Bitcoin price analysis today — Christmas Week 2025: Could BTC continue to rise?

Monday, December 22, 2025 – Bitcoin's price started the Christmas week trading near $88.800, up almost 1% in the last 24 hours.In the market, the prevailing interpretation is that BTC has managed to stay above the $88 mark, signaling buying pressure in that region, even after new failed attempts to break through the psychological barrier of $90.

In practice, The $90 mark remains the main obstacle in the short term.Still, with the asset consolidating above recent support, traders note that a gradual advance could gain momentum if buying pressure continues in the coming hours. This movement occurs within a broader recovery context, following a week considered relatively weak for some parts of the market.

Among the top cryptocurrencies todayEthereum (ETH) is trading above $3.016,65 again, up 1,6% on the day. If demand holds, the market will monitor the possibility of the price again reaching levels close to $3.120. BNB is around $855,55, also with a gain of around 1%. XRP is trying to hold above $1,92, while Solana (SOL) continues to try to surpass the $128 region.

Among the day's highlights, the strongest movement was in... Midnight (NIGHT), linked to the Cardano ecosystem, is up 35%., quoted at US$ 0,1085. On the other hand, the biggest drop mentioned was Canton (CC), at US$ 0,09491, with a decline of 17%.

Bitcoin analysis during Christmas week: what traders are saying

On social media, Merlijn The Trader described a Bitcoincompressed"Between support and resistance, without confirmation of a breakout, resumption, or liquidity sweep. For him, the $83,6 range would have held as support, while $91 would be the trigger for a breakout. If this level gives way, the trader points to $100 as the likely target for the move."

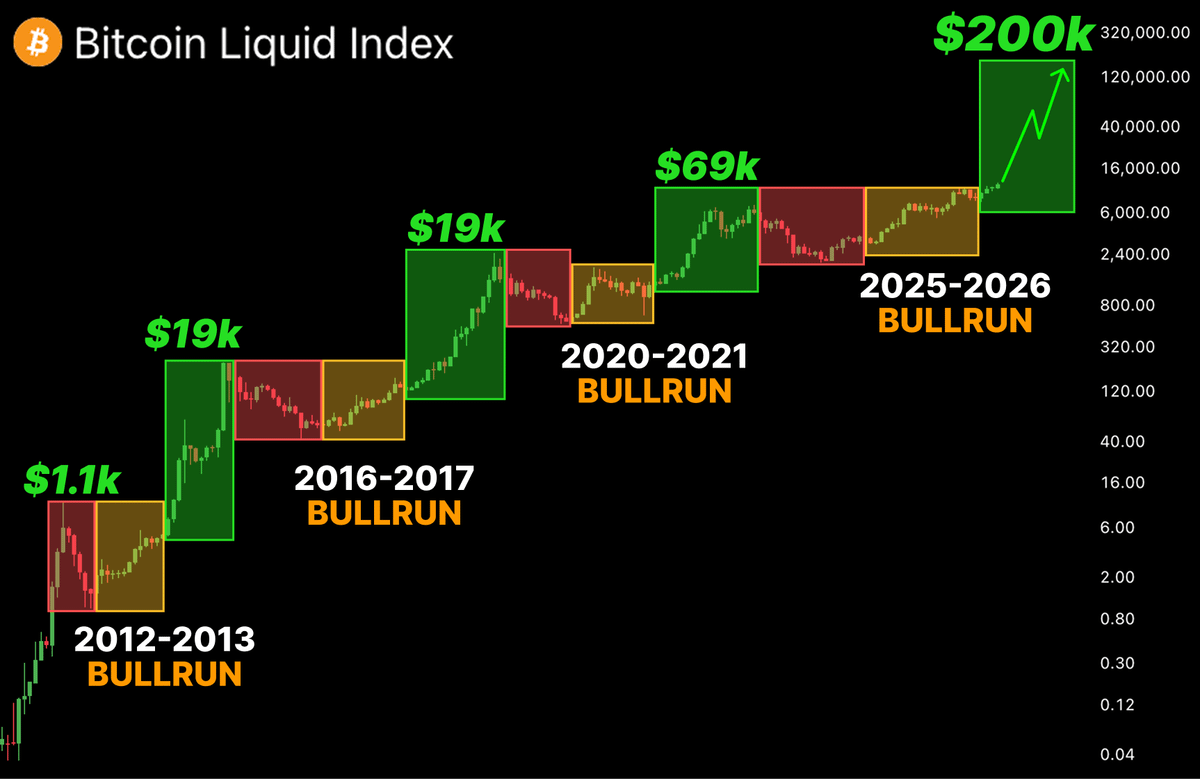

The profile crypto king He emphasized that, on the last five occasions when BTC was "so oversold," the price would have doubled in about three months. In his view, the return of the oversold signal requires extra caution before deciding to sell at this point in the cycle.

Lastly, Klarck He reinforced an argument based on liquidity: according to him, Bitcoin follows a pattern observed for over a decade, with strong increases when there is an inflow of money and corrections when liquidity dries up. He cites, as a reference, periods of QE associated with significant increases (+1.600% and +960%) and end-of-QE phases with relevant corrections (-23% and -51%), in addition to QT phases marked by greater volatility (including movements such as +49%).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Galaxy Digital Issues 2027 Bitcoin Forecast as 2026 Outlook Remains Unclear

Why Analysts Believe Altcoins Are in the Final Stage of the Bear Market

Ethereum Hit Harder Than Bitcoin as $952 Million Exits Crypto Funds—Here’s Why

3 Token Unlocks to Watch in the Fourth Week of December 2025