- Dormant Coins: Long-held Bitcoin is returning to circulation, increasing supply and market pressure.

- Liquidity Weakness: Inter-exchange flows are declining, limiting support for sustained price rallies.

- Price Strain: Bitcoin hovers near highs but lacks strong buying momentum and fresh demand.

Bitcoin’s rally has shown signs of strain, even as prices hover near cycle highs. Long-held coins are moving back into circulation, and liquidity is thinning across exchanges. Market participants are beginning to notice that capital flows are no longer as straightforward as before. With early holders releasing BTC into ETFs, exchanges, and institutional vehicles, the next phase for Bitcoin may depend heavily on how liquidity and demand evolve in the coming weeks.

Old Coins Return to Circulation

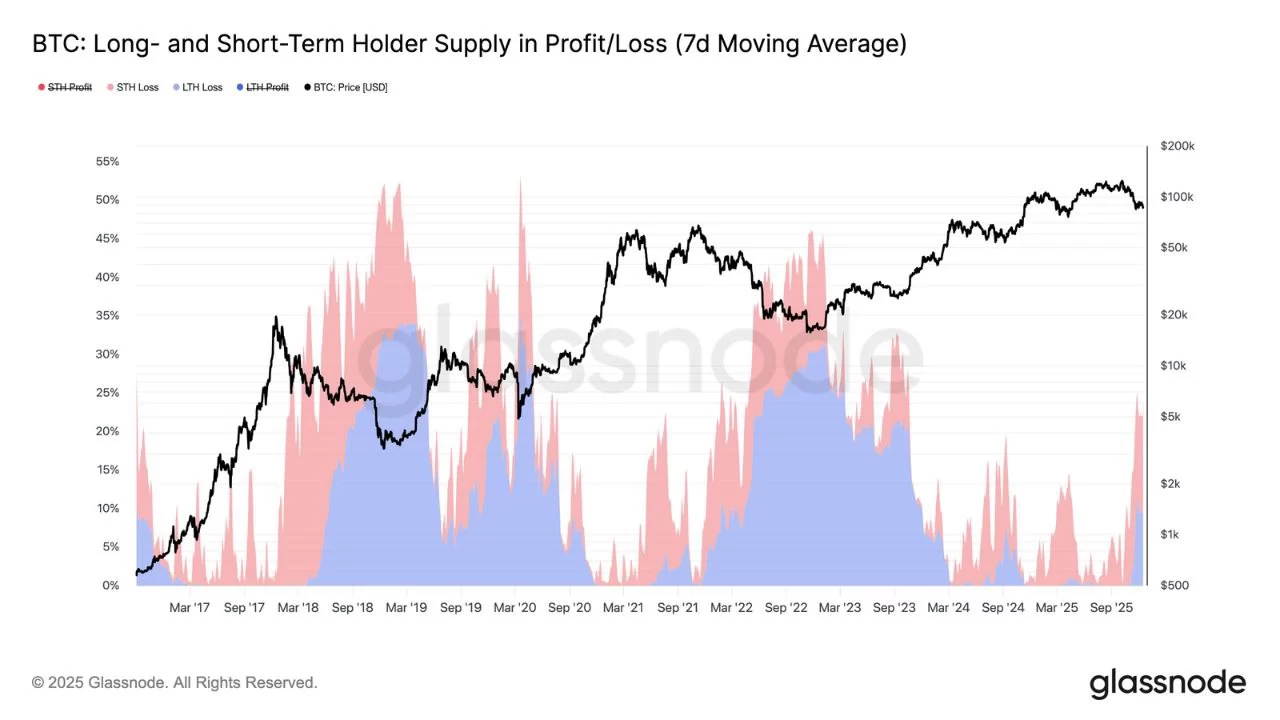

Data from Joao Wedson, CEO of Alphractal, indicates Bitcoin now has four distinct distribution alarms, a first in its history. These s reflect movements from dormant coins that have been inactive for years. The Reserve Risk indicator, which tracks such long-held coins, has repeatedly signaled selling pressure since 2024. Early holders are steadily releasing BTC, injecting supply back into the market during a period of heightened attention.

Much of this supply appears to flow directly into exchanges, ETFs, and institutional products. This pattern has emerged late in previous cycles and often marks a shift from rapid upside to slower, more fragile market conditions. As these old coins reemerge, fresh buyers may face competition from sellers who are already monetizing their positions. This could influence price consolidation and reduce the intensity of rallies for the foreseeable future.

Liquidity Lags Behind

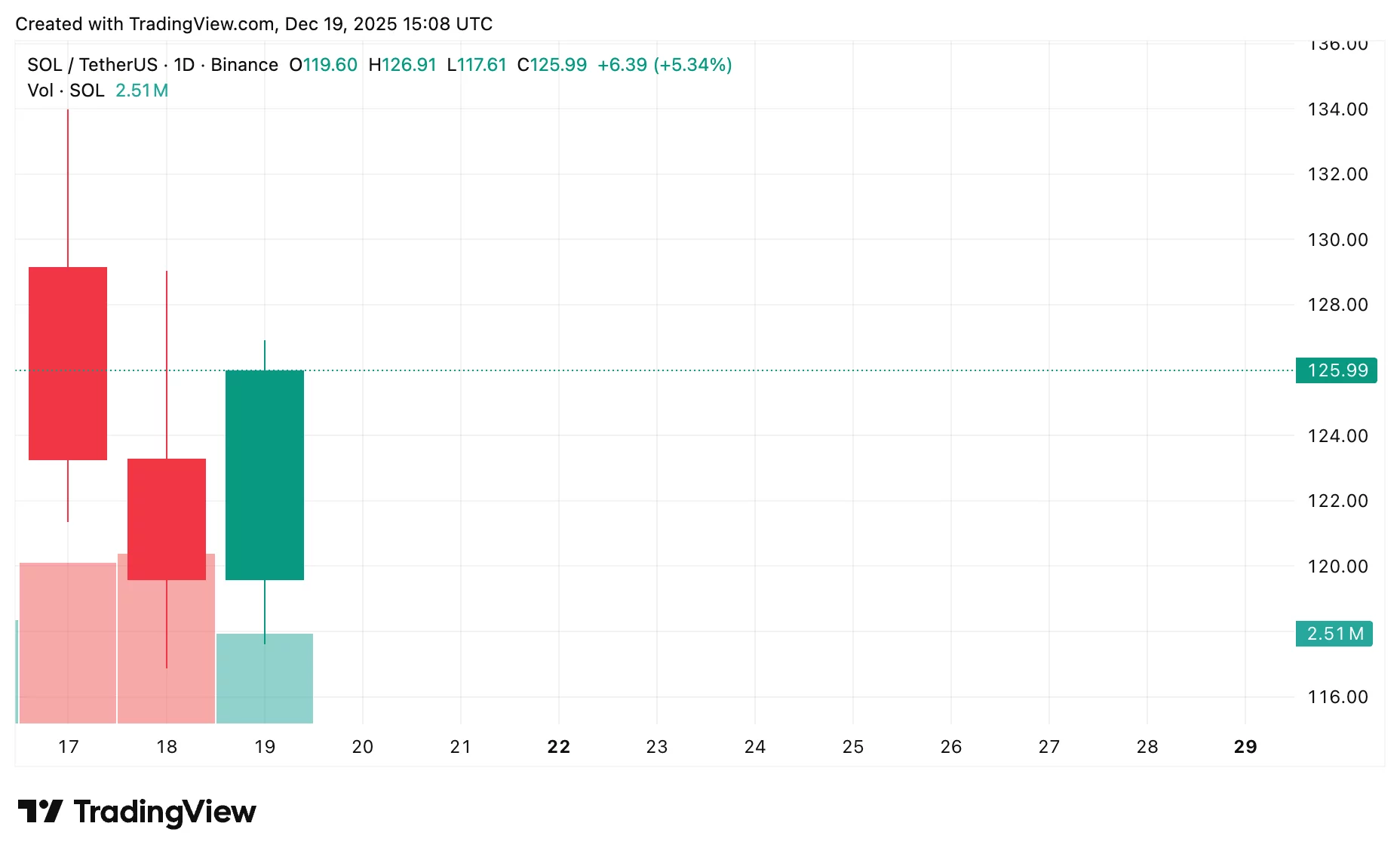

Alongside the return of dormant coins, Bitcoin’s liquidity is showing signs of weakness. The Inter-exchange Flow Pulse, which measures capital movement between exchanges, is trending lower and has slipped below its 90-day moving average. Historically, this level has indicated slower or corrective phases in Bitcoin cycles. Despite Bitcoin trading near $90,000, fewer positive flows are moving across exchanges to support the rally.

On-chain metrics show that demand from new buyers remains limited, creating a mismatch between price strength and liquidity. On the price chart, the trend appears strained. Bitcoin remains below key short and long-term moving averages, signaling a loss of trend momentum. The RSI does not show strong buying or selling pressure, while on-balance volume has flattened, indicating a lack of fresh demand entering the market.

If inter-exchange flows do not recover, sustaining upside could become challenging. Traders and investors should watch these liquidity metrics closely, as they often dictate whether Bitcoin consolidates or experiences sharper pullbacks. While the market has absorbed previous surges from long-held coins, current conditions suggest caution.

The reemergence of old coins combined with weakening liquidity highlights a critical inflection point for Bitcoin. The market could continue to consolidate near current highs or experience corrective pressures if demand does not pick up. Monitoring capital flows, exchange inflows, and early-holder activity will remain essential for predicting the next move.