Foreign Investors Set Record With $646.8 Billion in US Stock Purchases Amid Shifting Global Capital Flows

A powerful and unusual wave of global capital is rushing into US markets. Foreign investors are buying American equities at a record pace, Treasury demand is reshuffling at a structural level, and domestic inflows are accelerating into year-end. At the same time, US consumer debt has hit its highest level in history. For crypto and

A powerful and unusual wave of global capital is rushing into US markets. Foreign investors are buying American equities at a record pace, Treasury demand is reshuffling at a structural level, and domestic inflows are accelerating into year-end.

At the same time, US consumer debt has hit its highest level in history. For crypto and equity investors, the scale and direction of these flows signal a major shift in risk appetite and global macro positioning.

Foreign Investors Drive Record Equity Buying Amid Historic Realignment in Treasury Ownership

Private investors outside the US purchased $646.8 billion in US equities in the 12 months ending September 2025, according to data cited by Yardeni Research.

JUST IN: 🇺🇸 Private investors outside U.S. purchased record $646.8 billion of U.S. equities in the 12 months ending in September 2025 – Yardeni Research.

— Whale Insider

This marks the highest level on record, surpassing the 2021 peak by 66%, with flows doubling since January.

The buying is not limited to US equities. Foreign private-investor purchases of US Treasuries totalled $492.7 billion in the same period. Rolling 12-month non-US buying of Treasuries has remained above $400 billion for four consecutive years, reflecting persistent global demand for dollar-denominated safety.

“Everyone wants US assets,” analysts at the Kobeissi Letter remarked.

The composition of foreign Treasury holders is shifting in ways not seen in decades:

- China’s share of foreign Treasury holdings has fallen to 7.6%, the lowest in 23 years, and down 20% over 14 years.

- The UK’s share has quadrupled to 9.4%, near its highest level on record.

- Japan, still the largest foreign holder, now accounts for 12.9%, down 26 points over the last 21 years.

These shifts suggest a long-term repositioning of sovereign and private capital, a trend with direct implications for interest rates, liquidity, and market volatility.

Something unusual is happening in the US Treasury market:China’s Treasury holdings as a % of all foreign holdings is down to 7.6%, the lowest in 23 years.This percentage has declined -20 points over the last 14 years.As a result, China now ranks as the world’s 3rd-largest…

— The Kobeissi Letter

Domestic Investors Also Going Risk-On, But Record Consumer Debt Adds Complexity

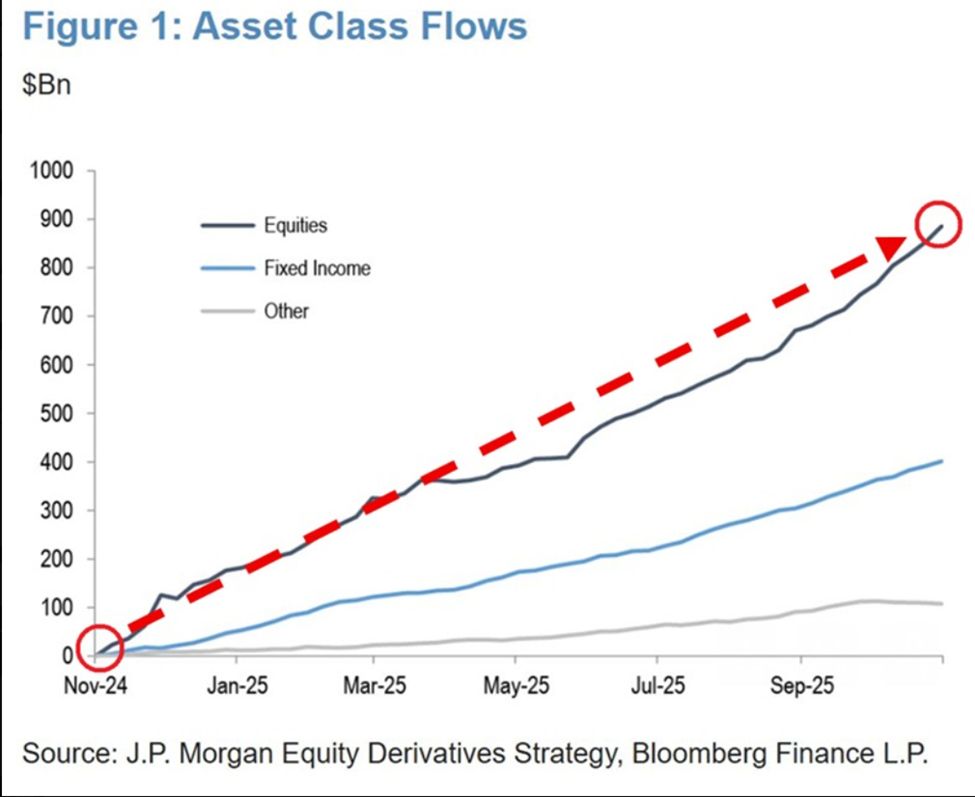

US investors have poured an extraordinary $900 billion into equity funds since November 2024, according to JPMorgan data, with half of that total, $450 billion, arriving in just the last five months.

US Asset Class Flows. Source: JP Morgan

US Asset Class Flows. Source: JP Morgan

Fixed-income funds added another $400 billion, while all other asset classes combined attracted only $100 billion.

Inflows into US equities have exceeded those into all other asset classes combined, reinforcing the strength of the bid for US risk assets.

While institutional and foreign investors are ramping up their exposure, US households are under growing financial pressure. Total US credit-card debt climbed to $1.233 trillion in Q3 2025, the highest level ever recorded.

JUST IN: 🇺🇸 Total U.S. credit-card debt reaches $1.233 trillion in third quarter of 2025, highest amount since tracking began.

— Whale Insider

This divergence between market optimism and consumer strain raises questions about sustainability, earnings resilience, and the timing of potential policy shifts.

Seasonality and Bullish Projections Lift Sentiment

JP Morgan expects the S&P 500 to reach 8,000 next year, a view reinforced by powerful seasonal tailwinds. This projection comes as markets anticipate the bank’s “everything rally” forecast shared just over a week ago.

S&P 500 could hit 8,000 next year says JP Morgan 🥳📈🤑🫂

— Barchart

December has historically been the strongest month for US stocks, with the S&P 500 rising 73% of the time since 1928 and delivering an average return of +1.28%.

For both crypto and equity markets, the surge in capital flows toward the US signals rising confidence in American assets, or a lack of attractive alternatives abroad.

Investors will watch to see whether these inflows accelerate in 2026, how Treasury demand shifts as global holdings rebalance, and whether record consumer debt becomes a drag on macroeconomic momentum.

With liquidity building and seasonality strengthening, both traditional markets and digital assets are entering a potentially decisive phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AWS and Cloudflare Failure Show the Real Risk of Centralized Cloud

The Federal Reserve's Change in Policy and Its Growing Influence on Blockchain-Based Innovation

- The Fed's 2025 GENIUS Act and FedNow infrastructure catalyzed blockchain growth, boosting Solana's capital inflows and institutional adoption. - Regulatory clarity for stablecoins (1:1 reserves, AML safeguards) drove $315B market cap and $9T annual transactions, reshaping digital finance. - Solana's 5,000 TPS and partnerships with Visa/Stripe/BlackRock positioned it as a FedNow alternative for cross-border settlements and tokenized assets. - Hybrid infrastructure models (FedNow + permissionless chains) m

Apple Music’s Replay 2025 has arrived