Analysis: Bitcoin selling pressure is gradually weakening but demand remains lacking; the reasonable expectation for December is stabilization rather than an immediate rebound.

According to ChainCatcher, trader Murphy posted that the main sources of selling pressure currently come from the profitable chips of long-term holders (LTH) and the underwater chips of short-term holders (STH) of bitcoin. For STH, after panic sentiment is released in a concentrated manner, if the price stabilizes or shifts from a sharp drop to a slow decline, the selling pressure will gradually decrease; for LTH, if their realized profit and loss ratio declines, their motivation to sell will also decrease.

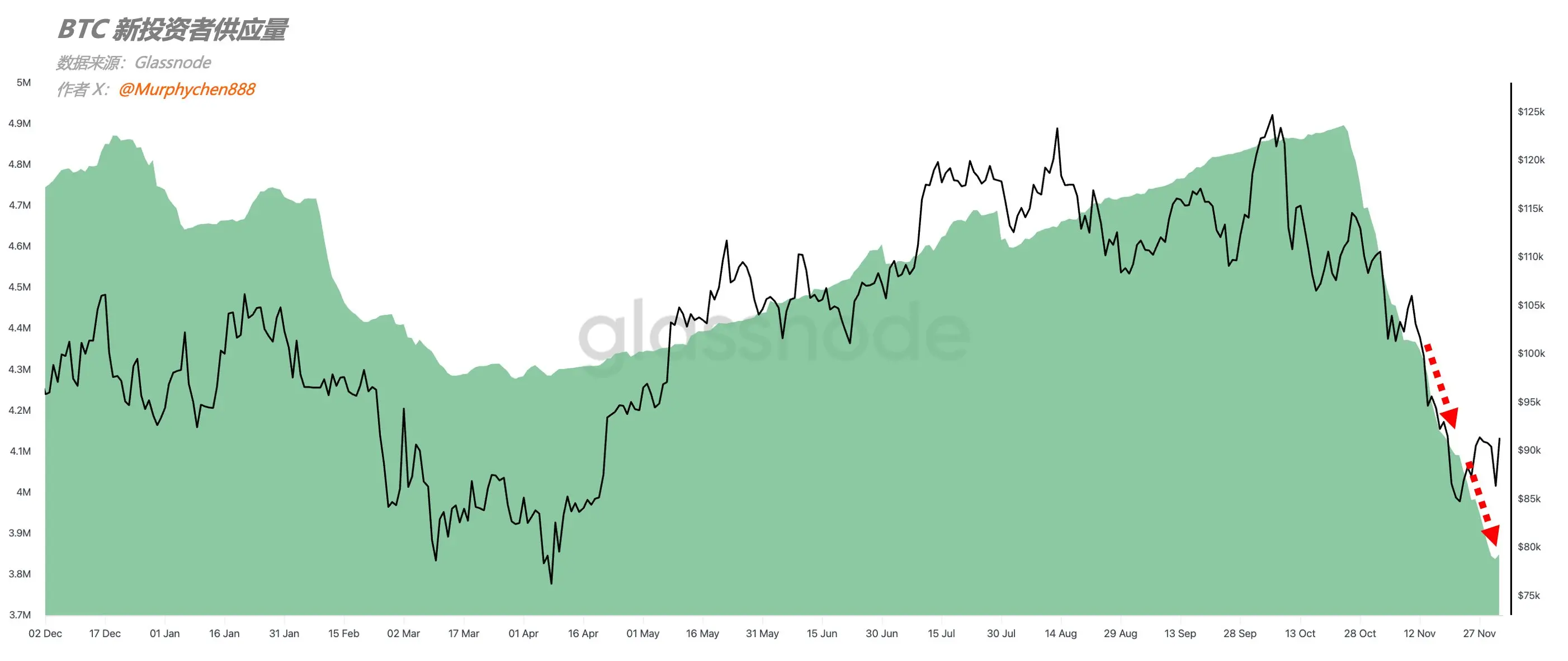

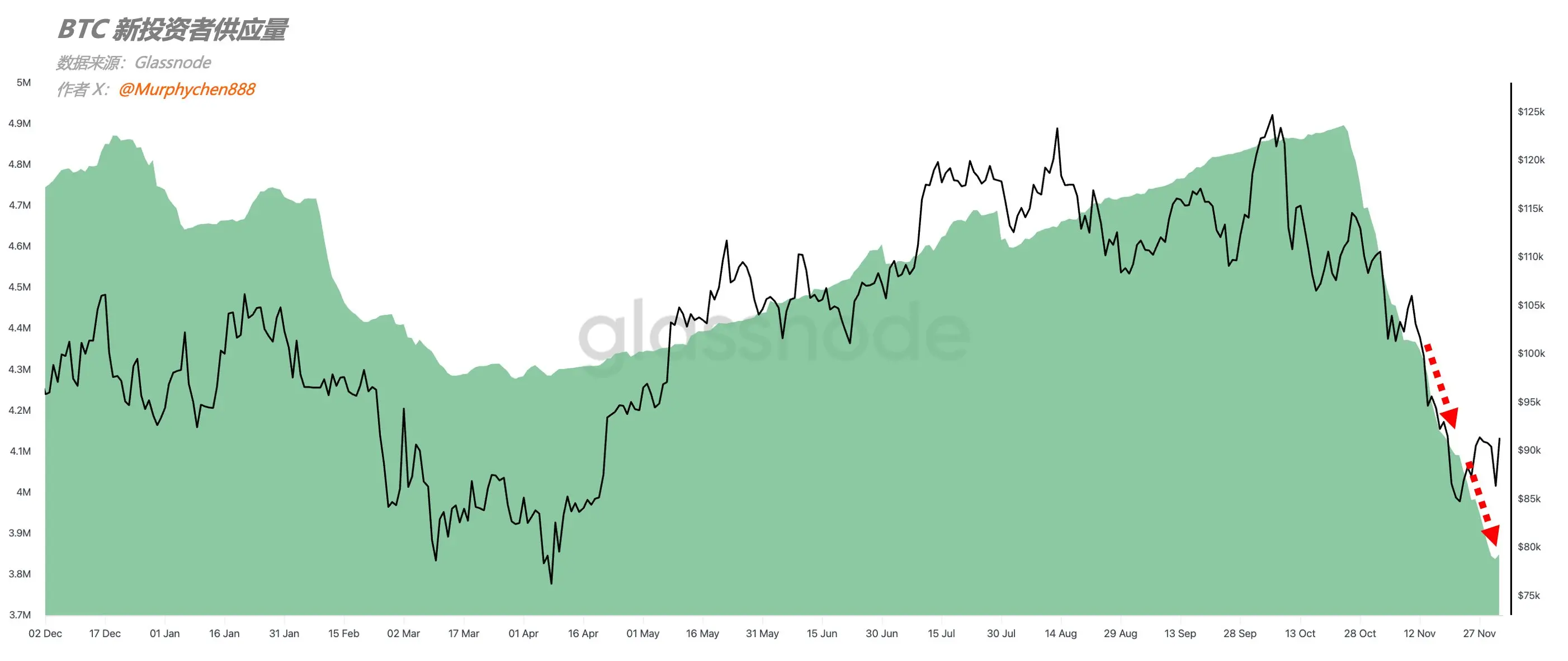

Currently, the number of new BTC addresses has temporarily stabilized after a round of decline, but the amount of BTC held by these addresses is still decreasing. This indicates that the overall risk appetite of BTC investors has not significantly improved, resulting in a lack of new demand. He believes that before seeing a clear recovery on the demand side, a reasonable expectation for BTC in December should not be an immediate reversal, but rather no further sharp or deep declines, and a corresponding rebound after an oversold situation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Uniswap founder opposes regulating DeFi developers as centralized institutions

RootData: IO will unlock tokens worth approximately $3.05 million in one week

Columbus Circle Capital Corp I shareholders approve merger with ProCap BTC business