The Report on Bitcoin (BTC) Adoption in Countries Has Been Published! Where Does Türkiye Rank? – A World Leader Surprised Everyone!

The popularity and adoption of cryptocurrencies, especially Bitcoin (BTC), continues to increase day by day, with some countries standing out.

The latest research report published at this point has revealed some interesting data.

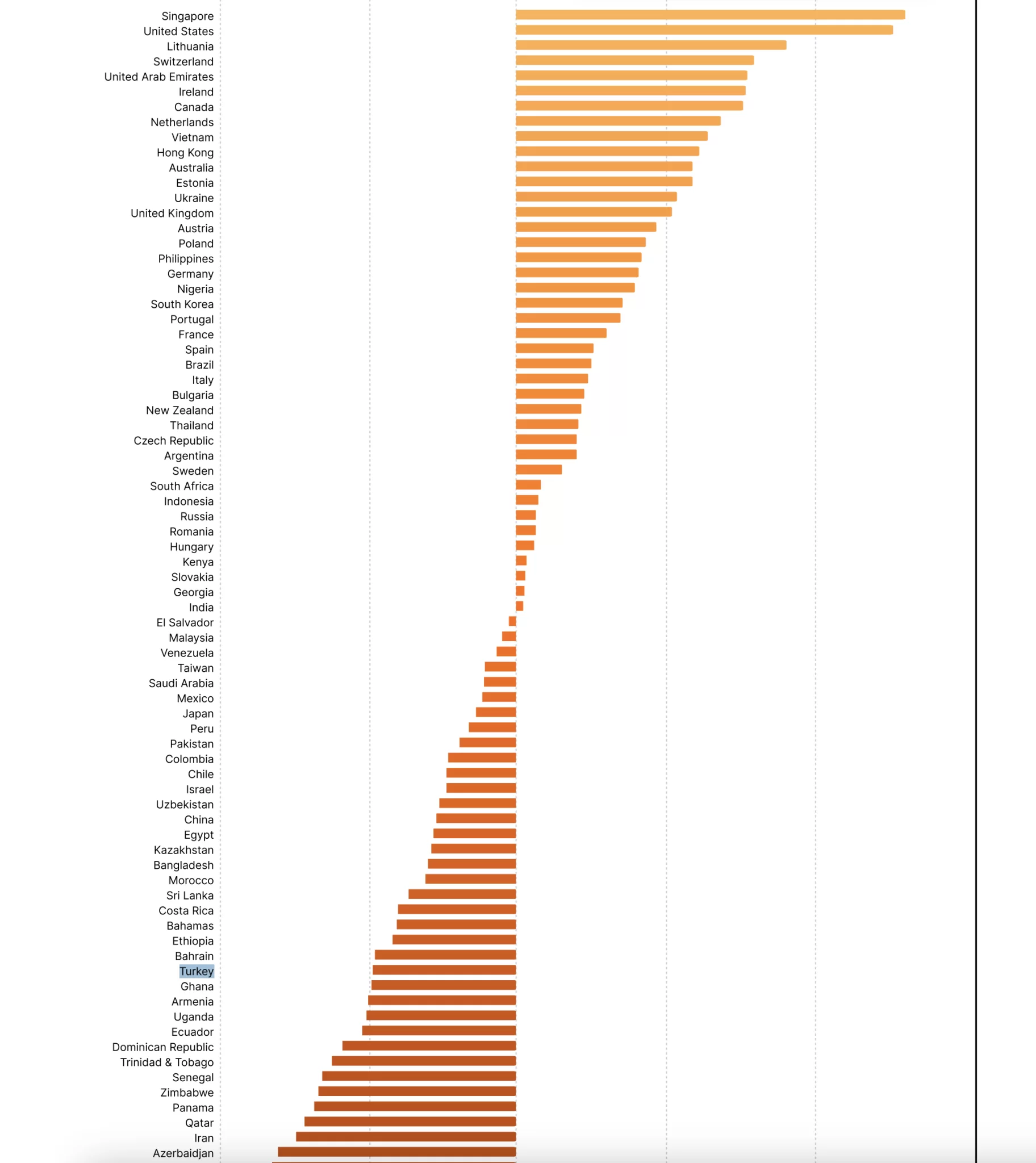

According to a new report by Bybit and DL Research, Singapore has risen to become a global leader in cryptocurrency adoption.

A new report titled “World Crypto Ranking 2025” has placed Singapore in first place among 79 countries.

Singapore was followed by the United States, Lithuania, Switzerland, and the United Arab Emirates, in that order.

Other data included in the report showed the significant success of stablecoins across regions and income levels, the rising growth of stablecoins other than the US dollar, and the rapid increase in businesses accepting cryptocurrency payments.

The report also highlighted that the market value of real-world asset (RWA) tokenizations increased by 63%, reaching $2.57 billion.

Additionally, the report noted that on-chain payrolls have expanded to account for 9.6% of all payrolls, with over 90% of these transactions being conducted using stablecoins.

Among the 79 countries on the list, Türkiye was ranked towards the bottom.

While Turkey ranks 64th globally, the report states: “Turkey benefits from strong DeFi web traffic, ranking 7th globally, and a relatively high cryptocurrency ownership rate (ranked 23rd); this contributes to its 15th place ranking in user penetration. Despite widespread adoption, the formal infrastructure remains weak; limited licensing, insufficient fiat currency support, and unclear policy frameworks exist. Ranked 54th in institutional readiness, Turkey has a predominantly informal and retail-focused market; users interact with cryptocurrencies without strong institutional support.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HYPE Token Crypto: High-Risk Speculation or the Future Breakthrough?

- HYPE token's 2025 speculative surge stems from strategic partnerships, on-chain utility expansions, and mixed market signals. - Hyperion DeFi's Felix collaboration and $30M repurchase program aim to boost HYPE's institutional appeal and staking value. - Price volatility saw $53-$71 highs in December 2025, followed by sharp declines to $28.81 amid bearish technical indicators. - Risks include 10M token unlocks, limited exchange listings, and reliance on internal value mechanisms amid market sentiment shif

Hyperliquid's Growing Popularity Among the Public and Its Impact on the Structure of the Crypto Market

- Hyperliquid dominates 73% of 2025 decentralized derivatives market with $320B July trading volume and 518K+ user addresses. - HIP-3 Growth Mode slashes taker fees by 90%, enabling hybrid liquidity models that blend DeFi transparency with CEX speed. - Institutional adoption and 97% fee buybacks drive HYPE token's 380% surge, while $4.9M manipulation loss highlights retail-driven risks. - Platform's two-tier market structure and tokenomics reshape liquidity dynamics, but regulatory scrutiny and volatility

Momentum ETF (MMT) and the Intersection of Retail Hype and Institutional Backing in November 2025

- Momentum ETF (MMT) surged 1,330% in Nov 2025 due to retail frenzy and institutional validation. - Binance airdrop and Sui-based perpetual futures DEX boosted retail demand through liquidity and yield incentives. - $10M HashKey funding and $600M TVL validated MMT's institutional credibility under CLARITY Act/MiCA 2.0 frameworks. - ve(3,3) governance model and token buybacks created flywheel effects, aligning retail/institutional incentives. - Q1 2026 Token Generation Lab aims to expand Sui ecosystem proje

Fed Cuts Rates, Announces $40B T-Bill Program, Crypto Dips