Key Market Intelligence for December 9th, how much did you miss?

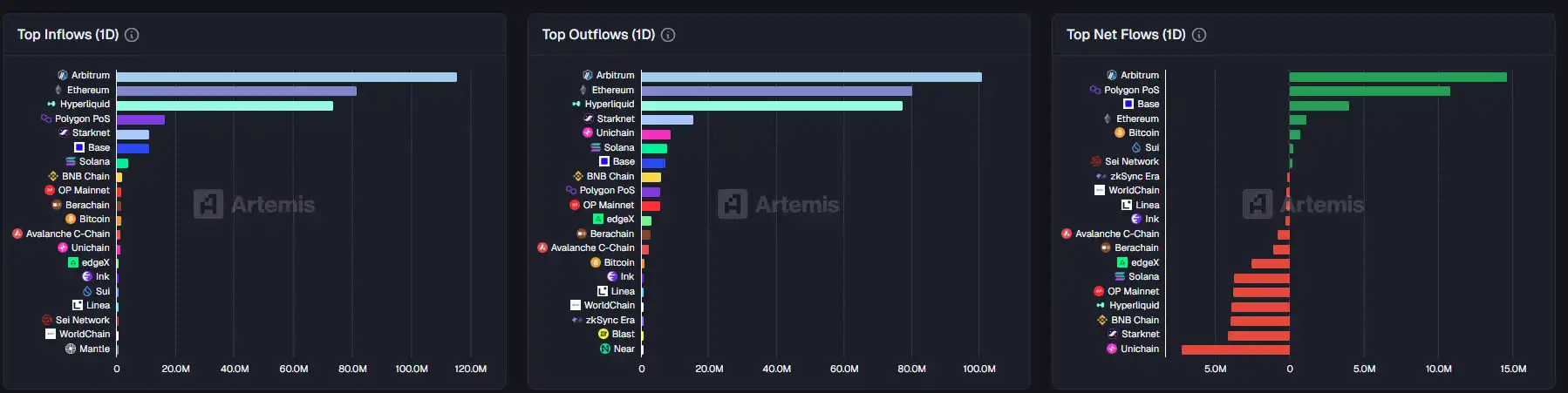

1. On-chain Funds: $14.6M flowed into Arbitrum last week; $7.2M flowed out of Unichain 2. Largest Price Swings: $LUNA, $NIGHT 3. Top News: NFT Market Sees Another "Meme Dog" Surge, Multiple Regular Animals Trades Eclipse $35,000

Top News

1. NFT Market Sees Another "Golden Dog," Regular Animals See Multiple Trades Surpassing $35,000

2. U.S. Short-Term Zero-Interest Bond Issuance Reaches Near Historic High, Signaling Escalating U.S. Debt Crisis

3. Zcash Privacy Narrative Shaken, Arkham De-Anonymizes Over Half of Its Transactions

4. SOL On-Chain Meme Coin Franklin24 Surges 160% in 24 Hours

5. EU Plans to Include Cryptocurrency Firms in ESMA Regulation, Aims to Launch Capital Market Union Reform in 2027

Featured Articles

1. "Crypto Tycoons Spending Eight-Figure Sums on Security Each Year, Fearing Blue War Non-Encounter"

Travel blogger Blue War Non, with over 20 million fans on TikTok, was robbed. In recent years, from France to the UAE, from the U.S. to South America, kidnapping cases involving cryptocurrency holders have been on the rise. Assets not dependent on banks, easily transferable on the go, combined with the "digitally staggering" wealth of crypto tycoons, have made them the top targets for certain criminal groups, rather than just "random victims." This also explains why the security budgets of crypto tycoons are shocking even to traditional enterprises.

2. "Exclusive Interview with Solstice Founder: Reshaping Yield on Solana from First Principles"

At the end of November 2025, Solstice Staking partnered with the Liechtenstein Trust Integrity Network (LTIN), Swiss crypto finance giant Bitcoin Suisse, and decentralized staking protocol Obol to launch an institutional-grade Ethereum Distributed Validator Technology (DVT) cluster. This seemingly technical collaboration hides a grander ambition behind it. On the same day, Kamino, a DeFi platform in the Solana ecosystem, announced the launch of the PT-USX token on Solstice Market, offering a 16.5% fixed yield. At this time, Solstice's Total Value Locked (TVL) had surpassed $3.2 billion, with over 26,000 holders and 131,000 monthly active users.

On-chain Data

Weekly On-chain Fund Flows for December 9th

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Federal Reserve's Change in Policy and Its Impact on Rapidly Growing Cryptocurrencies Such as Solana

- U.S. Fed's 2025 rate cuts and dovish pivot boosted risk-on sentiment, driving capital into high-growth crypto assets like Solana . - Solana's technical upgrades (Firedancer, Alpenglow) and institutional partnerships (Visa, Western Union) enhanced scalability and real-world adoption. - $2B+ inflows into Solana ETFs and regulatory clarity (GENIUS Act, OCC guidance) solidified its role in macro-driven crypto portfolios. - Despite short-term volatility, Solana's $10.2B TVL and 869 TPS throughput position it

The Increasing Expenses of Law School and Public Interest Incentives as Opportunities in the Market

- Rising legal education costs and public interest law demand create investment opportunities in legal tech and education platforms. - AI-driven legal tech (e.g., Bench IQ) reduces costs while addressing systemic barriers, with market growth projected at 9.14% CAGR to $65.5B by 2034. - Racial disparities in public interest scholarships (70% vs. 6% for Black students) drive institutional reforms like UC Berkeley's tuition relief and Harvard's ESG-aligned funding shifts. - Education platforms (Legora, Eudia)

Aligning ESG Investment with Legal Industry Transformation: The Societal Influence of Funding Legal Education and Supporting Public Interest Scholarships

- ESG investing in legal education promotes social equity by funding scholarships for underrepresented communities, aligning financial goals with justice access. - Programs like New York Law School's Wilf Scholars reduce financial barriers, creating pathways for graduates to address legal gaps in marginalized areas. - Persistent racial disparities (70% of full-tuition awards to white students vs. 6% to Black students) highlight the need for equitable ESG scholarship distribution. - ESG-aligned initiatives

Bitcoin Price Rally During Macroeconomic Instability: Investor Confidence and Institutional Integration in the Fourth Quarter of 2025

- Bitcoin surged 86.76% in Q4 2025 amid macroeconomic uncertainty, driven by institutional adoption and regulatory clarity. - 86% of institutional investors now allocate to crypto, with $1.65T market cap supported by 65% institutional demand via ETFs/ETPs. - Macroeconomic factors like inflation hedging and MMT-driven valuation models reshaped Bitcoin's role as a store of value. - Supply-demand imbalances and $4T potential institutional demand outpace Bitcoin's limited supply, creating upward price pressure