Gold, Not Bitcoin, Is Winning Over a New Generation of Investors in 2025

By:BeInCrypto

New investors are increasingly gravitating toward gold and silver, rather than cryptocurrencies, amid mounting macroeconomic pressures. This shift highlights a growing preference for traditional safe-haven assets, despite Bitcoins (BTC) positioning as digital gold and its long-term store-of-value narrative. Younger Investors Embrace Gold as a Hedge Against Inflation Across global markets, investors are turning to precious metals as a hedge against inflation and economic volatility. Market observers note that individuals with no prior trading experience are now entering gold and silver markets instead of crypto. People I know that have never traded anything are trading gold and silver. The retail did come and they did pump coins, just not in crypto. The alt season we waited for happened in precious metals, a crypto market watcher stated. In the Middle East, local media reported that record-high prices are attracting younger investors into the gold market. According to Gulf News, Chirag Vora of Bafleh Jewellers stated that first-time buyers now account for 55% to 60% of the gold demand. This group, primarily comprising Gen Z and Millennials, is increasingly viewing gold as a hedge against inflation. The surge in prices has also altered buying behavior. Jewelry sales volume has declined, but overall spending rose, driven by higher prices. Retail buyers focused on investment value, preferring lower ticket sizes and flexible options. Interest shifted from traditional jewelry to gold bars, coins, and light pieces that offer easier resale. A similar pattern is evident in India. Gold demand remains divided, with strong investment demand contrasting with weaker jewelry volumes. Demand for gold investment products, particularly bars and coins, remains strong. The preference towards investment-focused buying is reflected in the volume of gold imports, which rose sharply to 340t between July and October, compared with 204t between January and June, underscoring the resilience of investment-led demand, World Gold Councils Research Head for India, Kavita Chacko, wrote. The demand is not new. In October, BeInCrypto reported that retail buyers were lining up outside bullion dealers to acquire physical gold and silver. A notable observation was the growing presence of younger investors among these buyers. This reinforces evidence of a generational shift toward traditional safe-haven assets. This shift is also reflected in online search behavior. Google Trends data showed that search interest for terms such as buy gold has consistently outpaced buy Bitcoin over the past year, indicating stronger retail curiosity and intent toward precious metals compared to cryptocurrencies. Despite this renewed interest, gold still represents a relatively small portion of household portfolios in the US. Kip Herriage, managing partner and founder of Vertical Research Advisory, noted that gold accounts for approximately 1% of total assets held by US retail investors, suggesting there is room for further allocation if the trend continues. In US households of retail investors, gold represents approximately 1% of their total portfolio (with silver even lower than that). We believe this move higher is just beginning, with a gold PT of $15,000/oz and silver $200/oz, as true price discovery is now underway. In 2003, when we first recommended gold silver ($350/oz $5/oz) we also recommended that investors save in gold, rather than fiat savings accounts. We continue to recommend this strategy today. Highly, Herriage stated. Beyond retail investors, central banks have also increased their exposure to gold. Global gold reserves surpassed 40,000 tonnes in the third quarter of 2025, reaching their highest level in at least 75 years. Central banks purchased a net 53 tonnes in October alone, marking a 36% month-over-month increase and the largest monthly net demand recorded year to date. From Crypto to Bullion: Why New Investors Are Choosing Gold The demand has further fueled golds rally. The yellow metal hit a fresh all-time high of $4,497 per ounce today. Meanwhile, Bitcoin has slipped nearly 2% over the past 24 hours. BeInCrypto recently highlighted that BTC has lagged gold on a year-to-date basis, while silver has emerged as the top-performing asset, surging 138%. Ray Youssef, CEO of NoOnes, told BeInCrypto that while gold may clearly be winning the 2025 debasement trade on price performance, the comparison masks a more nuanced market reality. Golds recent run to new all-time highs and 67% YTD gains reflect classical defensive investor positioning as capital seeks certainty in a market environment defined by fiscal excess, geopolitical strain, and macro policy uncertainty. Increased central bank accumulation, a softer dollar, and persistent inflation risks have reinforced golds role as the markets preferred defensive asset. Bitcoin, by contrast, has recently failed to deliver on the hedge narrative, as its market behaviour has evolved. The asset has not traded like digital gold in 2025, owing to its heightened sensitivity to macroeconomic factors. BTCs upside is now tied to liquidity expansion, sovereign policy clarity, and risk sentiment, rather than to monetary debasement alone, he commented. Crypto Markets Remain in Wall of Disbelief Phase While retail interest has faded, some analysts believe that crypto may still experience growth. An analyst stressed that in prior cycles, retail activity surged as markets peaked. By contrast, this time, retail interest never climbed much and cooled quickly after rallies. Our Crypto Talk stressed that the December 2024 price strength came without retail spikes. Instead, institutions, funds, and structured buying drove the action. Markets usually end when retail is fully involved, loud, confident, and overexposed. Were not there. Right now, this looks more like a market still climbing a wall of disbelief, where price advances without broad participation and sentiment stays cautious even after strong moves. That doesnt guarantee higher prices tomorrow. But it strongly suggests that this cycle hasnt reached the psychological phase where excess gets punished. Retail hasnt arrived yet. And historically, the biggest moves happen after they do, not before, the analyst commented. Whether retail capital will rotate from gold and silver back into digital assets is uncertain. For now, precious metals continue to draw interest and funds. As 2026 approaches, the question is whether this preference persists or shifts. Read the article at BeInCrypto

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Solana (SOL) Under Pressure Despite ETF Inflows as Traders Watch $110 Support Zone

Newsbtc•2025/12/23 20:03

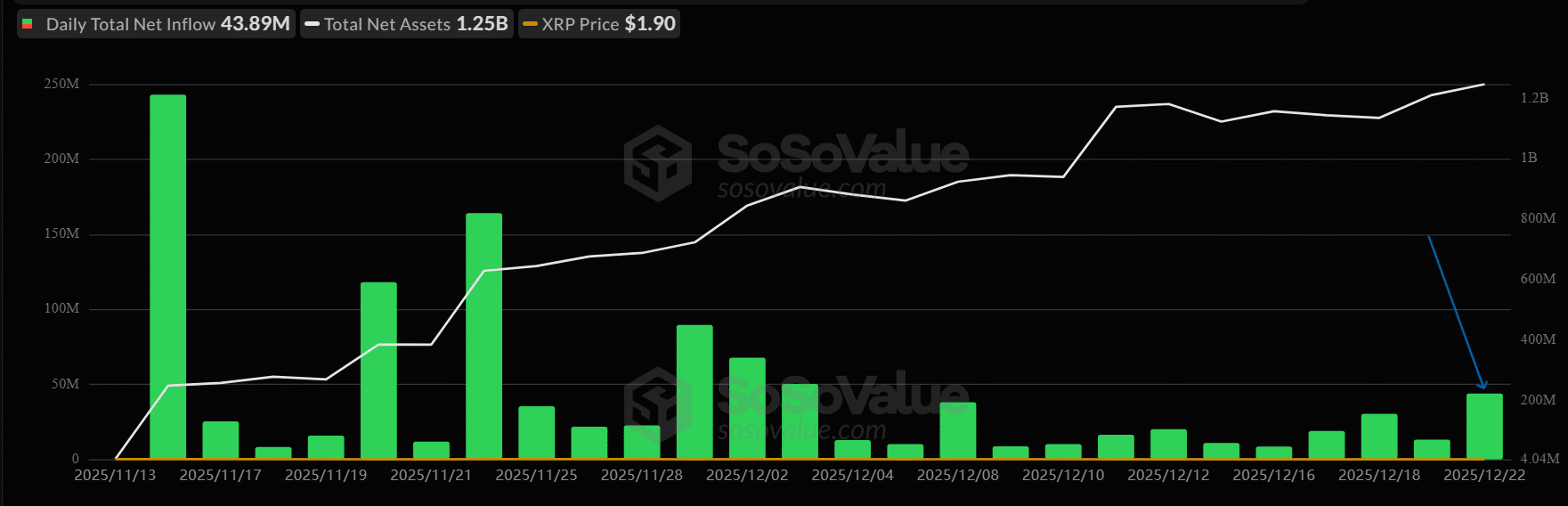

$43.89M flows into XRP ETFs despite falling sentiment – Here’s why

AMBCrypto•2025/12/23 20:03

PlayAstroon Taps Cache Wallet to Advance Web3 Onboarding and Security

BlockchainReporter•2025/12/23 20:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,777.49

-0.31%

Ethereum

ETH

$2,956.15

-0.41%

Tether USDt

USDT

$0.9996

+0.02%

BNB

BNB

$842.53

-1.41%

XRP

XRP

$1.89

-0.56%

USDC

USDC

$1.0000

+0.03%

Solana

SOL

$124.05

-0.38%

TRON

TRX

$0.2825

-0.70%

Dogecoin

DOGE

$0.1291

-1.74%

Cardano

ADA

$0.3622

-1.39%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now