Date: Wed, Dec 03, 2025 | 04:25 AM GMT

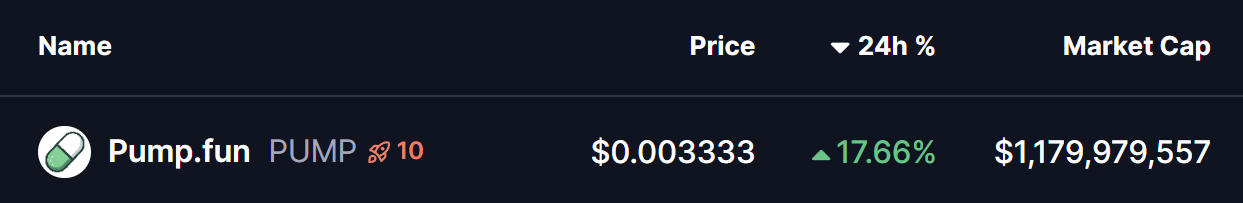

The broader cryptocurrency market is showing a strong rebound following the December 1 selloff, with Bitcoin (BTC) and Ethereum (ETH) up 6% and 8% in the last 24 hours. This recovery has sparked fresh momentum across several tokens — and Pump.fun (PUMP) is proving to be one of today’s standout performers.

PUMP has jumped over 17% today, and more importantly, its latest price structure is forming a harmonic pattern that may support continued bullish action in the short term.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Potential Upside

On the 4-hour chart, PUMP is developing a Bearish Butterfly harmonic pattern. Despite the name, this structure often includes a strong bullish rally into the final CD leg before the pattern completes in the Potential Reversal Zone (PRZ).

The formation started with Point X near $0.003399, followed by a steep slide into Point A. Price then rebounded toward Point B and later retraced into Point C around $0.002567. This final corrective low completed the harmonic baseline, and since then, PUMP has rallied sharply, now trading near $0.003333.

Pump Fun (PUMP) 4H Chart/Coinsprobe (Source: Tradingview)

Pump Fun (PUMP) 4H Chart/Coinsprobe (Source: Tradingview)

Price is also approaching the 200-period moving average at $0.003477 — a major short-term resistance level that aligns directly with the pattern’s upward trajectory. A successful breakout above this MA would indicate strengthening bullish momentum.

What’s Next for PUMP?

If PUMP reclaims and consolidates above the 200 MA, the harmonic blueprint suggests a potential continuation toward the PRZ zone between $0.003651 (1.272 Fibonacci) and $0.003972 (1.618 Fibonacci). This range represents the typical completion zone for a Butterfly pattern and reflects a possible upside of roughly 19% from current levels.

Meanwhile, the key support for bulls to defend remains around $0.003161, which serves as the short-term structural floor of the ongoing pattern.

At present, PUMP’s market structure appears constructive, with higher lows, improving momentum, and a well-defined harmonic leg pointing toward further strength.