Original: Pantera Capital

Compiled & Edited by: Yuliya, PANews

Recently, two partners from top venture capital firm Pantera Capital, Paul Veradittakit and Franklin Bi, analyzed the current state and changes in the crypto investment market in the first episode of their podcast. They reviewed the speculative wave of altcoins in recent years, analyzed this year's record-high fundraising alongside a sharp drop in the number of deals—a "tale of two extremes"—and debated topics such as project investment strategies, exit paths, DAT, tokenization, and zero-knowledge proofs. PANews has compiled and translated this episode.

Crypto investment returns to professionalism and rationality; team execution and asset appreciation are key to DAT competition

Host: Today, let's talk about the current state of crypto venture capital. Data shows that this year's total fundraising amount has reached a record high of $34 billion, but the number of deals has dropped by nearly half compared to 2021 and 2022, and more capital is flowing into later-stage projects. How do you interpret this "tale of two extremes"?

Franklin: That's a great question. To understand the current situation, we need to look back at 2021 and 2022, which were the "Metaverse years." At that time, zero interest rates and abundant liquidity fueled a surge in speculative activity. However, many deals were not built on solid foundations; everyone was telling stories driven purely by imagination. Investors didn't have a clear judgment on how metaverse projects could actually succeed, leading to a lot of projects that shouldn't have been funded getting money. In hindsight, we should have asked a simple question: In an environment where even stablecoins lack clear regulation, how could we possibly bring everyone into a fully digital metaverse world? Logically, it just doesn't add up.

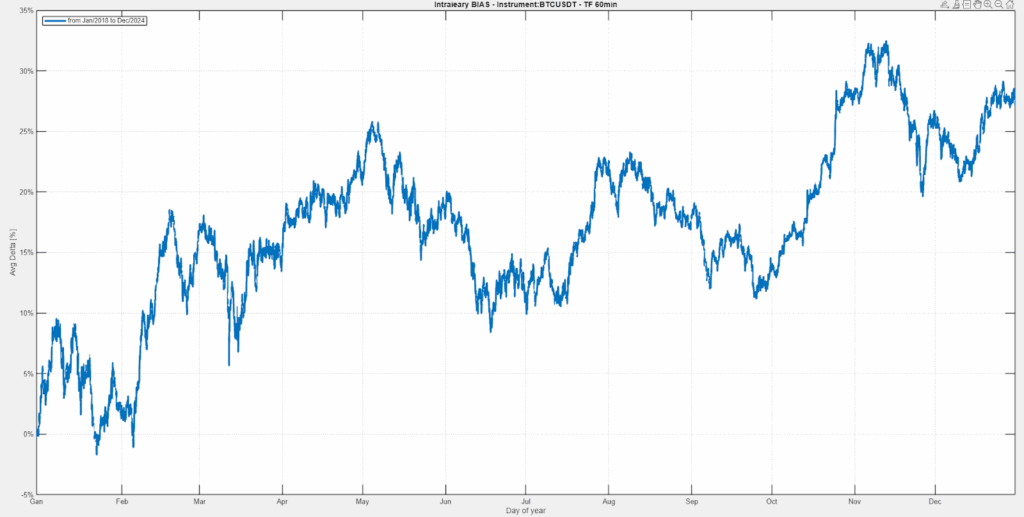

Paul: Another reason is that those two years saw an "altcoin bull market," which we don't have now. The current market is mainly dominated by Bitcoin, Solana, and Ethereum. Without the altcoin frenzy, there aren't as many retail investors, family offices, and small entrepreneurs rushing in to invest heavily in early-stage projects. Now, the funds mainly come from more professional crypto funds, which are more institutionalized, conduct stricter due diligence, and invest more selectively. This means fewer deals, but higher quality and larger amounts per deal. Especially with the emergence of real use cases like stablecoins and payments, traditional fintech VCs have also entered the scene, and their style is also about fewer but better deals.

Host: Indeed, now everyone is more focused on "exits," that is, how investments can be realized. The IPO of Circle is a milestone, providing VCs with a clear exit path.

Franklin: That's right, Circle's IPO is very significant. It finally completes the last piece of the investment story. Previously, everyone wondered how the public market would react after a crypto company went public. Now, with examples like Circle and Figure (a company focused on real-world asset tokenization), investors have more confidence. VCs can now clearly see that a project can go from seed round to Series A and eventually to IPO—the path is viable. They can better assess the likelihood of a project going from seed to IPO, which reduces the perceived risk across the sector.

Paul: Yes, when I first entered the industry, I thought a Bitcoin ETF would definitely be approved within ten years, but it took more than a decade. Now, the infrastructure is finally in place, creating the conditions for these massive exits. In addition, the exit method has shifted from token generation events (TGE) in the past two years to going public on the open market. Investing in equity and investing in tokens face completely different investors and expectations. In the past two or three years, we've seen far more equity deals than token deals, which is also a key reason for the decline in deal numbers.

Host: Besides IPOs, new tools have also emerged in the market, such as "Digital Asset Treasuries" (DATs). It seems to have cooled off recently—what do you think about its future?

Franklin: The emergence of DATs shows that the market's understanding of digital assets has matured. You can think of DATs as a "machine." In the past, you could buy a barrel of crude oil directly, or you could buy Exxon Mobile stock. You make more money buying the stock because you're buying a "machine" that continuously extracts, refines, and creates value. DATs are this "machine" in the digital asset space—they don't just passively hold assets, but actively manage them to generate more returns. The market is cooling off now, and people realize it's not just simple speculation—they're starting to focus on the execution ability of management teams. This is a positive shift, showing the market is returning to rationality and focusing on quality.

I believe DATs won't be a flash in the pan; actively managed investment tools will always have value. I even think that in the future, project teams' own foundations could transform into DATs, using more professional capital market tools to manage their assets, rather than being largely nominal as many foundations are now.

Paul: I think the DAT creation boom may be nearing its end in the US, but there's still plenty of room in regions like Asia-Pacific and Latin America. In the future, the market will go through a round of consolidation, and only those DATs with strong team execution and the ability to continuously appreciate assets will ultimately prevail.

Crypto investment trends: Infrastructure must be verifiable, consumer applications must break out

Host: Now that we've discussed the current state, let's look to the future. Data shows that over the past year, finance, consumer, infrastructure, and AI have been the most attractive sectors for capital. In your view, what will be the next investment hotspot?

Franklin: I'm particularly focused on two directions. The first is tokenization. Although it's an old topic, it's a decades-long trend that's only just beginning. I've been following it since 2015, and it's taken ten years for the field to go from an idea to having real institutions and clients involved. It's like the early days of the internet, when people simply moved newspapers online. Today, we're "copy-pasting" assets onto the blockchain, which is great for efficiency and globalization, but the real potential lies in the fact that these assets can be "programmed" by smart contracts, creating entirely new financial products and risk management models.

The second is ZK-TLS technology, or "network proofs." Simply put, blockchain has a "garbage in, garbage out" problem—if the data on-chain is wrong, no matter how powerful the blockchain is, it's useless. ZK-TLS technology can verify the authenticity of off-chain data (such as your bank statements or ride-hailing records) and bring it on-chain without exposing the data itself. This way, your behavioral data in applications like Robinhood or Uber can safely interact with on-chain capital markets, creating many cool new applications. Additionally, JPMorgan was an early partner of the Zcash and Starkware teams, indicating that the core insights of zero-knowledge proof technology have long existed, but only now are conditions right for large-scale application. With the right infrastructure and talent, zero-knowledge proof technology is gradually maturing.

Paul: Let me add a few points. First, in tokenization, stablecoins are undoubtedly the killer application. As regulation becomes clearer, stablecoins are unleashing the true potential of "money on top of IP," making global payments extremely cheap and transparent. When I first entered the industry, my boss's first task for me was to find markets around the world with real demand for crypto. We found that in places like Latin America and Southeast Asia, stablecoins are the best entry point for ordinary people to accept the crypto world.

Secondly, I'm very optimistic about consumer and prediction markets. From the veteran Augur to today's Polymarket, this field is booming. It allows anyone to create markets and place bets on any topic (such as company earnings or sports events), which is not only a new form of entertainment but also an efficient and democratized information discovery mechanism. The potential of prediction markets in terms of regulation, economics, and cost is gradually emerging, making it possible to create markets on various topics, which will bring an unprecedented influx of information into news and trading sectors.

Franklin: All this shows that on-chain capital markets are by no means just a replica of traditional markets. For example, in Latin America, many people make their first investment in Bitcoin through platforms like Bitso—they've never even bought stocks, but may soon be exposed to complex financial derivatives like perpetual contracts. This "generational leap in finance" means they may never use traditional Wall Street tools again, as those tools seem inefficient and hard to understand to them.

Bullish or bearish? On exchanges, payment chains, and privacy tracks

Host: Let's play a game called "Bullish or Bearish." First question: If you had to hold for three years, would you buy Robinhood (HOOD) or Coinbase (COIN) stock?

Franklin: I'd choose Robinhood. I think the market hasn't fully understood its ambition. Robinhood doesn't just want to be a broker—it is vertically integrating clearing, trading, and all other segments, aiming to become a fully integrated fintech platform that controls its own destiny. In contrast, Coinbase's vision (to bring everyone on-chain) is grander and will take 10 to 20 years; the market is unlikely to fully digest it in three years.

Paul: Then I have to pick Coinbase. I actually think the market underestimates Coinbase's potential in institutional business and international expansion. As global regulation becomes clearer, Coinbase can quickly capture global markets through acquisitions and empower many traditional financial institutions with its "crypto-as-a-service" model.

Host: I also lean toward Robinhood. It has already proven its ability to quickly launch new products and successfully monetize them.

Host: What about "dedicated payment chains" built for stablecoin payments—bullish or bearish?

Paul: I'm curious, not bearish. Customizing a chain for specific scenarios (like payments) and optimizing for scalability and privacy has value. For example, Stripe's Tempo chain—although it's not neutral, with Stripe's resources, it will definitely achieve significant scale.

Franklin: I'm slightly bearish. In the long run, value will ultimately flow to users, not platforms that try to lock them in. Users will eventually choose the most open and liquid places, rather than being locked into a single chain. In the open crypto world, the moat of channels will be greatly weakened.

Host: Last question—is privacy a track worth investing in?

Franklin: I'm bearish. I think privacy is a feature, not a product. Almost all applications will eventually need privacy features, but it's hard for this feature alone to capture value, as any technological breakthrough can be open-sourced.

Paul: I have the opposite view. Ordinary users may not care, but at the enterprise and institutional level, privacy is a necessity. The investment opportunity is not in the technology itself, but in who can combine technology with compliance to provide commercial solutions and make them industry standards.

Rejecting investor "privileges," the public chain war is not over yet

Host: Let's talk about some hot topics on Twitter. The first is about token lock-up periods. Some say it should be four years, others say it should be unlocked immediately. What do you think?

Franklin: I actually hate this topic. Because the premise is wrong—people always think "I invested money, so it must be worth something." But the harsh reality of venture capital is that 98% of projects will ultimately go to zero. If a project fails, the root cause is that it has no value, not because its lock-up period wasn't designed well.

Paul: I understand the founders' difficulties. Token price is important for incentivizing the community and subsequent fundraising. But from the project team's perspective, a reasonable lock-up period (such as 2 to 4 years) is necessary—it gives the team enough time to develop the product and achieve goals, preventing the token price from collapsing too early.

Host: Should founders and investors have the same lock-up period?

Franklin: Absolutely. Our philosophy is "one team, one dream." If an investor seeks special terms to exit early, it means they never intended to stay with the project long-term, and that signal is devastating for the project.

Host: Last topic—has the "L1 public chain war" ended?

Paul: I think it will continue, but not as frantically as before. There won't be as many new L1 public chains emerging in the future, but existing ones will continue to exist thanks to their communities and ecosystems.

Franklin: I think people are now starting to focus on how L1 public chains can capture value, which is a good sign. It's too early to declare L1s dead, as technology keeps evolving and value capture methods are still being explored. Just like Solana back in the day—everyone said it was dead, but as long as you believe it still has a breath left, you can make a lot of money. As long as there's a lot of user activity on-chain, there will always be ways to capture value. Ultimately, "priority fees decide everything"—wherever there's competition, there's value.

Read the original

Pantera partner: Crypto VC returns to professionalism and rationality, where is the next investment hotspot?

Show original

By:吴说

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Bitmine’s Stunning Progress: 66% Towards Controlling 5% of Total Ethereum Supply

Bitcoinworld•2025/12/20 11:27

Retail Is Staring At XRP Price Chart. Institutions Are Staring at D.C

TimesTabloid•2025/12/20 11:12

Citigroup Cuts Crypto Targets While Keeping Long-Term Faith

Cryptotale•2025/12/20 11:06

Bitcoin after the October 2025 crash: causes, consequences, and year-end outlook

Cryptonomist•2025/12/20 11:03

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$88,226.95

-0.03%

Ethereum

ETH

$2,983.96

+0.53%

Tether USDt

USDT

$0.9995

-0.00%

XRP

XRP

$1.94

+3.88%

BNB

BNB

$853.17

+0.53%

USDC

USDC

$0.9998

-0.00%

Solana

SOL

$126.3

+0.73%

TRON

TRX

$0.2791

+0.13%

Dogecoin

DOGE

$0.1319

+2.86%

Cardano

ADA

$0.3784

+3.21%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now