Bitcoin traders hit peak unrealized pain as ETFs start to turn positive

Bitcoin may be nearing a make-or-break point as short-term traders sit on the steepest unrealized losses of the current bull cycle.

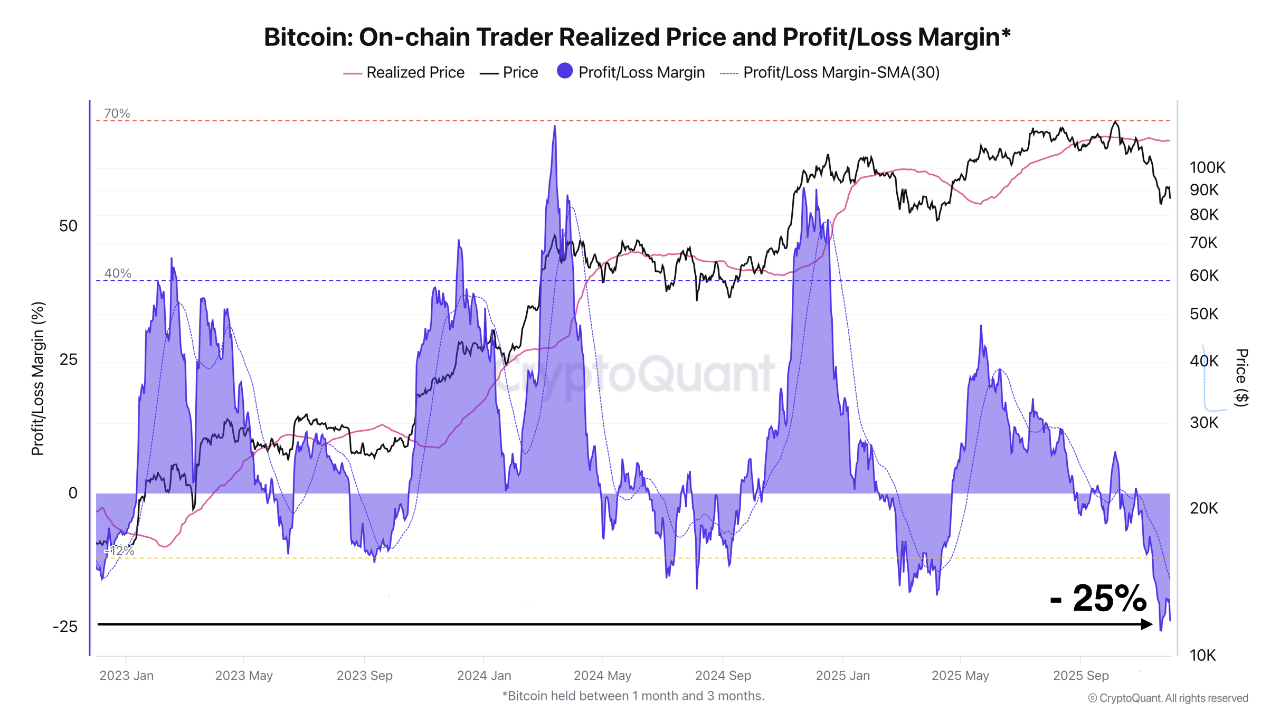

Short-term Bitcoin (BTC) traders who have held BTC between one to three months have been sitting on losses ranging from 20% to 25% for over two weeks, marking the highest pain point of the current market cycle, according to CryptoQuant analyst Darkfrost.

“Once a large portion of them has capitulated, as we have seen in recent weeks, that is usually when the opportunity to accumulate becomes interesting,” he wrote in a Monday note.

This cohort will remain underwater until BTC trades back above its realized price of about $113,692, Darkfrost added.

Some of the largest financial institutions remain optimistic about Bitcoin’s trajectory in 2026, despite the current correction.

On Monday, asset management giant Grayscale said that Bitcoin’s current drawdown points to a local bottom ahead of a recovery in 2026 — a development that will invalidate the four-year cycle theory, according to the company.

Related: Cathie Wood still bullish on $1.5M Bitcoin price target: Finance Redefined

Bitcoin ETF only accounted for up to 3% of selling pressure: ETF analyst

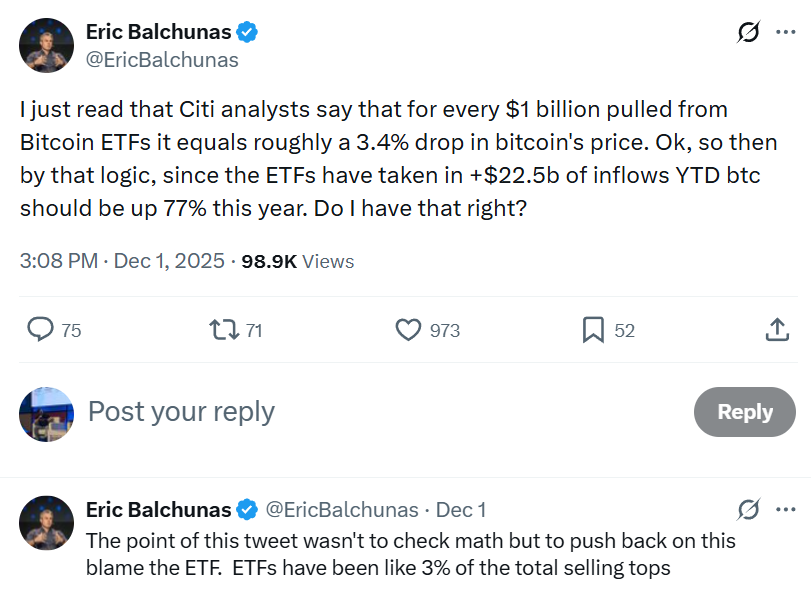

Despite previous concerns about the large-scale sales from spot Bitcoin exchange-traded fund (ETF) holders, these funds were only a fraction of the selling pressure behind Bitcoin’s price decline.

“I just read that Citi analysts say that for every $1 billion pulled from Bitcoin ETFs it equals roughly a 3.4% drop in Bitcoin's price. Ok, so then by that logic, since the ETFs have taken in +$22.5b of inflows YTD BTC should be up 77% this year,” wrote Bloomberg ETF analyst Eric Balchunas, in a Monday X post.

“ETFs have been like 3% of the total selling tops.”

Related: Bank of America backs 1%–4% crypto allocation, opens door to Bitcoin ETFs

Meanwhile, Bitcoin ETFs have started to recover from the $3.48 billion of cumulative outflows recorded during November, marking their second-worst month on record.

The Bitcoin ETFs recorded $58 million worth of net positive inflows on Tuesday, staging their fifth consecutive day of positive inflows, according to Farside Investors data.

Those modest inflows could continue as Bitcoin trades back above the roughly $89,600 flow-weighted cost basis for ETF buyers, meaning the average holder is no longer sitting on paper losses.

Looking at the other US crypto funds, spot Ether (ETH) ETFs saw $9.9 million in outflows on Tuesday, while the Solana (SOL) ETFs recorded $13.5 million of net negative outflows, according to Farside Investors.

Magazine: Mysterious Mr Nakamoto author — Finding Satoshi would hurt Bitcoin

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITE's Price Movement After Listing: Managing Retail REIT Fluctuations in the Context of AI-Influenced Industrial Property Developments

- KITE's Q3 2025 net loss of $16.2M and -$0.07 EPS highlight retail REIT sector challenges despite industrial real estate resilience. - Institutional investors show mixed positioning: Vanguard and JPMorgan sold shares while COHEN & STEERS increased stake by 190.4%. - KITE's indirect AI exposure through logistics partnerships contrasts with peers like Digital Realty , which directly develops AI infrastructure . - The stock's 10% YTD decline reflects market skepticism about its retail-centric model amid $350

The MMT Token TGE: Driving DeFi Advancement and Shaping Investment Approaches in 2025

- Momentum (MMT) launched its TGE on Sui , leveraging CLMM and ve(3,3) models to enhance DeFi efficiency and governance. - The TGE distributed 204.1M tokens, achieving $25B trading volume and $600M TVL within weeks, despite post-launch price volatility. - CLMM optimizes liquidity allocation while ve(3,3) aligns incentives through token locks, addressing DeFi's fragmentation and governance risks. - Investors face balancing long-term staking rewards against market risks, as MMT's success depends on Sui's ado

BTC Chart Shows 3 Major Rejections With a Clear Signal Toward 6% Support

Altcoins on the Edge of Phenomenal Gains — Top 5 High-Risk Plays Targeting 150%+ Upside as Small Caps Rally