How will the Federal Reserve in 2026 impact the crypto industry?

Shifting from the technocratic caution of the Powell era, the policy framework is moving towards a more explicit goal of reducing borrowing costs and serving the president's economic agenda.

Original Title: 2026: The Year of the Fed's Regime Change

Original Author: @krugermacro

Translation: Peggy, BlockBeats

Editor's Note: The Federal Reserve may undergo a true "regime change" in 2026. If Hassett becomes chairman, monetary policy could shift from the cautious and steady approach of the Powell era to a more aggressive rate-cutting path and a "growth-first" framework. Short-term rates, long-term expectations, and cross-asset pricing will all be forced to be re-evaluated. This article outlines the key logic and market impacts of this potential turning point. Next year's main trading theme is not just rate cuts, but an entirely new Federal Reserve.

The following is the original text:

The Federal Reserve as we know it will end in 2026.

The most important driver of asset returns next year will be the "new Fed"—more specifically, the policy paradigm shift brought about by the new chairman appointed by Trump.

Kevin Hassett has become the most likely candidate for Trump's nomination as Fed chairman (as of December 2, Kalshi prediction market gives a 70% probability). Hassett is currently the Director of the National Economic Council, a supply-side economist, and a long-term loyal supporter of Trump. He advocates a "growth-first" philosophy, believing that since the war against inflation has largely been won, maintaining high real interest rates is no longer economically rational but rather a political stubbornness. If he takes office, this will mean a decisive institutional shift: the Fed will move from the technocratic caution of the Powell era to a policy framework that more explicitly aims to lower borrowing costs and serve the president's economic agenda.

To understand what kind of policy regime he will establish, we can look directly at his public statements about interest rates and the Fed this year:

"If the Fed doesn't cut rates in December, the only explanation is anti-Trump partisan bias." (November 21)

"If I were on the FOMC, I would be more likely to vote for a rate cut, while Powell would be less likely." (November 12)

"I agree with Trump: rates can be cut significantly." (November 12)

"The expected three rate cuts are just the beginning." (October 17)

"I want the Fed to aggressively and continuously cut rates." (October 2)

"The Fed's direction of rate cuts is correct, rates should be lower." (September 18)

"Waller and Trump are right about rates." (June 23)

If we mark the stance from dovish to hawkish on a scale of 1–10 (1 = most dovish, 10 = most hawkish), Hassett is probably at 2.

If nominated, Hassett will replace Miran as a Fed governor in January, as Miran's short-term term ends then. Subsequently, in May, as Powell's term expires, he will be promoted to chairman; Powell is expected to resign his governor seat after announcing his intention, following historical precedent, thus creating a vacancy for Trump to nominate Kevin Warsh.

Although Warsh is currently Hassett's main competitor for the chairman position, this article assumes he will ultimately be incorporated into the system as part of the reform force. As a former Fed governor, Warsh has been publicly "campaigning" on a structural reform platform, explicitly calling for the reconstruction of a "new Treasury-Fed Accord" and criticizing the current Fed leadership for "succumbing to the tyranny of the status quo." Crucially, Warsh believes that the current AI-driven surge in productivity is inherently deflationary, meaning the Fed is making a policy mistake by maintaining tight rates.

New Balance of Power

Under this structure, the Trump-era Fed will form a dominant dovish core team with a feasible path to win votes on most easing issues. But this is not a 100% guarantee, as consensus still needs to be reached, and the degree of dovishness is uncertain.

➤ Dovish Core (4 people):

Hassett (Chairman), Warsh (Governor), Waller (Governor), Bowman (Governor)

➤ Persuadables (6 people):

Cook (Governor), Barr (Governor), Jefferson (Governor), Kashkari (Minneapolis), Williams (New York), A. Paulson (Philadelphia)

➤ Hawks (2 people):

Hammack (Cleveland), Logan (Dallas)

However, if Powell chooses not to resign his governor seat (although the historical probability is extremely low—almost all departing chairs resign, e.g., Yellen resigned 18 days after Powell was nominated), it would be extremely bearish. This would not only prevent a vacancy for Warsh but also make Powell a "shadow chairman," maintaining stronger appeal and influence over FOMC members outside the dovish core.

Timeline: Four Stages of Market Reaction

Based on all the above factors, the market's reaction will roughly go through four clear stages:

1. (December / Next January) Immediate optimism after Hassett's nomination. In the weeks following confirmation, risk assets will welcome a clearly dovish and loyal new chairman.

2. If Powell does not announce his resignation within three weeks, gradually rising unease will appear. Every day of delay will reactivate the tail risk of "what if he doesn't resign?"

3. The moment Powell announces his resignation, there will be a wave of joy in the market.

4. As the first FOMC meeting chaired by Hassett in June 2026 approaches, market sentiment will become tense again.

Investors will closely watch all public statements by FOMC members (they will speak frequently, providing clues to their thinking and inclinations).

Risk: A Divided Committee

In the absence of the "key vote" that many mistakenly believe the chairman has (in fact, it does not exist), Hassett must win the debate within the FOMC to ensure majority support.

If every 50bp rate cut decision passes by a narrow margin like 7–5, it will have a corrosive effect on the institution: signaling to the market that the chairman is more of a political agent than an independent economist.

More extreme scenarios: a 6–6 tie, or 4–8 against rate cuts

That would be disastrous.

Specific voting details will be released in the FOMC meeting minutes three weeks after each meeting, making the release of the minutes an important market volatility event.

As for what will happen after the first meeting, it remains a huge unknown.

My basic judgment is: with solid support from 4 votes and a credible path to 10 votes, Hassett will be able to shape a dovish consensus and advance his agenda.

Inference: The market cannot fully front-run the dovish tendencies of the new Fed.

Interest Rate Repricing

The "dot plot" is an illusion.

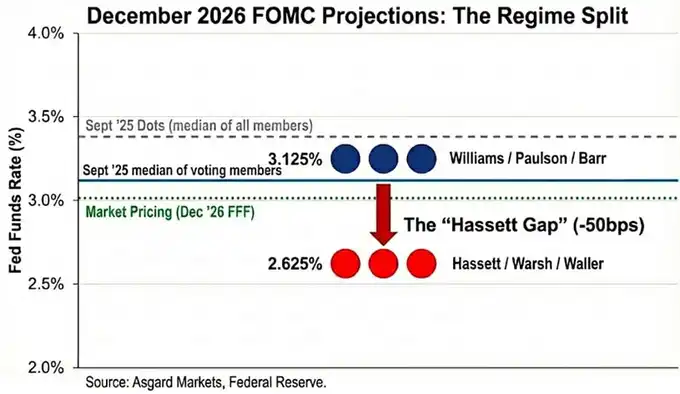

Although the median forecast for December 2026 rates released in September is 3.4%, this number is the median of all participants (including non-voting hawkish members).

Based on attribution analysis of public statements, I estimate the true median for voting members is significantly lower, at 3.1%.

When Hassett and Warsh replace Powell and Miran, the picture changes further.

Using Miran and Waller as proxies for the "aggressive rate-cutting" new regime, the 2026 voting distribution still shows a bimodal pattern, but both peaks are lower:

Williams / Paulson / Barr → 3.1%

Hassett / Warsh / Waller → 2.6%

I set the anchor for the new leadership at 2.6% to match Miran's official forecast; however, it should be noted that Miran has publicly stated that the "desirable rate" should be 2.0%–2.5%, meaning the new regime's preference may be even more dovish than the "dot plot" suggests.

The market has already reflected some of this change; as of December 2, the December 2026 rate is priced at 3.02%, but it still does not fully account for the upcoming regime shift. If Hassett successfully pushes the committee to cut rates further, the short end of the yield curve still has about 40 basis points of downside.

In addition, if Hassett's judgment on "Supply-Side Disinflation" is correct, inflation will fall faster than market consensus, forcing the Fed to cut rates further to avoid "passive tightening" caused by a passive rise in real rates.

Cross-Asset Implications

While the market's initial reaction to Hassett's nomination should be "risk-on," a more precise way to express this regime change is Reflationary Steepening:

Short end: betting on aggressive rate cuts

Long end: pricing in higher nominal growth (and potential inflation risk)

1. Rates

Hassett's goal is to combine "recession-style aggressive rate cuts" with "3%+ boom period growth."

If this policy works: 2-year yields will fall sharply to price in the rate-cutting path in advance; 10-year yields may remain high because of stronger structural growth and higher inflation premium.

In other words: sharp drop at the short end, resilience at the long end, and a sharply steepening curve.

2. Equities

In Hassett's view, the current policy stance is suppressing the AI-driven productivity boom.

Once he takes office: he will lower the real discount rate, driving a "melt-up" in growth stocks through valuation expansion.

The biggest risk is not an economic recession, but if long-term yields surge, it could trigger a "revolt" in the bond market.

3. Gold

When the Fed is politically aligned with the government and explicitly prioritizes growth over the inflation target, this is the classic long thesis for hard assets.

Therefore: gold should outperform US Treasuries, as the market will hedge against the possibility that the new regime could repeat the "excessive rate cuts and policy mistakes" of the 1970s.

4. Bitcoin

Under normal circumstances, Bitcoin would be the purest expression of this "Regime Change" trade.

But since the 10/10 event, Bitcoin has shown: obvious downside skew; weak rallies on macro positives; catastrophic drops on negatives; "four-year cycle top" fears; narrative identity crisis

I believe that by 2026, Hassett's monetary policy and Trump's deregulation agenda will be enough to outweigh this self-reinforcing pessimism.

Technical Note: About Tealbook (Fed Internal Forecasts)

Tealbook is the official economic forecast of the Fed's research department and the statistical benchmark for FOMC debates.

It is managed by the Division of Research & Statistics, which has more than 400 economists and is led by Director Tevlin.

Tevlin, like most team members, is a Keynesian, and the Fed's core model FRB/US is also explicitly a New Keynesian system.

Hassett can appoint a supply-side economist to lead the department through a board vote.

Replacing Keynesian modelers who "believe growth brings inflation" with supply-side modelers who "believe the AI boom brings deflationary pressure" will significantly change forecasts.

For example: if the model predicts inflation will fall from 2.5% to 1.8% due to productivity gains,

those FOMC members who were not so dovish before will also be more willing to support aggressive rate cuts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COC the Game Changer: When Everything in GameFi Becomes "Verifiable", the Era of P2E 3.0 Begins

The article analyzes the development of the GameFi sector from Axie Infinity to Telegram games, pointing out that Play to Earn 1.0 failed due to the collapse of its economic model and trust issues, while Play for Airdrop was short-lived because it could not retain users. COC Game has introduced the VWA mechanism, which verifies key data on-chain in an attempt to address trust issues and build a sustainable economic model. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively updated.

BTC Volatility Weekly Review (November 17 - December 1)

Key metrics (from 4:00 PM HKT on November 17 to 4:00 PM HKT on December 1): BTC/USD: -9.6% (...

When all GameFi tokens have dropped out of the TOP 100, can COC reignite the narrative with a Bitcoin economic model?

On November 27, $COC mining will be launched. The opportunity to mine the first block won't wait for anyone.

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

Fede, the founder of LambdaClass, provides an in-depth explanation of anti-fragility, the 1 Gigagas scaling goal, and the vision for Lean Ethereum.