The discussions surrounding future SUI price prediction have intensified, primarily due to the SUI ETF and the upcoming FOMC meeting on 10th. If a perfect swing is built this month, that would mean liquidity entering, and that’s the technical trigger everyone has their eyes on. With the SUI price in early December already reacting to both macroeconomic liquidity shifts and new institutional initiatives, the SUI market is positioning itself for a potentially very important month that will significantly shape the future going into 2026 after concluding December 2025.

The latest debate began from 21shares breaking news for SUI crypto, the a senior ETF analyst of Bloomberg highlighted that 21Shares has launched the first-ever 2x leveraged SUI ETF, marking the first SUI ETF on the market.

Interestingly, this follows the pattern previously seen with XRP, where the first ETF to launch was also leveraged, too.

With this, SUI crypto became part of the rapidly expanding ETF landscape, which, per the analyst, now includes 74 new crypto ETFs launched this year and 128 in the overall count. He even predicts that he expects for another 80 within the next 12 months.

The tone across the public discussion was also largely aligned, where people agree with Eric Balchunas’ opinions and find crypto ETFs as not as noise for the market but viewing it as a needed structural expansion of crypto-based investment products.

One community comment described this ETF wave as a “takeover,” emphasizing that institutions are building the rails long before general retail awareness catches up.

Another highlighted that first-of-their-kind leveraged products draw significant traction, often becoming catalysts for early liquidity inflows.

The growing ETF pipeline signals a maturing sector and increases the likelihood that assets with ETF representation, including SUI crypto, may experience reinforced liquidity and legitimacy.

This ETF momentum closely aligns with a recent observation by the CEO of CryptoQuant , who noted that altcoin liquidity has been drying up, making external liquidity channels, such as ETFs, essential for long-term resilience.

Notably, SUI crypto was included in a liquidity table shared earlier by the CEO, supporting the view that SUI has positioned itself well for improving liquidity conditions.

However, despite a recent price spike fueled by the Federal Reserve’s $13.5 billion liquidity injection, this macro uplift wasn’t strong enough to sustain broad crypto momentum.

The crypto sector has shifted from micro to macro sensitivity, meaning these injections now provide short-lived boosts rather than structural moves. Therefore, the more reliable drivers in the current environment come from whale accumulation, institutional wallets, and new product launches like the SUI ETF.

- Also Read :

- Aptos (APT) Price Down 90%—But Here’s Why Major Investors Aren’t Walking Away

- ,

SUI’s near-term narrative is now heavily tied to the ETF launch, with another catalyst expected to come from macroeconomic news on December 10 by the FOMC.

This introduces a scenario where assets already benefiting from ETF backing may stand out compared to altcoins without institutional liquidity channels, particularly when the FOMC makes a positive announcement, which can spark a surge.

Consequently, even a conservative SUI price forecast suggests the asset could respond positively to this expanding ETF momentum.

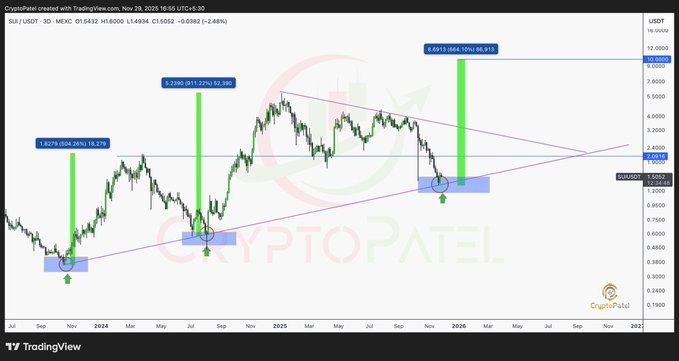

From a technical perspective, the pattern shared by an analyst is also compelling. It highlighted that the SUI price has historically rallied sharply each time the price touched major support zones. For instance, in 2023, a +450% gain was observed, in 2024, a +750% rally was experienced, and now we have 2025, which has retested this support level again.

Following this history, a conservative SUI price prediction projects a 520% climb to around $10, aligning with previous percentage-based expansions.

A more ambitious scenario, assuming the SUI price outperforms its historical rallies, suggests a potential move toward $18, representing roughly a 1,000% gain from the current SUI price USD, near $1.63.

With ETF catalysts aligning with past technical behavior, the month ahead holds elevated significance for SUI crypto’s trajectory.