russia is facing long-standing sanctions and is restricted from using its usual foreign exchange channels. The government authorities did not go so far as to promote cryptocurrency as cash, but they acknowledged that mining is a significant macroeconomic variable in today’s circumstances. This recognition brings mining income to the same level as other external sources of inflow that affect exchange rate fluctuations.

From Prohibition to Measured Recognition

For years, the Central Bank argued that cryptocurrencies threatened financial stability and repeatedly supported a total ban on their use. Nabiullina confirmed that the institution still does not recognize Bitcoin as legal tender for domestic payments. At the same time, she stated that mining-generated value now affects exchange rates, even if authorities cannot fully quantify its scale.

The governor explained that many mining operations remain in a legal gray zone, which limits reliable reporting. Because of that structure, official statistics do not reflect the entire volume of crypto-related inflows. Despite those limits, the Bank now treats mining as a tangible economic activity rather than a purely speculative risk.

This shift followed sustained economic pressure after sanctions narrowed access to international finance. As liquidity tightened, policymakers examined alternative channels that could support balance-of-payments flows. Mining activity expanded during that period due to Russia’s energy resources and rising global demand for Bitcoin.

Sanctions Pressure and Mining as an Informal FX Channel

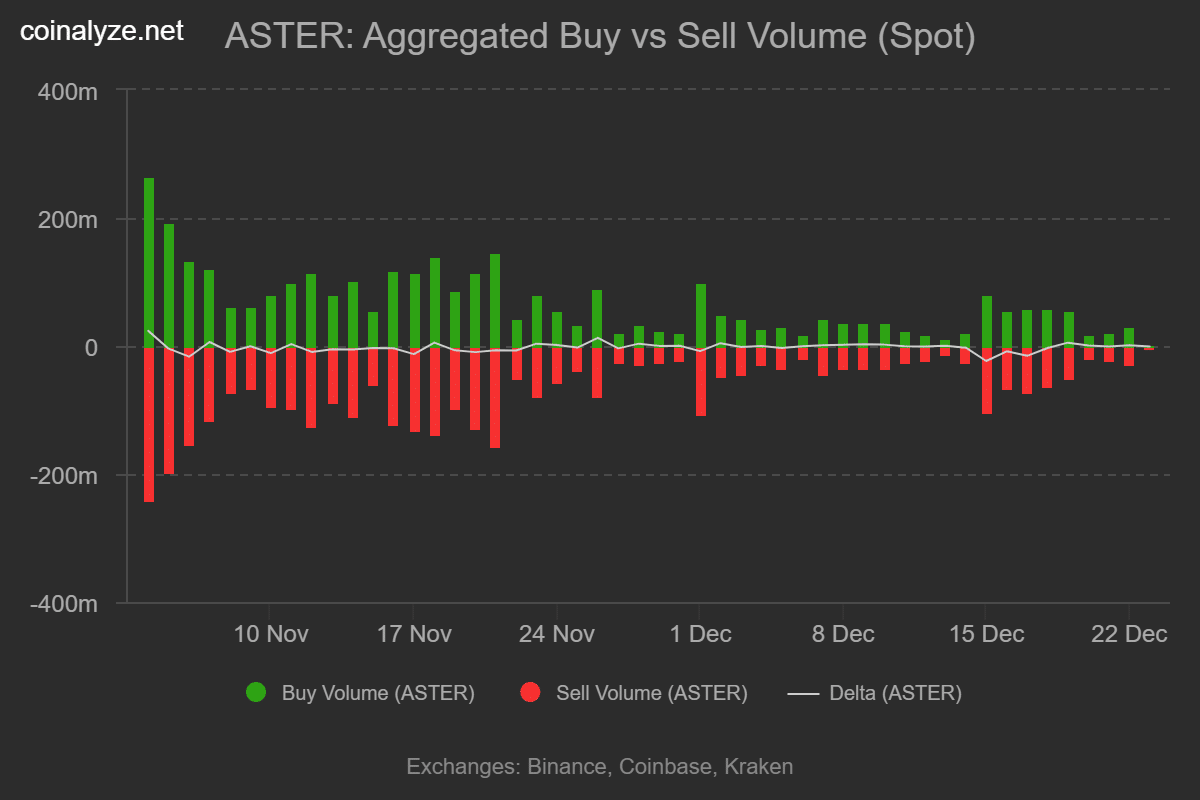

Russia’s economy has operated under restrictions that constrained trade settlement and foreign exchange access. Against that backdrop, Bitcoin mining emerged as a source of externally priced value linked to global markets.

Officials now view those inflows as one component supporting ruble exchange rate resilience. Nabiullina noted that measuring mining’s impact remains complex because transactions often bypass regulated systems. Still, the Central Bank now factors those flows into its broader macroeconomic assessments.

That recognition reframes mining from a regulatory threat into a potential buffer during financial isolation. Does this recognition mark the start of a durable policy recalibration rather than a temporary response to sanctions pressure?

Related: Russia Acknowledges Bitcoin Mining Impact on Ruble Exchange

Legislative Alignment and Banking Sector Integration

The shift at the Central Bank aligns with changing views inside the State Duma. Anatoly Aksakov, who chairs the Financial Markets Committee, said Bitcoin will not serve retail payments. He described mining instead as a strategic investment activity and a “new export item” for the economy.

Governments are investigating the provision of legal access to cryptocurrency via licensed banks. It is expected that state-supported financial institutions such as VTB and Sberbank will be able to provide monitored crypto trading under the new legislative proposals. This action would bring the current informal transactions within the banking system under control, and for tax purposes.

While Russia prepares its 2026 fiscal plan, the Central Bank is working with the Ministry of Finance and Rosfinmonitoring. The target is to convert cryptocurrency trading from the unregulated market to the official settlement channels. The authorities plan to track cryptocurrency movements, impose conformity requirements, and use mining-related assets for international transactions.