Axis Secures $5 Million from Galaxy Ventures

- Funding round led by Galaxy Ventures with strong support.

- Oversubscribed, indicating high investor interest.

- Plans to incorporate diversified asset yields.

Axis secured $5 million in funding led by Galaxy Ventures to advance its on-chain yield protocol. The funding will support USD and Bitcoin yield products, with future gold assets planned, demonstrating strong investor confidence and market interest.

Axis completed a successful $5 million funding round aimed at scaling its innovative on-chain yield protocol. Galaxy Ventures led the investment, with high participation from notable financial players, underscoring the protocol’s appeal.

The protocol will initially focus on USD and Bitcoin assets, backed by prominent investors like OKX Ventures and FalconX. The team’s expertise and delta-neutral framework were praised by Will Nuelle, emphasizing a secure approach to yield generation.

“Axis brings the precision and transparency of institutional trading to decentralized markets. Their delta-neutral framework represents a risk-managed yield infrastructure, created by a team with a solid track record and designed to support real adoption.” — Will Nuelle, General Partner, Galaxy Ventures

Axis’s $100 million capital deployment during its closed beta phase showcased promising results, achieving strong risk-adjusted returns. This indicates a positive trajectory for its main product, USDx.

Axis aims to operate on the Plasma blockchain, supported by Bitfinex, to enhance cost efficiencies and integrate high-level security measures such as Chainlink proof-of-reserve and Veda custody.

The ongoing institutional interest and significant funding reflect Axis’s potential to transform the yield protocol space. The participation of industry leaders signifies trust in Axis’s strategy and suggests a trend towards diversified, blockchain-based asset management.

With the integration of diverse assets like Bitcoin and potential gold-backed instruments, Axis’s approach mirrors the evolving landscape where DeFi meets traditional finance principles. Such developments indicate Axis is well-placed to leverage institutional demands and broaden multi-chain asset offering frameworks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Amazon aims to boost the adoption of its AI coding assistant Kiro by offering it free of charge to startups

AAVE drops 1.47% amid Aave’s overhaul of its multichain approach

- Aave's multichain strategy shift caused AAVE to drop 1.47% despite 7.08% weekly gains. - Governance proposal aims to consolidate operations on high-revenue chains like Ethereum , phasing out low-performing deployments. - Strategy prioritizes capital efficiency and risk management by focusing liquidity on core networks with stronger revenue potential. - Unanimous DAO support signals industry trend toward quality-focused chain selection over maximalist expansion in DeFi.

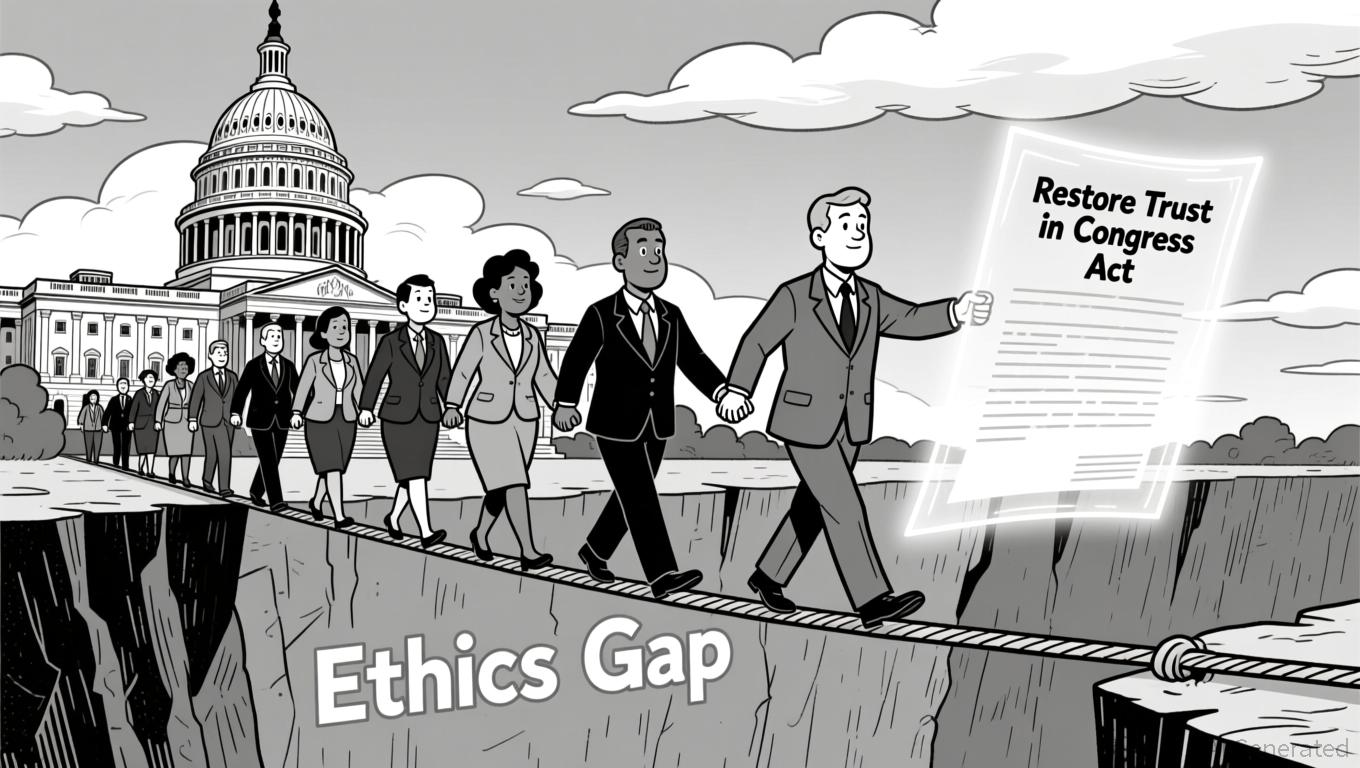

LUNA Price Remains Steady as U.S. Lawmakers Advance Stock Trading Ban

- LUNA's price remained stable at $0.0727 in 24 hours but fell 82.47% annually amid U.S. legislative efforts to restrict congressional stock trading. - Rep. Anna Paulina Luna's bipartisan bill seeks to ban lawmakers, spouses, and children from individual stock trading to address ethical conflicts. - The bill, supported by 100+ co-sponsors, faces opposition over financial flexibility concerns for lower-income legislators amid unchanged congressional salaries since 2009. - A discharge petition aims to force

PENGU Price Forecast for 2026: Managing Fluctuations and Momentum from Key Catalysts After the 2025 Market Adjustment

- 2025 crypto market correction reshaped altcoin dynamics as Bitcoin/Ethereum declined amid macroeconomic uncertainty and regulatory pressures. - Pudgy Penguins (PENGU) saw sharp volatility post-correction, with technical indicators suggesting potential $0.069 rebound by 2026 if adoption metrics align. - Strategic partnerships with Bitso and cross-chain integrations, plus Kung Fu Panda NFT collaborations, aim to boost PENGU's liquidity and mainstream adoption. - Despite 12% early 2026 price drop, Pudgy Inv