How to Buy Bitcoin and Crypto on Exchanges

Crypto exchanges are the best solution for those who want to buy Bitcoin and cryptocurrencies, especially if they wish to pay in fiat currency.

This is a very simple and immediate solution that has only one real difficulty.

However, it is necessary to make a clear distinction between centralized exchanges and decentralized exchanges.

Summary

Centralized Exchanges

Centralized exchanges are by far the most well-known and widely used.

They are recognized for two reasons.

The first is that they require identity verification. The second is that they do not allow you to save the seed or private keys of the wallet because they act as the sole custodian.

Identity verification is mandatory in many cases on centralized exchanges, although in some rare instances it may not be required.

This is the only real challenge in adopting such a solution.

In fact, identity verification not only takes some time, but it is often not particularly simple, as it involves providing documents and being recognized by taking selfies.

However, once completed, it will no longer be necessary to do it again unless there are changes. Therefore, it is a challenge that requires a few extra minutes and a bit more effort, but then it ceases to cause issues unless it cannot be overcome or further documentation is requested later.

The fact that they do not allow the user to personally hold the funds, but instead act as the sole custodian, can be an advantage but is also a risk at the same time.

Indeed, it does not require ensuring the careful storage of the seed or private keys, but at the same time, it leaves full control of the funds to a third party who can always shut down, go bankrupt, be hacked, or even steal them.

Decentralized Exchanges

Decentralized exchanges, on the other hand, do not require identity verification (they are used anonymously) and leave full control of the funds to the user.

This last feature, however, introduces an element of risk, even though it eliminates the one associated with using a third-party custodian. In fact, to use them, it is essential to carefully safeguard the seed and the private keys of the wallet, because in the event of theft or loss, significant risks are incurred.

However, from the perspective of practical use for purchasing cryptocurrencies, the procedure is similar to that of centralized exchanges, albeit with some minor differences and, most importantly, certain precautions.

The only issue is that the so-called DEX (decentralized exchanges) do not support traditional fiat currencies, as they only support tokens on blockchain, therefore, to purchase in fiat on DEX, one must first convert fiat into stablecoins on another platform, or by using an external tool.

The Purchase Procedure

The first step to purchasing Bitcoin or crypto on an exchange is to register and open an account. This is a standard procedure, similar to that on many other platforms, but with a couple of particularities.

In the case of centralized exchanges, the key aspect lies in identity verification, which is advisable to complete immediately, even if it requires investing some time.

In the case of decentralized exchanges, the peculiarity lies in the need to connect your non-custodial wallet to the exchange. It is not always strictly necessary to do so, but in most cases, it is required and, to be honest, also quite convenient.

After completing this procedure, you can proceed with the purchase.

The first step is to deposit the necessary funds on the exchange to cover the purchases.

Regarding centralized exchanges, you can deposit both regular fiat currencies (dollars, euros, etc.) and stablecoins, whereas on DEXs, you cannot deposit fiat but only stablecoins.

In this case, stablecoins are tokenized fiat, such as USDT or USDC, which replicate the value of the US dollar (USD) on-chain.

However, before depositing stablecoins, it is always necessary to verify that they are supported, because, for example, USDT is often not available for EU users, even though it is the largest stablecoin in the world, so it is advisable to use USDC. Those who pay in fiat on centralized exchanges can also completely do without stablecoins, if they wish.

The Actual Purchase

Once the funds have been deposited for purchase, it is often sufficient to select the desired crypto, set the amount, and proceed with the payment. The purchased tokens will be immediately credited to your account on the exchange.

In this regard, however, it is useful to make a clarification.

Simplified purchasing procedures like this are often available because they are very convenient, but they come with higher fees.

In theory, it would be better to use the non-simplified procedure, because although it is less immediate, it has significantly lower costs.

In that case, after depositing the funds, you need to search on the exchange for the trading pair between the cryptocurrency you want to purchase and the currency you wish to use for payment.

For example, if you want to buy Bitcoin in euros, you need to select the BTCEUR trading pair, whereas if you want to buy Ethereum in USDC, you need to select ETHUSDC.

Once the pair is selected, proceed to enter the amount of cryptocurrency you wish to purchase.

At this point, there is one final step to complete before confirming the purchase. You need to decide whether to make the purchase immediately at the market price or set a maximum limit price that you do not wish to exceed.

In the case of so-called “limit” orders (i.e., with the maximum limit price indicated), it is true that you avoid buying at too high a price, but it is by no means certain that the purchase can be immediate. Indeed, if a price is set too low, there is even a risk that the purchase may not be executed at all, as the exchange might not find any other user willing to sell at that price.

Binance

One of the most widely used centralized exchanges is undoubtedly Binance.

After registering and completing identity verification, you can deposit funds in both fiat currency and stablecoins.

To make deposits, you can go to “Buy Crypto” > “Fiat Deposit” or “Credit/Debit Card”, and you can deposit using a credit/debit card, SEPA transfer (recommended for euros), or other methods.

Once the deposit is credited (it may take more than a day via bank transfer), go to “Buy Crypto” > “Buy with Card” or “Convert”, select the payment currency and the crypto you want to purchase, enter the amount, and confirm.

Alternatively, you can go to “Trading” > “Convert” and select the desired trading pair.

Bybit

Another widely used crypto exchange is Bybit.

The procedure is very similar.

After registering and completing identity verification, go to “Buy Crypto” > “Fiat Deposit” or “One-Click Buy” to deposit funds.

The deposit can be made using a credit/debit card, SEPA transfer, or other methods, including Google Pay and Apple Pay.

Once the deposit is made, go to “Buy Crypto” > “One-Click Buy” or “Express”, select the crypto you want to purchase and the currency you wish to pay with, enter the amount, and confirm the payment.

Alternatively, you can go to the “Spot Trading” section, select the desired trading pair, and proceed with the purchase as explained above.

Bitget

A third widely used crypto exchange nowadays is Bitget.

In this case as well, similar to most centralized exchanges, the purchasing procedure is quite similar.

After registering and completing identity verification, navigate to “Buy Crypto” > “Fiat Deposit” or “Bank Deposit”, and proceed to deposit funds using a credit/debit card, SEPA transfer, or other methods.

Once the deposit is credited, go to “Buy Crypto” > “One-Click Buy” or “Third Party”, select the currency you wish to pay with and the crypto you want to receive, enter the amount, and confirm the purchase.

Alternatively, you can go to the “Spot Trading” section, select the desired trading pair, and proceed with the purchase as explained above.

DEX

On decentralized exchanges, however, there is no registration and no identity verification. You simply need to connect your non-custodial wallet.

Fiat currencies cannot be used, so stablecoins must be deposited on the DEX.

Once the deposit is made, select the desired trading pair and proceed with the purchase using a process very similar to the one explained above for trading pairs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

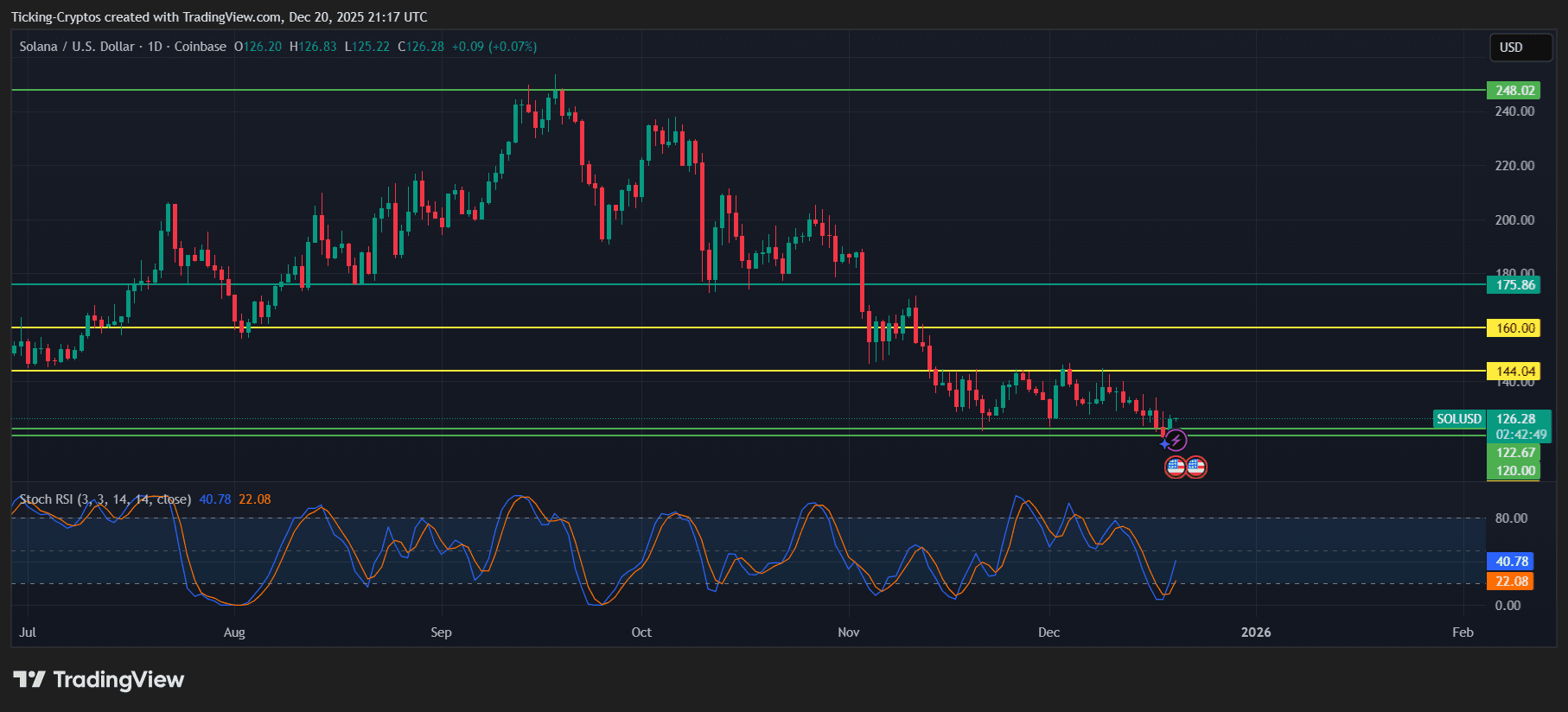

Solana (SOL) Still Under Market Pressure, Institutions Are Eyeing GeeFi (GEE) as Presale Raised Over $1.6M

Solana Price Depends On Existing SOL Holders, Here’s Why

Crypto Price Today: Bitcoin, Ethereum, Dogecoin, and Solana at Key Levels

Banks Need XRP To Be Pricier—Here’s Why A Finance Expert Says So