Transak, a major payments provider for stablecoins and crypto with more than 10 million users worldwide, has officially integrated with Monad, following the network’s mainnet launch on November 24.

The integration brings full support for Monad’s native token, MON, allowing users to buy or sell it through familiar payment methods such as credit cards, bank transfers, and local rails across multiple regions.

Sponsored

Apps building on Monad can integrate Transak’s on-ramp from launch, giving users direct access to the network without going through centralized exchanges.

Monad: A High-Speed Ethereum-Compatible Blockchain

Monad is a Layer-1 blockchain designed to combine full Ethereum Virtual Machine ( EVM ) compatibility with high throughput and low latency. The team claims the network can handle more than 10,000 transactions per second and confirm them in under a second.

Its mainnet launch had been closely monitored by developers, who are now testing whether the system can support DeFi, gaming, and other high-volume applications without turning to Layer-2 scaling tools.

The network went live on November 24, 2025. MON, its native token, has a fixed supply of 100 billion, with roughly 10.8 billion, or about 10.8%, entering circulation at launch.

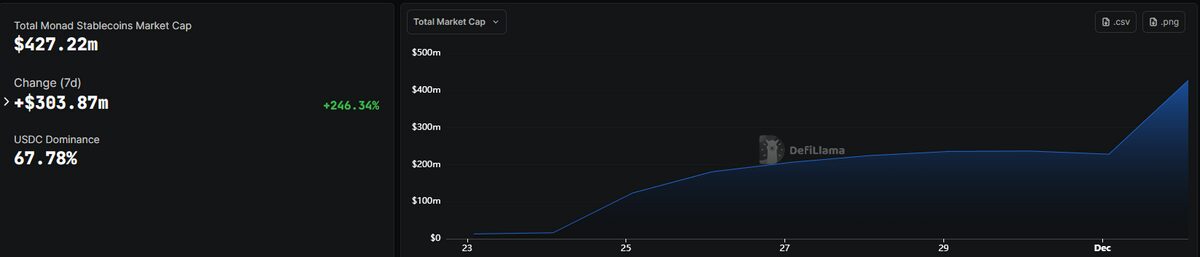

The ecosystem saw an early surge in activity, with more than $120 million in stablecoins bridged into the network during the first 24 hours, according to DeFiLlama .

Source: DeFiLlama

Source: DeFiLlama

Transak’s Role in the Ecosystem

Transak provides payments infrastructure for stablecoins and crypto, allowing apps to onboard users, manage cross-border transfers, and handle multi-party payment flows.

Integrated into more than 450 applications, its platform reaches over 10 million users globally, supporting fiat-to-crypto and crypto-to-fiat transactions through cards, bank transfers, local methods, and stablecoins.

Why This Matters

Monad’s integration with Transak makes it easy for users to buy crypto with fiat from day one, helping its fast Layer-1 attract users and developers and stay competitive with other Ethereum-compatible blockchains.

Discover DailyCoin’s hottest crypto news today:

Vanguard Caves, Listing XRP & Select Other Crypto ETFs

Chainlink ETF Set to Debut as LINK Slips Amid Market Weakness

People Also Ask:

Monad is a high-performance Layer-1 blockchain that is fully Ethereum Virtual Machine (EVM) compatible. It supports high throughput (over 10,000 transactions per second) with low latency, making it suitable for DeFi, gaming, and other high-volume applications.

MON is the native token of the Monad blockchain. It has a fixed supply of 100 billion tokens, with around 10.8 billion entering circulation at launch. MON is used for transactions, staking, and interacting with applications on the Monad network.

Transak is a global payments provider that allows users to buy and sell crypto using fiat currencies like credit cards, bank transfers, and local payment methods. It serves over 10 million users and is integrated with more than 450 applications.