BTC Market Pulse: Week 49

Over the past week, Bitcoin showed early signs of stabilisation after the deep oversold slide. Momentum has recovered and sell pressure is beginning to ease across spot and derivatives markets.

Overview

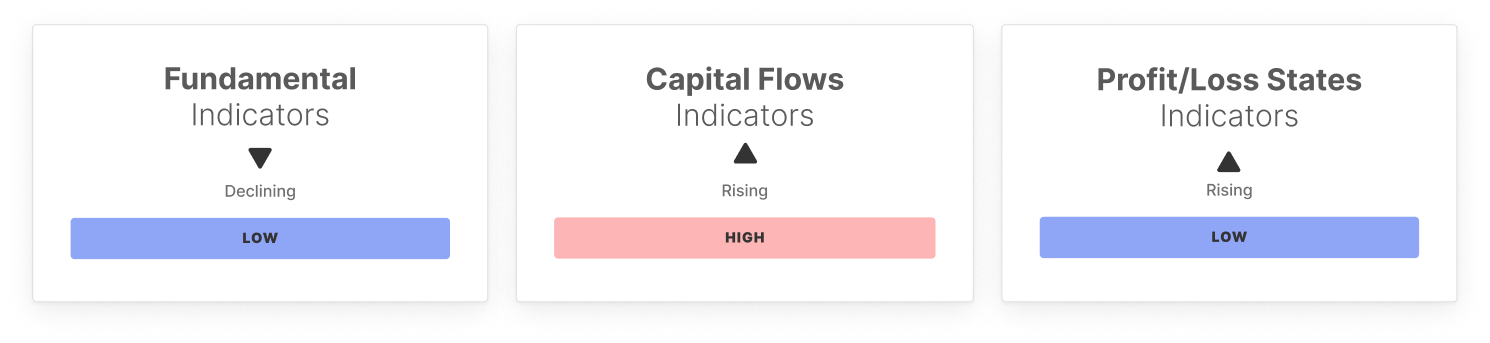

Price held above recent lows while RSI rebounded sharply from extreme conditions, indicating exhaustion may be taking hold even as the broader trend remains fragile. Spot flows improved meaningfully with CVD turning positive for the first time in several weeks, signalling renewed buy-side aggression despite thinning liquidity. However, aggregate spot volume remains compressed near historical lows, suggesting the market is still operating cautiously with limited participation.

Derivatives markets reflect this transition from stress toward tentative balance. Futures Open Interest has slipped below its lower band and funding has collapsed to cycle-low levels while leverage continues to unwind, forming a structure that aligns more with de-risking than speculative expansion. Futures CVD is recovering at the same time, indicating that the worst of the sell-side pressure may be passing. In options, Open Interest has grown modestly while volatility pricing has shifted into discount, suggesting the market may now be underpricing forward risk. Skew has eased from last week’s defensive posture, pointing to reduced downside hedging demand and a softening in bearish sentiment.

ETF trends improved meaningfully. Netflows turned positive at 159.8 million after persistent outflows, hinting at renewed institutional interest despite ETF volumes remaining below their lower band. MVRV is stable in profit, indicating limited pressure for widespread distribution.

On-chain activity remains soft. Active addresses and transfer volumes have eased, while fee revenue has dropped below its lower band, pointing to lighter network usage. Realised Cap Change continues to fade, suggesting muted inflows. Supply structure is still speculative, with both the STH to LTH ratio and Hot Capital Share above upper bands, reflecting short-term churn and heightened reactivity. Profitability metrics have not improved, with all metric remaining loss-dominant, signalling a lack of momentum.

In sum, Bitcoin appears to be transitioning out of deleveraging into a fragile equilibrium. Oversold conditions have eased and ETF flows have improved, but liquidity remains thin and conviction unproven. A sustained recovery will likely require much stronger spot demand, renewed inflows, and broader participation.

Off-Chain Indicators

On-Chain Indicators

🔗 Access the full report in PDF

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Livio from Xinhuo Technology: The value of the Ethereum Fusaka upgrade is underestimated

Weng Xiaoqi: The strategic value brought by Fusaka far exceeds its current market valuation, making it worthwhile for all institutions to reassess the long-term investment value of the Ethereum ecosystem.

Hyperliquid Whale Game: Some Make a Comeback Against the Odds, Others Lose Momentum

The largest IPO in history! SpaceX reportedly seeks to go public next year, aiming to raise over 30 billion and targeting a valuation of 1.5 trillion.

SpaceX is advancing its IPO plan, aiming to raise significantly more than $30 billion, which could make it the largest public offering in history.

DiDi has become a digital banking giant in Latin America

Attempting to directly replicate the "perfect model" used domestically will not work; we can only earn respect by demonstrating our ability to solve real problems.