Bitcoin Stuck Between $81K Support and $95K Resistance as Glassnode Warns of a Fragile, Range-Bound Market

Bitcoin market analysis from COINOTAG News and Glassnode describes a fragile, time-sensitive structure driven by supply dynamics, realized losses, and fading demand. Price faced resistance near $93,000 and retraced to roughly $85,600, highlighting dense supply in the $93,000–$120,000 zone as established buyers suppress rebounds. With price action beneath key levels, the risk/reward remains skewed to the downside until catalysts emerge.

A sustained reclaim of the near-term benchmark around $101,500 is needed to unlock upside, while dips below $95,000 keep gains constrained. The realized value sits near $81,300, tempering further declines. Spot demand remains selective, and corporate fund flows are intermittent; futures position gradually de-risks rather than rebuilds confidence. The options market shows a range-bound pattern, with contraction in near-month volatility and expiry-driven activity likely limiting price action into late December.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Foundation Proposed Three Solutions for One of ETH’s Biggest Problems

Fading ETF Interest Puts Pressure on Dogecoin as Price Approaches Critical Cost-Basis Zone

Why British politicians are flocking to American tech giants

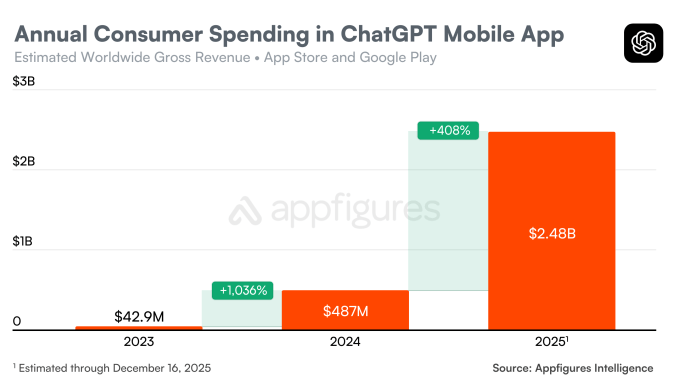

ChatGPT’s mobile app hits new milestone of $3B in consumer spending