Will XRP Price Crash Further or Rebound Soon?

XRP price is struggling to regain balance after a sharp sell-off that mirrored the broader crypto market’s turbulence. Over $640 million in leveraged positions were wiped out in 24 hours, turning a typical weekend correction into a cascading liquidation event. Bitcoin’s plunge below $86,000 triggered panic across altcoins, and XRP was no exception — dropping about 4% in the latest session to trade around $2.09. The question now is whether XRP’s decline is nearing exhaustion or just beginning another leg down.

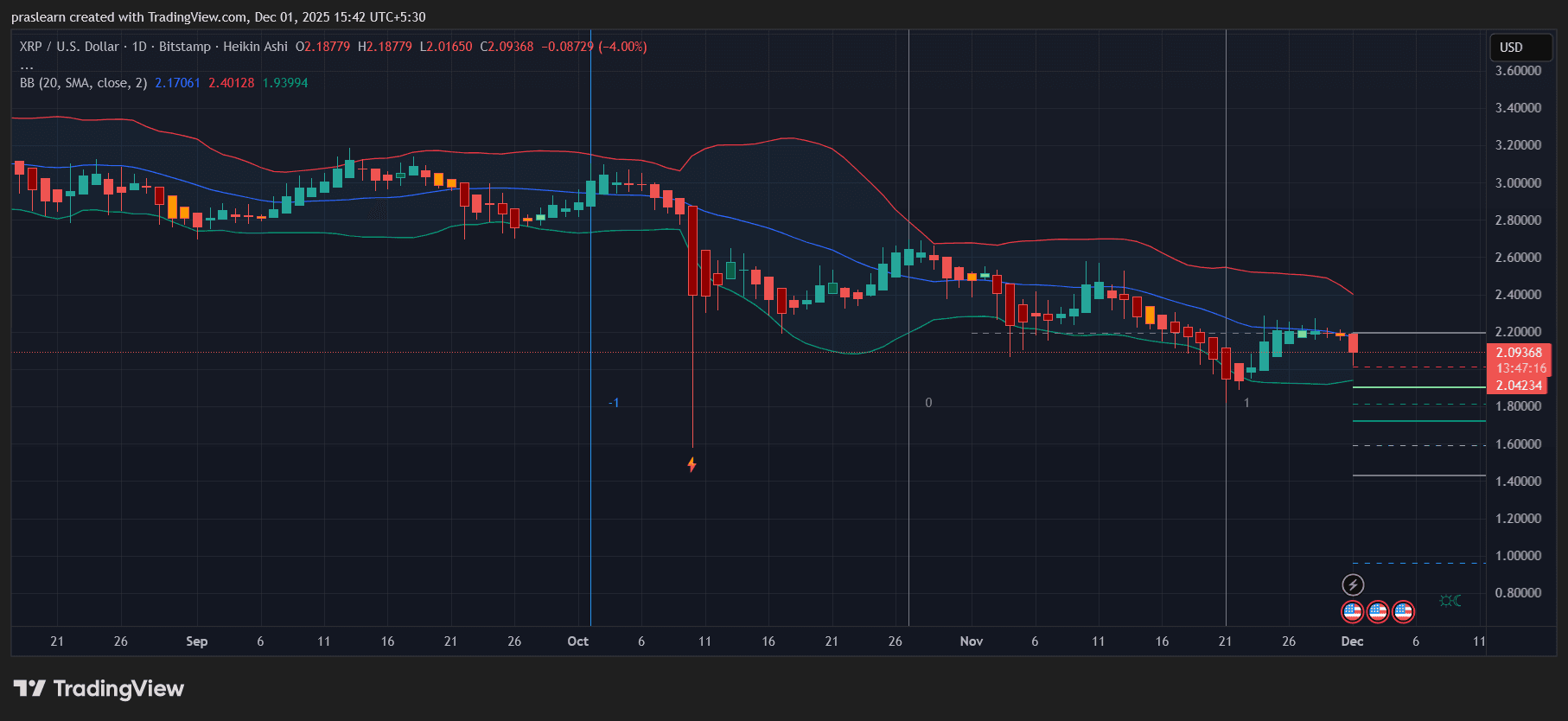

XRP Price Prediction: Price Fights the Midline of Bollinger Bands

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

The daily chart shows XRP price trading below the 20-day moving average (blue line) and clinging to the mid-zone of the Bollinger Bands. This setup typically signals ongoing bearish control, especially when candles close beneath the middle band. The recent rejection near $2.18 suggests the bulls are struggling to flip that level into support.

The Bollinger Bands are moderately contracted, indicating that volatility might compress before another directional move. A close below $2.04 — the lower range of recent consolidation — could invite deeper selling pressure, pushing XRP price toward $1.85 or even $1.65, where the next Fibonacci retracement supports align. Conversely, reclaiming $2.20 could signal the start of a short-term rebound toward $2.40, but momentum indicators still favor the bears.

Macro Headwinds: Rising Yields and Risk-Off Sentiment

Outside the charts, macro signals continue to weigh on crypto sentiment. Japan’s 10-year bond yield climbing to 1.84% — its highest since 2008 — hints at a global shift in liquidity preferences. Investors are moving back into traditional assets like gold, which gained 0.58% while Bitcoin and altcoins suffered broad losses. The strong correlation between crypto and the Nasdaq (0.83 on a 7-day basis) also means that any equity pullback could further drag XRP and other risk assets down.

Derivative Market Stress: High Leverage Magnifies Losses

Liquidations are another red flag. With open interest hovering around $771 billion, the market remains dangerously over-leveraged. This setup amplifies volatility — even minor dips can trigger forced selling, as seen during the recent cascade. XRP, being a high-beta altcoin, often bears the brunt of these liquidations, exaggerating its price swings.

XRP Price Prediction: Cautious Short-Term, Opportunity Mid-Term

Technically and sentiment-wise, XRP price still faces downside risk in the near term. A decisive breakdown below $2.00 could accelerate losses toward $1.80. Yet, with RSI approaching oversold levels and the broader market showing signs of exhaustion, a relief rally isn’t off the table. Medium-term investors may look for accumulation zones between $1.65 and $1.85 if Bitcoin stabilizes above $85K.

In short, while $XRP may see more pain before recovery, panic selling is already showing signs of cooling. Whether the coin rebounds or continues sliding will depend heavily on Bitcoin’s ability to reclaim lost ground — and on whether macro risks ease before December’s key Fed decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP Faces a Defining Moment in 2026—Will Institutional Excitement or Practical Use Prevail?

- Grayscale XRP Trust (GXRP) launches on NYSE, joining 3 XRP ETFs as institutional adoption accelerates post-SEC legal resolution. - Ripple's XRP gains traction in cross-border payments via partnerships with Santander , SBI, and Amex , competing with stablecoins/CBDCs. - XRP faces challenges: declining ledger transaction volume, banks favoring ODL corridors over direct XRP holdings, and stablecoin competition. - ETF allocations remain in cold storage, limiting on-chain demand, while 2026 price forecasts hi

Industrial Property Prospects in Webster, NY, During Xerox Campus Transformation: A Strategic Plan for Sustainable Value Growth via Infrastructure

- Webster , NY, is redeveloping the Xerox campus with a $9.8M FAST NY grant, transforming a 300-acre brownfield into a high-tech industrial hub. - Infrastructure upgrades, including roads and sewer systems, aim to attract $1B+ in private investment, exemplified by a $650M fairlife® dairy plant creating 250 jobs. - Parcel subdivision and municipal boundary adjustments eliminate jurisdictional barriers, enabling scalable development and attracting manufacturers requiring contiguous land. - Industrial vacancy

Bitcoin Updates: 2025 Crypto Downturn Driven by Liquidity, Not Crisis, as Markets Demonstrate Evolving Stability

- Cryptocurrency markets collapsed in late 2025, with Bitcoin dropping 31% as $1.2T in value vanished amid liquidity crunches and macroeconomic pressures. - Analysts attribute the selloff to thin trading during holidays, BoJ rate hike speculation, Chinese crackdowns, and Tether/MicroStrategy risks. - MicroStrategy's potential Bitcoin sales and Fed policy shifts highlight institutional influence over volatility, contrasting past retail-driven crashes. - Market maturity is tested as Bitcoin approaches $60K s

Dogecoin News Today: Dogecoin Faces a Turning Point: Popular Enthusiasm Meets Broader Economic and Regulatory Challenges

- Dogecoin (DOGE) drops 7% amid broader crypto bearishness, extending a five-day losing streak as retail-driven momentum falters. - Technical indicators signal weakness near $0.13000, with a break below $0.12986 risking a slide toward $0.09500 support. - Japan's new DOGE department, focused on fiscal efficiency, adds macroeconomic uncertainty, influencing investor trust in markets. - Diverging futures open interest (OI) highlights mixed sentiment: DOGE and SHIB attract optimism , while PEPE faces declining