Bitcoin Whipsaws as $1.39 Billion Whale Dump Triggers Coordinated Sell-Off

Bitcoin’s Sunday price action turned chaotic after a wave of whale-driven sell orders triggered a rapid $2,000 drop, mass liquidations, and an equally aggressive rebound. The moves wiped out both long and short traders within hours, raising fresh concerns about low-liquidity manipulation and order book fragility at a time when Bitcoin continues hovering above $91,000.

Bitcoin’s Sunday price action turned chaotic after a wave of whale-driven sell orders triggered a rapid $2,000 drop, mass liquidations, and an equally aggressive rebound.

The moves wiped out both long and short traders within hours, raising fresh concerns about low-liquidity manipulation and order book fragility at a time when Bitcoin continues hovering above $91,000.

$1.39 Billion in Bitcoin Dumped Within One Hour

Several analysts reported a what appeared to be coordinated sell-offs, where more than 15,565 BTC, worth roughly $1.39 billion, hit the market in a single hour.

“Here is why the market just nuked: whale dumped 4,551 BTC, Coinbase dumped 2,613 BTC, Wintermute dumped 2,581 BTC, Binance dumped 2,044 BTC, BitMEX dumped 1,932 BTC, Fidelity dumped 1,844 BTC. A total of 15,565 BTC worth $1.39 billion was dumped in one hour! This was a full-scale coordinated sell-off,” wrote analyst Wimar in a post.

The sudden surge in supply hitting the market simultaneously accelerated Bitcoin’s decline from $89,700 to $87,700, setting the stage for a cascade of liquidations.

$171 Million in Liquidations as Longs and Shorts Get Wiped

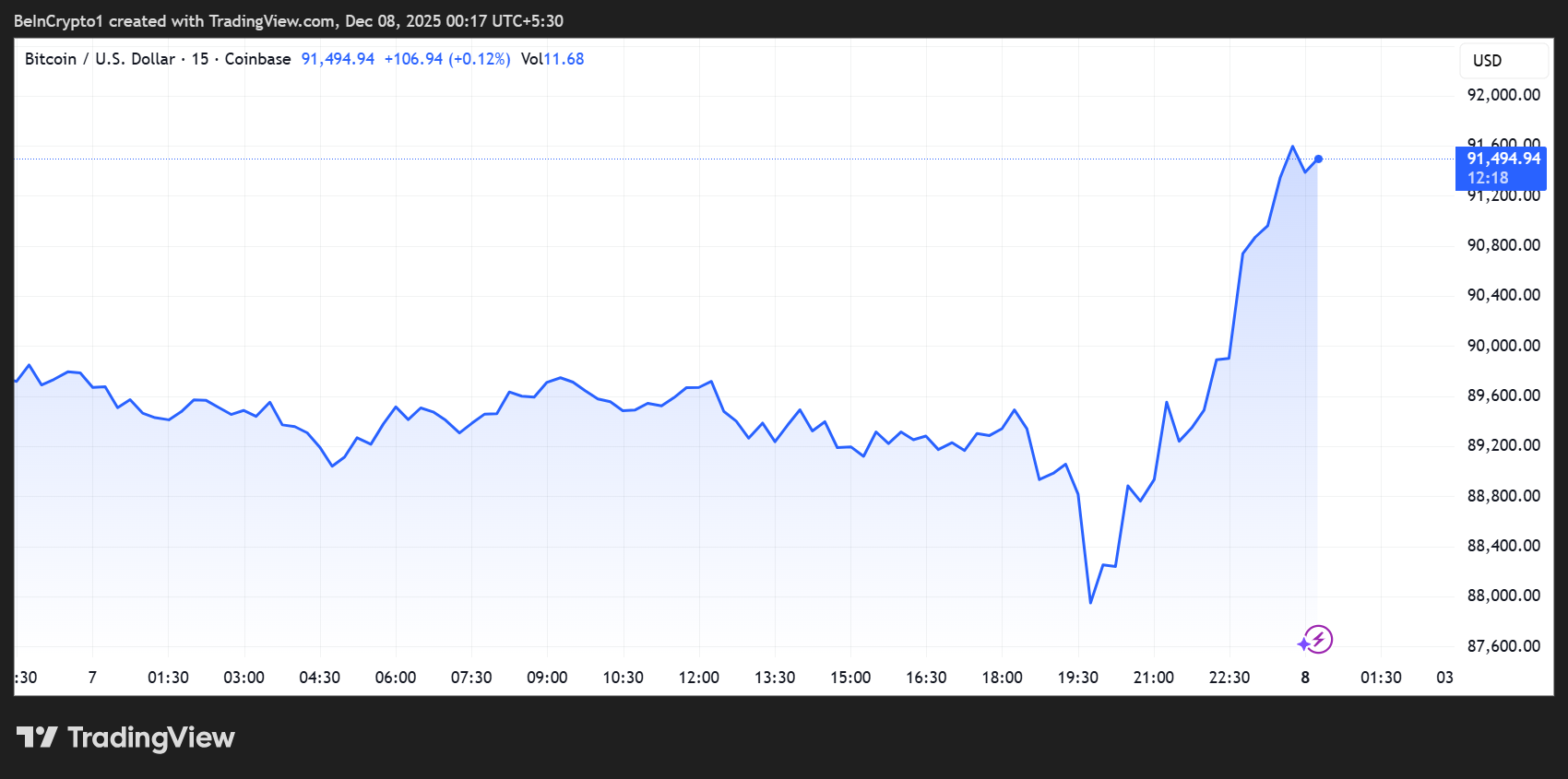

The sharp initial drop wiped out $171 million worth of BTC longs, caught off guard as the Bitcoin price fell $2,000 in minutes before rebounding with equal force. As of this writing, the Bitcoin price is $91,494.

Bitcoin (BTC) Price Performance. Source:

TradingView

Bitcoin (BTC) Price Performance. Source:

TradingView

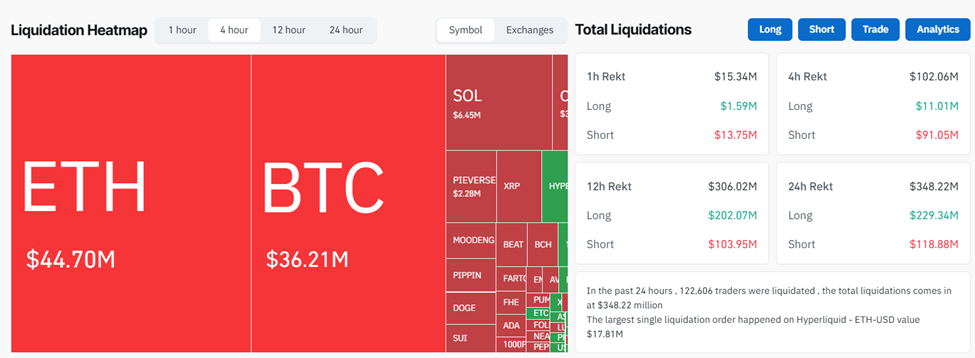

Along with this quick recovery, almost $14 million in short positions were liquidated in the past hour and over $91 million in the past four hours.

“This is another example of manipulation on the low-liquidity weekend to wipe out both leveraged longs and shorts,” Bull Theory said.

Data from Coinglass confirms the scale of the damage. Over the past 24 hours, 121,628 traders were liquidated, resulting in total liquidations of $346.67 million.

Crypto Liquidations. Source:

Coinglass

Crypto Liquidations. Source:

Coinglass

Traders Call It “Engineered Liquidity Collection”

Market commentators say this wasn’t normal volatility, with Marto arguing that the sequence was not accidental.

“People keep calling this volatility. It’s not. It’s engineered liquidity collection. When the order book is weak, whales swing the price like a door hinge and cash in on both sides,” he wrote.

Others pointed to the speed of the recovery, with Lenny, a trader known for tracking liquidity flows, remarking about the whipsaw.

“Honestly, that BTC dip to 89k got absorbed fast. That’s not noise,” Lenny chimed.

The quick absorption suggests strong spot demand remains intact even as aggressive leverage flushes continue at weekend lows.

Can Bitcoin Maintain $90,000?

The Bitcoin price is recovering its weekend losses but still showing signs of heavy intraday stress. The dual liquidations demonstrate how thin order books on weekends continue to be a target for large players capable of moving billions of dollars in minutes.

Spot demand may stabilize price action into the upcoming week, especially as liquidity normalizes and derivatives markets reset.

With over $300 million in liquidations behind it, Bitcoin enters the next trading sessions with cleared leverage, but also heightened sensitivity to further whale-driven moves.

Meanwhile, data shows that $1 billion in short positions are at risk of liquidation if the Bitcoin price pumps to $93,000.

JUST IN: $1,000,000,000 in short positions will be liquidated if $BTC pumps to $93,000. pic.twitter.com/2NCzQujQv2

— Whale Insider (@WhaleInsider) December 7, 2025

Notably, the $93,000 threshold stands barely 2% above current levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Leveraged Position Liquidations and Market Fluctuations: Urging Proactive Risk Control Strategies

- 2025 crypto market saw $21B in leveraged liquidations as Bitcoin's volatility triggered systemic collapses in October and November. - Over-leveraged long positions, social media hype, and automated deleveraging mechanisms fueled cascading losses across exchanges. - Traders shifted to 1-3x leverage and AI-driven risk tools post-liquidations, with 65% reducing exposure in Q4 2025. - Experts emphasize dynamic position sizing, diversification, and 5-15% stablecoin allocations to mitigate volatility risks in

Urban Industrial Properties in Markets Following Corporate Divestitures: Approaches to Strategic Investment and Insights from the Xerox Webster Campus Example

- Xerox Webster campus in NY secures $14. 3M in public grants to transform 300-acre brownfield into advanced manufacturing hub. - Infrastructure upgrades reduced industrial vacancy to 2% by 2024, attracting $650M fairlife® dairy plant creating 250 jobs. - Public-private partnerships and policy alignment through Brownfield Opportunity Area designation ensure sustained investment and regulatory stability. - The model demonstrates how strategic infrastructure and policy frameworks can catalyze $1B+ developmen

Bitcoin’s Sharp Decline: Should Investors See This as a Chance to Buy or a Signal to Be Cautious?

- Bitcoin's November 2025 price drop below $86,000 reflects Fed policy uncertainty, geopolitical tensions, and leveraged retail trading. - Market fear indices hit "extreme" levels as ETF outflows and weak correlations with equities highlight structural crypto shifts. - While on-chain demand and seasonal buying optimism persist, critical support at $89,183 determines near-term bearish/bullish trajectories. - Long-term outcomes hinge on regulatory clarity, mining economics, and whether central bank liquidity

The PENGU USDT Sell Signal: A Significant Change in Stablecoin Approach?

- The 2025 PENGU/USDT sell signal triggered a 30% collapse, exposing algorithmic stablecoin fragility and a $128M liquidity shortfall on Balancer. - Technical indicators and $66.6M in team wallet withdrawals validated bearish trends, highlighting systemic risks in non-collateralized models. - Market shifts toward fiat-backed stablecoins like USDC accelerate as regulators push hybrid models combining AI governance with CBDCs. - PENGU's technical outlook remains bearish with RSI at 40.8 and projected 5-day r