Zcash Leads in Hype — But Monero (XMR) Is Quietly Dominating Where It Matters

Privacy coins have emerged as one of the dominant narratives shaping cryptocurrency investment trends this year. The two leading altcoins in this sector by volume and market capitalization are Zcash (ZEC) and Monero (XMR). Investor attention has focused heavily on ZEC. Meanwhile, XMR continues to show strong and steady growth. XMR Outperforms ZEC in Many

Privacy coins have emerged as one of the dominant narratives shaping cryptocurrency investment trends this year. The two leading altcoins in this sector by volume and market capitalization are Zcash (ZEC) and Monero (XMR).

Investor attention has focused heavily on ZEC. Meanwhile, XMR continues to show strong and steady growth.

XMR Outperforms ZEC in Many Aspects Despite Lacking the Spotlight

In terms of daily spot trading volume in December, ZEC performed exceptionally well.

ZEC maintains a daily trading volume of nearly $1 billion. This level surpasses XMR and DASH, thanks to strong liquidity on major exchanges like Binance.

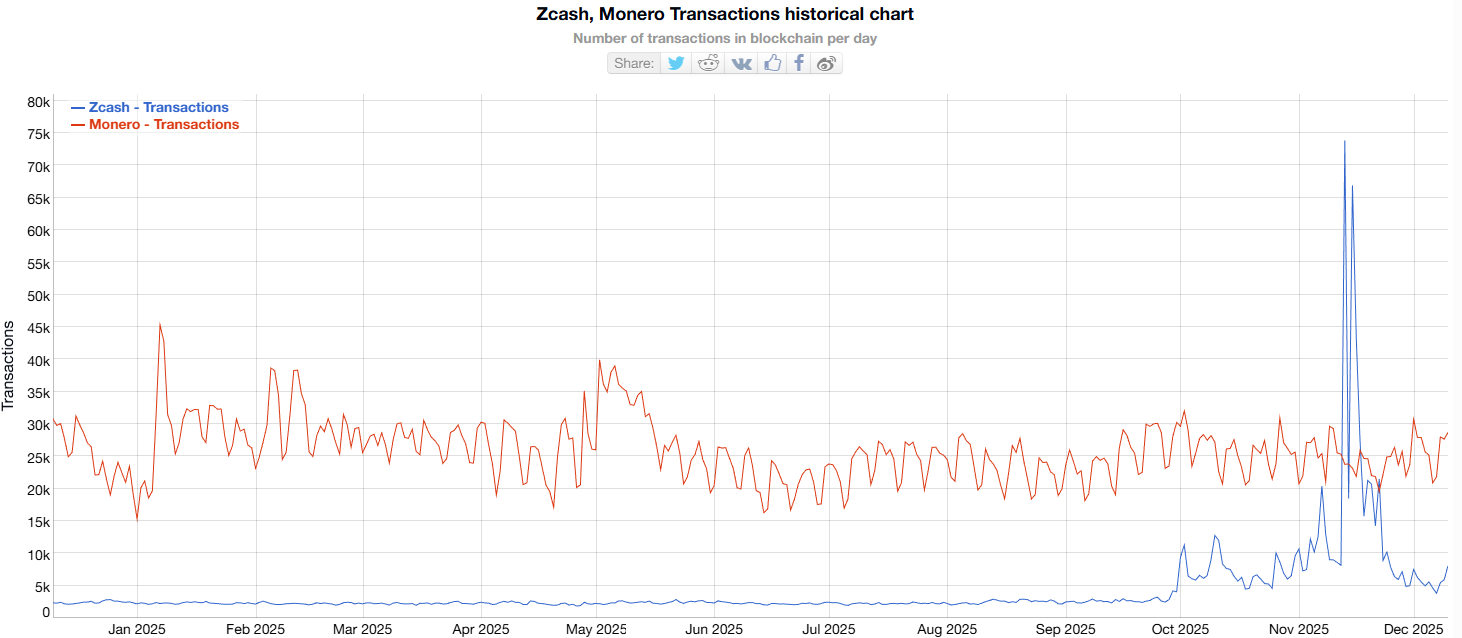

However, ZEC falls far behind in daily on-chain transactions. Data from BitInfoCharts shows XMR reaching an average of about 26,000 transactions per day. This figure is more than triple ZEC’s average of roughly 8,000 transactions per day.

Zcash, Monero Daily Transactions. Source:

BitInfoCharts

Zcash, Monero Daily Transactions. Source:

BitInfoCharts

The chart also indicates that XMR’s on-chain activity remains consistent over the long term. This trend reflects stable user behavior. In contrast, ZEC’s recent surge and sharp decline appear more like temporary excitement.

On-chain activity carries longer-term significance than spot volume. It reflects real usage patterns and user acceptance of XMR for anonymous transfers rather than short-term trading sentiment.

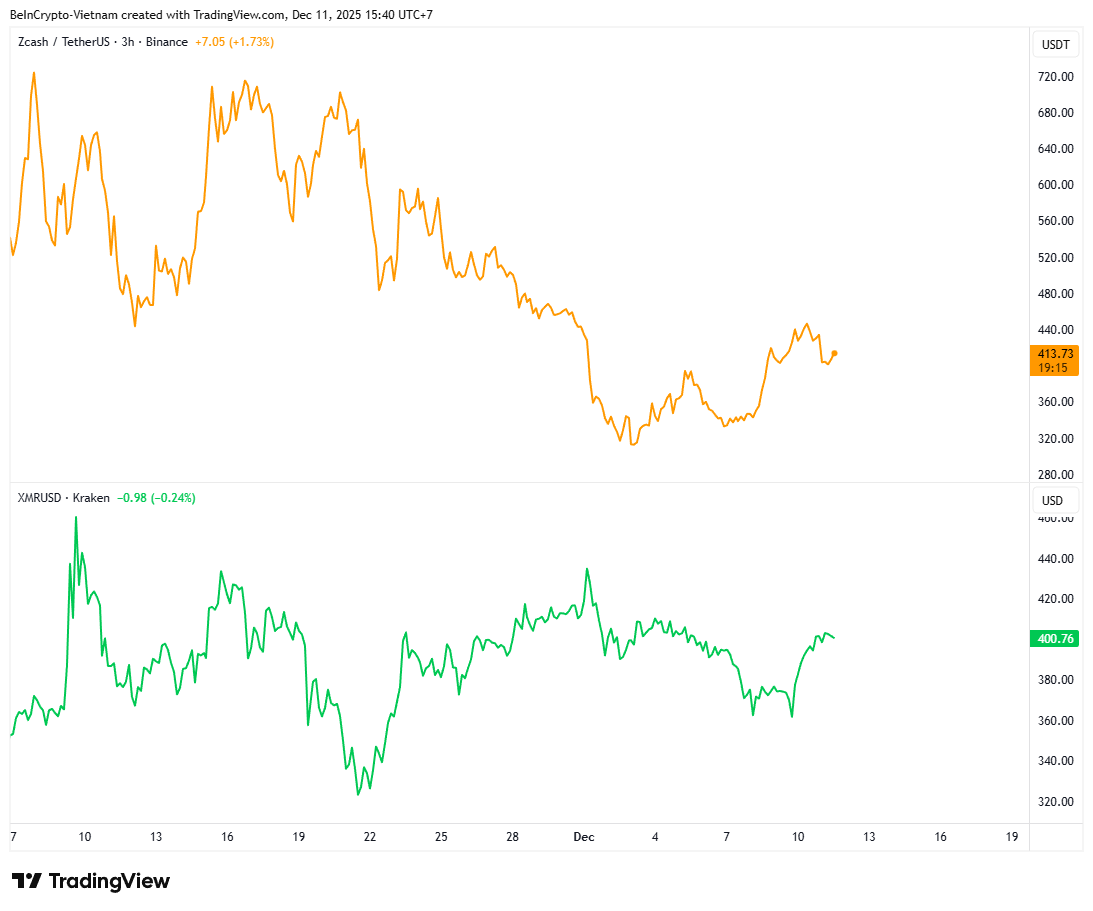

Additionally, ZEC’s price fluctuates due to increased volatility resulting from speculative trading. XMR’s price movement remains more stable.

TradingView data shows that ZEC has fallen by more than 40% over the past month. Many analysts now suggest the possibility of a bubble pattern. Meanwhile, XMR declined by roughly 12%.

Comparing The Price Performance Between ZEC and XMR. Source:

TradingView

Comparing The Price Performance Between ZEC and XMR. Source:

TradingView

From this perspective, ZEC suits traders who chase the privacy coin narrative and aim for quick profits during extreme FOMO cycles. The downside is deeper price drops and longer recovery periods.

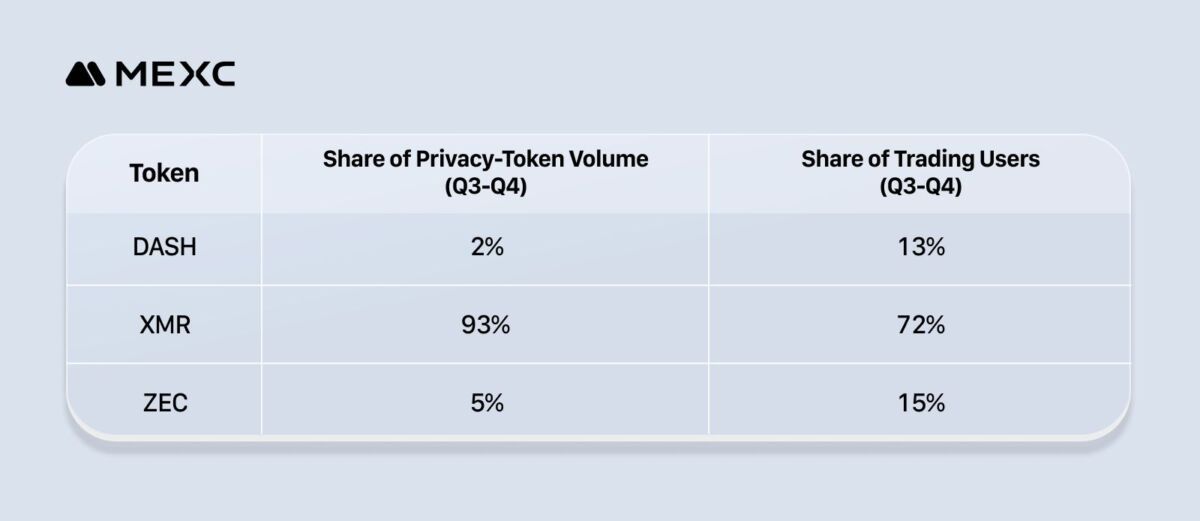

Furthermore, the latest report from MEXC Research reinforces XMR’s position. Over longer timeframes, XMR demonstrates superior trading volume and user activity compared to ZEC and DASH.

“Despite ZEC and DASH posting record-high trading volumes, Monero remains an asset of choice among privacy coin traders, accounting for 93% of total trading volume in Q3–Q4 and 72% of users in this segment,” MEXC Research reported.

The report also notes that growing interest in privacy assets reflects users’ increasing need for anonymity as regulators strengthen capital controls.

Therefore, regardless of holding ZEC or XMR, investors can continue to benefit next year. Experts predict privacy coins will remain a dominant market narrative in 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.

Renewable Energy Training as a Key Investment to Meet Future Workforce Needs

- Farmingdale State College's Wind Turbine Technology program aligns with surging demand for skilled labor in decarbonizing economies, driven by U.S. renewable energy targets. - Industry partnerships with Orsted, GE Renewable Energy, and $500K in offshore wind funding validate the program's role in addressing workforce shortages in expanding wind sectors. - Hands-on training with GWO certifications and VR simulations prepares graduates for high-demand, high-salary roles ($56K-$67K annually), reducing corpo