MicroStrategy Bitcoin: Saylor Reaffirms Strategy Amid Volatility

Michael Saylor, the executive chairman of MicroStrategy, made headlines recently. He said that even if Bitcoin fell to $1, MicroStrategy would not sell its holdings. Instead, the company would continue buying more Bitcoin. Saylor has long supported Bitcoin, and his words show he does not worry about short-term price drops.

MicroStrategy has purchased tens of thousands of Bitcoins over the past few years. The company uses Bitcoin to protect its cash from inflation. Saylor often calls Bitcoin “digital gold” and believes it preserves value better than cash.

Why MicroStrategy Is Confident

Saylor’s strategy depends on three main ideas:

- Think Long-Term: He believes Bitcoin’s value will rise over time and ignores temporary dips.

- Protect Company Funds: MicroStrategy invests corporate cash into Bitcoin to guard against inflation and currency devaluation.

- Handle Market Swings: Saylor manages risk carefully so that big price drops do not force the company to sell.

His recent statement shows that MicroStrategy sees steep price drops as opportunities to buy Bitcoin at lower prices, not as dangers.

Bitcoin Market Today

Bitcoin has shown extreme price swings in recent months. It reached multi-year highs but also fell sharply at times. Many investors feel nervous about this volatility. Still, MicroStrategy has continued buying Bitcoin, showing it does not plan to sell under pressure.

Saylor’s claim that the company could survive a $1 Bitcoin sounds extreme but highlights the company’s careful planning. MicroStrategy has structured its finances to handle difficult situations without liquidating its holdings.

Different Opinions

Not everyone agrees with Saylor. Critics warn that sudden regulations, liquidity issues, or unexpected market shocks could still create problems. They argue that even prepared companies could face challenges if Bitcoin collapsed dramatically.

Still, Saylor’s confidence inspires many investors. His long-term focus encourages people to look past short-term losses and think about the bigger picture.

MicroStrategy’s Long-Term Strategy

MicroStrategy treats Bitcoin as a key asset. Saylor’s approach shows that the company plans to embrace volatility instead of backing away from it. Investors now watch closely to see if MicroStrategy’s aggressive strategy works and how it handles future market swings. Whether Bitcoin rises or falls, Saylor’s message is clear. MicroStrategy is fully committed to Bitcoin for the long haul and will continue building its position over time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

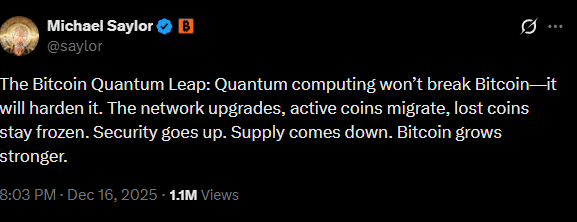

Bitcoin’s quantum future – Saylor plays down risks as experts raise red flags

Japan Rate Hike Looms: What Historical Trends Suggest for Bitcoin and the Broader Crypto Market

Unlock Your Sound: The ARIA Nana Remix Contest Closes for Submissions on January 9