Date: Wed, Dec 10, 2025 | 06:50 AM GMT

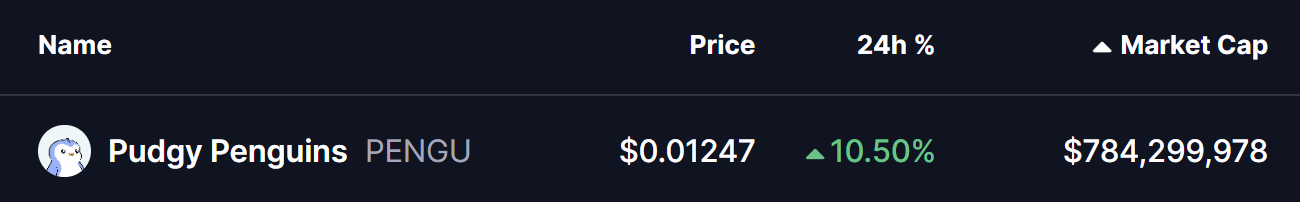

The cryptocurrency market has made a sharp bullish move in the past 24 hours as the prices of both Bitcoin (BTC) and Ethereum (ETH) rallied by 3% & 6%, allowing major tokens to regain momentum including Pudgy Penguins (PENGU).

PENGU has surged more than 10%, and beyond this price recovery, its chart is signalling a structural shift — one that could mark the beginning of bullish continuation if confirmed.

Source: Coinmarketcap

Source: Coinmarketcap

Rounding Bottom in Play

On the daily timeframe, PENGU appears to be shaping a textbook rounding bottom formation — a classic bullish reversal setup that typically forms after a prolonged decline. The structure highlights a transition phase in which selling pressure slowly fades while accumulation strengthens.

The token fell sharply from its neckline resistance around $0.01650 to form a major low at $0.009343. This bottom level acted as a key demand zone where buyers consistently defended price, preventing further breakdown and setting the foundation for a gradual reversal.

Pudgy Penguins (PENGU) Daily Chart/Coinsprobe (Source: Tradingview)

Pudgy Penguins (PENGU) Daily Chart/Coinsprobe (Source: Tradingview)

Since then, PENGU has steadily climbed back into strength and is currently trading at $0.01247, indicating early signs of stabilization and potential base formation.

What’s Next for PENGU?

To fully validate the rounding bottom pattern, PENGU must reclaim the 50-day moving average positioned at $0.01441. A clean breakout above that dynamic resistance would likely serve as the confirmation trigger, suggesting that the reversal is no longer just structural but active.

Once that level is cleared, the next major technical area to watch remains the neckline barrier at $0.01650. A successful breach above this zone would open the door for bullish continuation and could potentially ignite a stronger rally as technical sentiment flips in favor of buyers.

Until then, the pattern remains in development. Failure to reclaim the 50-day MA on the first attempt could invite short-term pullback or sideways consolidation, though the broader bottoming structure would still remain valid as long as higher lows continue holding.