AI Strategies Are No Longer a Wall Street Privilege — Nivex Is Bringing Institutional-Level Performance to Everyone

As we enter 2025, the global crypto market is undergoing a profound structural shift. Manual, intuition-driven trading is rapidly fading, while data-driven, algorithmic, and AI-powered strategies are becoming the new market standard. From exchanges to traditional institutions to everyday investors, one trend is clear: the era of “emotional trading” is giving way to intelligent, model-based decision-making.

AI now influences everything—from Wall Street hedge funds to on-chain liquidity flows. With the AI-driven finance market growing at over 40% CAGR, the shift toward automated, model-centric pricing is undeniable. Crucially, institutional-grade AI is no longer locked inside proprietary systems. A new wave of platforms—led by Nivex—is making these once-exclusive capabilities accessible to ordinary users.

The Decline of Manual Trading: Retail Is Losing Its Place in Price Discovery

The past decade was defined by retail-dominant crypto trading. But since 2024, market structure has undergone a fundamental realignment: shrinking volatility, declining on-chain activity, altcoin washouts, and steady ETF absorption of liquidity all signal that retail influence is rapidly diminishing.

Manual traders—often driven by emotions, fragmented information, and inconsistent execution—struggle to keep pace. Retail behavior typically falls into predictable traps: chasing highs, panic-selling bottoms, and overleveraged bets. Institutions, meanwhile, leverage superior data, compute, and systematic models to execute decisions in milliseconds.

Retail traders today aren’t just losing money—they’re losing structural influence. This raises a critical question: how can everyday investors stay competitive in an AI-dominated market?

The Institutional AI Advantage: Why These Systems Are So Hard to Replicate

Institutional-grade AI isn’t a single algorithm—it’s a complete infrastructure built on four pillars: compute power, data pipelines, model architecture, and risk management. Its core strengths include:

- Multi-layer data processing Institutions digest global markets, on-chain flows, macro events, and depth data in real time—far beyond human capacity. Decisions are made on structural logic, not emotions.

- Self-learning and model evolution Through deep learning, reinforcement learning, and factor models, AI constantly adapts and improves based on market feedback—achieving sustained performance over time.

- Robust, institutional risk management From multi-tier stop-loss systems to dynamic rebalancing and black-swan protection, institutional AI strategies are engineered for stability and long-term survivability.

This is why AI trading is a system, not a tool—and why, historically, it has never been accessible to average investors.

The New Paradigm: From Closed Institutional Strategies to Open CEX Distribution

The biggest shift in 2025 is the “open distribution” of quantitative and AI strategies. Leading quant firms are no longer serving only select clients—they are pushing signals to the masses via centralized exchanges. CEXs are becoming strategy distribution platforms, powered by automated AI execution.

Exchanges have the unique infrastructure to support this model: custody, order engines, transparent execution, risk controls, and compliance. Combined with AI automation, retail users can finally access the same execution accuracy, reaction speed, and strategy quality previously reserved for institutions.

For the first time, ordinary investors stand on equal footing with professional funds.

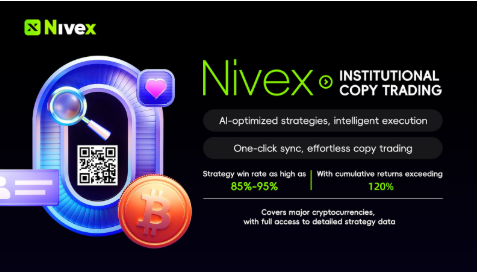

Nivex: Making Institutional-Grade AI Strategies the Standard for Everyday Users

Among global exchanges, Nivex stands out as one of the few platforms successfully delivering full-stack, institutional-grade AI to retail users.

1. Curated institutional strategies

Nivex partners with more than ten leading quant and AI firms. Every strategy signal undergoes rigorous vetting, scoring, and backtesting, supported by professional traders and research teams for continuous optimization.

2. AI-driven execution

Users simply select a strategy; the AI handles everything—millisecond execution, automated entries/exits, dynamic position adjustments, and real-time risk control. Experience and reaction speed no longer determine performance.

3. A complete AI trading ecosystem

Nivex offers one of the industry’s most comprehensive AI product suites, including:

- AI spot trading

- AI futures trading

- AI yield products

- Quant strategy bots

- Copy-trading systems All are powered by real-time analytics and automated execution with constant optimization.

This makes Nivex not just a trading tool, but a fully integrated intelligent trading ecosystem.

AI Is Becoming the Most Certain Growth Driver in Modern Investing

Across retail behavior, market structure, and institutional priorities, the direction is unmistakable: AI is becoming the dominant force shaping the future of trading.

Exchanges will evolve from mere trading venues into strategy-distribution infrastructures. Investors no longer need to “beat the market” manually—they simply need the right AI tools to participate alongside institutions.

As one of the most AI-driven exchanges globally, Nivex—backed by professional strategy sources, advanced execution systems, rigorous risk frameworks, and global compliance—is emerging as a key enabler of this shift.

The Future Belongs to Intelligent Traders

The decline of manual trading does not mean retail investors are being eliminated. It means a new opportunity has arrived. With AI and institutional strategies, every user can access capabilities once exclusive to top financial institutions.

Tomorrow’s markets will not be “humans vs. markets,” but AI systems competing with AI systems. Choosing AI isn’t just following a trend—it's aligning with the future.

Nivex is ensuring that every user can step into this new era with institutional-grade tools and truly compete in the age of intelligent trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What's Causing the Latest BTC Price Swings: Is It a Macro-Fueled Reevaluation?

- Bitcoin's late 2025 volatility reflects macroeconomic pressures, Fed policy shifts, and regulatory changes impacting institutional demand. - Sharp price swings from $126k to $87k highlight sensitivity to inflation, interest rates, and leveraged trading risks amid delayed economic data. - New U.S. crypto laws and ETF approvals boosted institutional participation, but geopolitical risks and token unlocks maintained uncertainty. - A potential Fed rate cut and stabilizing inflation could reignite risk appeti

The ChainOpera AI Token Collapse: A Cautionary Tale for AI-Powered Cryptocurrency Markets?

- ChainOpera AI (COAI) token's 96% collapse in late 2025 exposed systemic risks in AI-blockchain markets, mirroring 2008 crisis patterns through centralized governance and speculative hype. - COAI's extreme centralization (96% supply in top 10 wallets) and tokenomics (80% locked until 2026) created liquidity crises, undermining blockchain's decentralized ethos. - Regulatory actions intensified post-crash, with SEC/DOJ clarifying custody rules and targeting fraud, yet CLARITY/GENIUS Acts created compliance

The COAI Token Fraud: An Urgent Warning for Individual Investors in the Cryptocurrency Market

- COAI token's 88% devaluation in late 2025 erased $116.8M, exposing systemic risks in AI-integrated DeFi ecosystems. - Centralized control (87.9% tokens in 10 wallets) and algorithmic stablecoin failures enabled coordinated manipulation and liquidity collapse. - Regulatory gaps allowed cross-border operations in jurisdictions like Southeast Asia, highlighting urgent need for AI-powered oversight and standardized protocols. - Investors must prioritize smart contract audits, transparent governance, and on-c

Examining the Latest Decline in PENGU Value: Key Drivers and What It Means for Cryptocurrency Investors

- Pudgy Penguins (PENGU) plummeted 30% in late 2025 due to regulatory uncertainty, algorithmic trading triggers, and a $66.6M team activity event. - The collapse exposed systemic risks in crypto, including stablecoin liquidity crises and interconnectedness with traditional finance via ETFs and leverage. - Investors are urged to prioritize diversification, liquidity monitoring, and regulatory compliance to mitigate risks from opaque projects and volatile markets.