Date: Fri, Dec 12, 2025 | 06:58 PM GMT

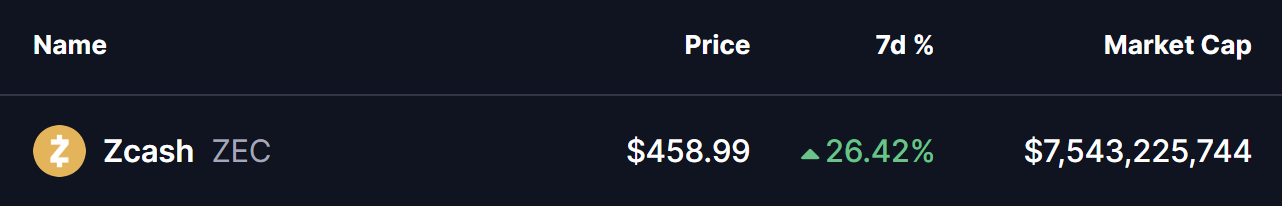

The broader cryptocurrency market continues to show notable volatility throughout the week. Despite the rapid swings, the privacy-focused token Zcash (ZEC) has remained resilient, securing a strong 26% weekly jump. Beyond price action alone, the ZEC chart is now beginning to highlight a key bullish structure — one that may soon open the door for a meaningful breakout.

Source: Coinmarketcap

Source: Coinmarketcap

Cup and Handle Pattern Taking Shape

On the 4H timeframe, ZEC is forming a classic Cup and Handle pattern. The cup structure developed after an extended downtrend, eventually bottoming out near the $390.24 zone where buyers stepped in aggressively. From there, ZEC staged a steady recovery, climbing back toward the major resistance area near $470.

This is where the “handle” began to form. A rejection from $470 triggered a measured pullback, creating a small, rounded consolidation before price climbed again. ZEC is now trading around $458, just below the critical neckline resistance at $470 — the major level that will determine whether this bullish continuation setup completes successfully.

Zcash (ZEC) 4H Chart/Coinsprobe (Source: Tradingview)

Zcash (ZEC) 4H Chart/Coinsprobe (Source: Tradingview)

The alignment of the rounded base, progressive higher lows, and tightening consolidation all support the argument that momentum is shifting in favor of the bulls.

What’s Next for ZEC?

The key focus is now the neckline at $470. A decisive breakout above this resistance would confirm the Cup and Handle formation and trigger a stronger bullish continuation phase. If this breakout materializes, the next upside target sits near $639 — a potential 39% move from current levels, aligning with the measured height of the pattern’s cup.

As ZEC approaches this inflection point, market participants are watching closely. The structure is clean, momentum has returned, and one of the strongest reversal-to-continuation patterns in technical analysis is now in play. A breakout would shift sentiment firmly in favor of further upside.