Fartcoin price prediction: Momentum builds, but breakout pending

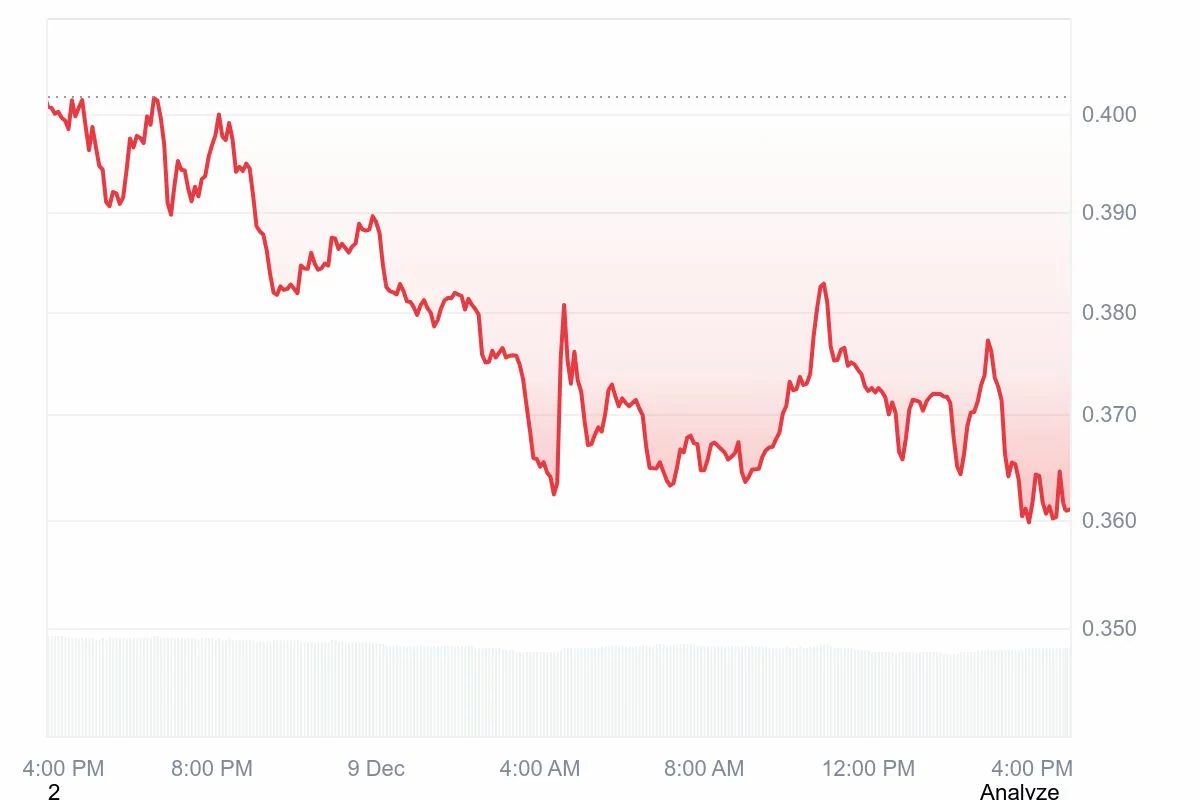

The Fartcoin price has been stuck in a narrow range today, trading between $0.3619 and $0.4035. It’s currently sitting at $0.3616 — more than a 10% drop for the day. Even so, the overall trend hasn’t broken, since Fartcoin is still up 4.3% this week and nearly 15% for the month. What we’re seeing is basically dips being bought while short-term traders take profits at the top.

So, with all that going on, let’s break down the chart and see what the Fartcoin price prediction could be in the short term.

Table of Contents

- Current market scenario

- Upside outlook

- Downside risks

- Fartcoin price prediction based on current levels

- Fartcoin is trading in a narrow range between $0.36 and $0.40, with support holding around $0.36–$0.37.

- Short-term dips are being bought while traders take profits at resistance, keeping the overall weekly and monthly trend positive.

- A breakout above $0.40–$0.42 could trigger a stronger bullish move toward $0.45.

- A drop below $0.36 could lead to a correction toward $0.32–$0.30.

- The market is at a key decision point, with buyers currently in control but no decisive breakout yet.

Current market scenario

Fartcoin ($FARTCOIN) is managing to protect its $0.36–$0.37 support zone, and every dip into that area has sparked a nice recovery, showing buyers are still active. But higher resistance levels continue to push the price back down, which means the bulls aren’t totally dominating yet.

The price is basically getting squeezed between support and resistance, and that kind of compression usually leads to a strong breakout. The side that wins this battle will set the tone for the Fartcoin outlook.

Upside outlook

From a bullish perspective, things still look pretty promising. As long as the $0.36–$0.37 support holds, the price has space to gather momentum for another upward move. If buyers step up and take back the short-term moving averages, the next target is $0.40–$0.42 — a resistance zone Fartcoin has hit trouble with before.

A solid daily close above that zone would flip sentiment in a big way and support a stronger Fartcoin forecast. With hype building across social platforms and memecoin money moving around, bulls have a realistic chance of heading back to those levels soon.

Downside risks

Even so, sellers still carry some weight here. A clean break below $0.36 would undermine the current support setup and open the door for a deeper correction. If that happens, the price may drift back toward the $0.30 imbalance area that’s still waiting to be filled.

Hitting that zone could shake out the weaker hands and trigger stop-losses, pushing volatility up. It’s a secondary scenario for now, but still worth keeping an eye on — especially if the broader crypto market weakens or Bitcoin drops sharply.

Fartcoin price prediction based on current levels

Considering the recent swings, Fartcoin is sitting at an important decision point. Either direction is still possible.

Bullish scenario: If buyers lift the price above $0.39, targets at $0.42 and possibly $0.45 open up, matching an optimistic Fartcoin price prediction.

Bearish scenario: Losing $0.36 would hand control to sellers, likely dragging the price toward $0.32 or $0.30.

Bulls are in charge for the time being, but a decisive breakout hasn’t happened yet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Emerging Educational Initiatives Driving Sustainable Economic Expansion: An Analytical Perspective on Strategic Investments

- Skills-based education prioritizes practical competencies over degrees, addressing 61% of employers' evolving workforce needs. - Experiential learning boosts career readiness (73% of interns) and aligns education with industry demands through hybrid training models. - AI-driven learning personalizes education, projected to increase global productivity by 1.5% by 2035 through targeted skill development. - Mental health support in academic programs becomes critical as 78% of students link well-being to lon

New Prospects in EdTech and Advancements in STEM Career Training

- Global EdTech market to grow from $277B to $907B by 2034, driven by AI, cybersecurity, and engineering education. - U.S. universities expand AI programs (114% growth since 2024) while states integrate AI into K-12 curricula to address 750K cybersecurity job shortage. - Federal and corporate investments ($18.5B U.S. AI Action Plan, IBM's 2M-trainee goal) create innovation ecosystems aligning education with AI-driven workforce needs. - Mentorship programs and federal grants (e.g., Cybersecurity Talent Init

Wellness-Driven Industries: A Profitable Intersection of Individual Health and Economic Wellbeing

- The global wellness industry, valued at $2 trillion, is reshaping healthcare , tech, and education through holistic well-being integration. - Younger generations drive 41% of U.S. wellness spending, prioritizing mental resilience and financial stability alongside physical health. - AI and wearables bridge health and financial wellness, with startups like Akasa and Meru Health leveraging tech for personalized solutions. - Education institutions adopt wellness programs, supported by public-private partners

Financial Well-being and Investment Choices: The Impact of Individual Financial Stability on Market Involvement and Building Lasting Wealth

- Financial wellness, combining objective health and subjective well-being, directly influences market participation and investment success according to 2025 studies. - Four financial wellness quadrants reveal systemic gaps: only 38% achieve high health and well-being, while millennials show mixed confidence amid rising debt and stagnant wages. - Behavioral biases affect all investors: 84% of high-net-worth individuals seek education to counter overconfidence, while young investors rely on social media for