Date: Mon, Dec 01, 2025 | 03:45 AM GMT

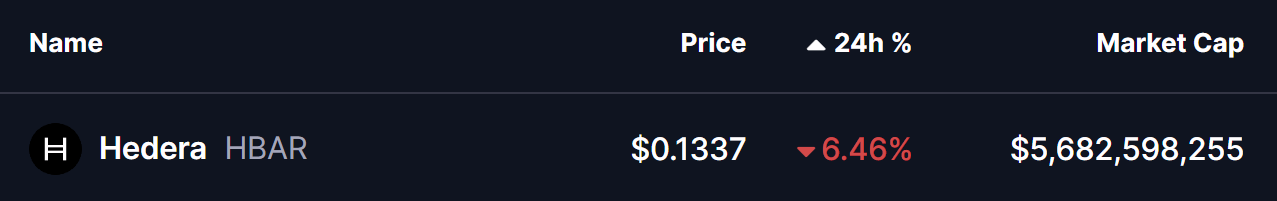

The broader cryptocurrency market is facing a sharp selloff at the start of the new week and month as Bitcoin (BTC) and Ethereum (ETH) slide more than 4% over the past 24 hours. This rapid move triggered over $526 million in liquidations , with long positions taking the majority of the damage. Market-wide volatility has dragged down major altcoins, and Hedera (HBAR) has not been spared, falling more than 6%.

Source: Coinmarketcap

Source: Coinmarketcap

But despite the heavy pressure, HBAR’s weekly chart is signaling a technical setup that could lay the foundation for a potential rebound.

Descending Triangle in Play

HBAR has been moving inside a large descending triangle pattern on the weekly timeframe. This structure is characterized by lower highs meeting a flat horizontal support zone. While descending triangles are typically bearish continuation patterns, they can also lead to sharp rebounds when the base support repeatedly holds, especially during periods of high market fear.

The chart shows that HBAR has once again pulled back into the critical support zone between $0.12 and $0.14 — a level that has triggered strong reactions from buyers throughout the year. Each dip into this region has created a wick-heavy candle, reflecting aggressive buying and clear accumulation. Sellers have tightened lower highs, but they have failed to break the major demand zone.

Hedera (HBAR) Weekly Chart/Coinsprobe (Source: Tradingview)

Hedera (HBAR) Weekly Chart/Coinsprobe (Source: Tradingview)

HBAR is currently trading just below the 100-week moving average, which is positioned near $0.1526. This moving average has played a pivotal role in past trend shifts, and reclaiming it would be an early signal that buyers are stepping back in.

What’s Next for HBAR?

If buyers defend the $0.12–$0.14 zone once again and push price back above the 100-week MA, a rebound toward the descending trendline resistance near $0.19 becomes likely. This upper trendline has capped upside attempts for months, and a breakout above it would signal a meaningful shift in market structure.

A decisive weekly close above the trendline would invalidate the descending triangle’s bearish bias and potentially initiate a broader trend reversal — especially if volume expands on the breakout.

However, the risk remains clear. If HBAR loses the $0.12 support with a weekly close below it, the descending triangle would technically break downward. Such a move could expose the price to deeper declines toward the next macro support zone around $0.09.

For now, all eyes are on how HBAR behaves within this major demand region. As long as buyers continue to defend the triangle’s base, a rebound remains a realistic and technically supported scenario.