Bank of Japan Readies 0.75% Rate Hike as US Yields Rise Ahead of Fed Cut, Marking the End of Ultra-Low Rates Era

The Bank of Japan is poised to deliver a 25-basis-point rate hike today, with markets pricing in roughly a 98% probability. If enacted, the policy rate would rise from 0.50% to 0.75%, the highest since 1995 and a shift from decades of ultra-low policy.

Markets anticipate spillovers from the BoJ decision into global fixed income and currencies. A firmer stance could lift Japanese yields and push up US Treasuries via rate differentials, a dynamic amplified by Japan’s position as the largest foreign holder of US debt (~$1.2 trillion as of September).

Governor Haruhiko Kuroda will hold a press conference at 14:30 local time, a key signal for policy credibility. With policy normalization data-dependent, traders will watch global equities and FX for implications relative to the Fed and other central banks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

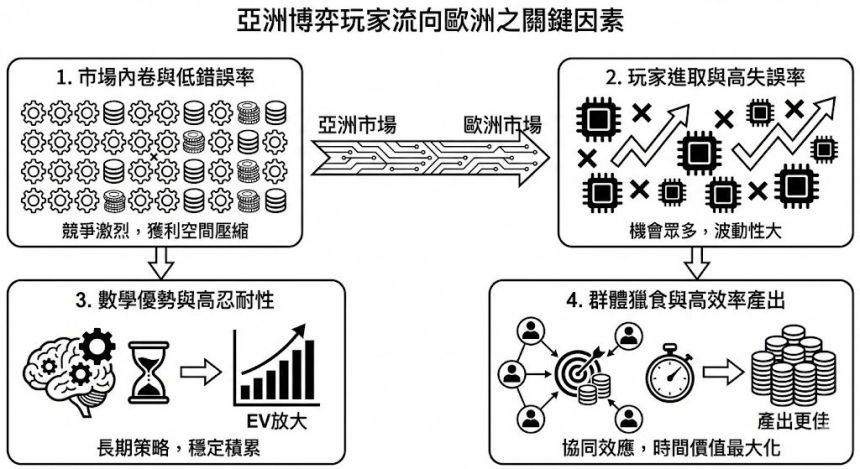

德州撲克趨勢|亞洲高級玩家轉戰歐洲撲克網內幕

BTC Rises Above $87,000: A Stunning Surge and What It Means for You

How is Crypto VC Investment Trending in a Bearish Market?