Key Notes

- Solana price holds above $135 despite 21Shares withdrawing its SOL staking ETF application.

- Derivatives data shows $12.5 million in bullish leverage added as traders counter bearish headlines.

- Solana ETFs swung back to $5.3 million inflows on Friday, signaling improving sentiment after Thursday’s $8.3 million drawdown.

Solana price found firm support above $135 on Saturday, Nov. 29, positioning the asset to close the week with roughly 6% gains despite bearish sentiment triggered by 21Shares withdrawing its Solana staking ETF application , citing challenges in completing regulatory obligations.

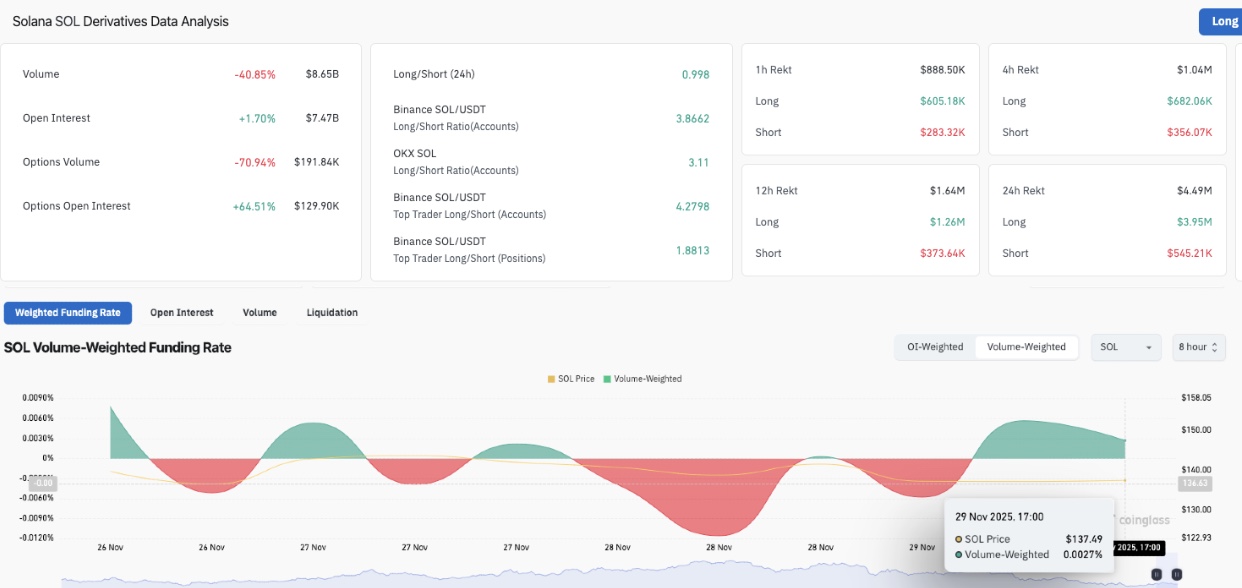

Solana open interest rises 1.7% as bulls defend $135 support after 21Shares withdrew its application for SOL ETF staking. | Source: Coinglass

Resilience from bull traders cushioned the downside impact, with Coinglass data showing Solana open interest rising 1.7%, even as SOL price dipped 1.25% intraday in the spot markets. This indicates that speculative traders added $12.5 million in notional leverage to defend the $135 price support level.

Solana’s funding rate also flipped positive to hit 0.0027% on the 8-hour time frame, showing the bulls are paying higher fees to keep bullish positions open.

The long-to-short ratio, hovering near 1.0, confirms that most of these new positions came from bullish market participants covering aggressively rather than from shorts piling in.

Solana ETF Flows as of Nov 28, 2025 | Source: FarsideInvestors

ETF flows also reinforced the resilience narrative. All actively traded Solana ETFs closed the week positive, recording $5.3 million inflows on Friday, reversing Thursday’s $8.3 million outflow that ended a 22-day inflow streak dating back to SEC approval on Feb. 28. The return to net inflows suggests traders expect the 21Shares ETF headwind to fade quickly.

Solana Price Forecast: Can Bulls Confirm the Falling Wedge Breakout Toward $220?

Solana continues to trade inside a well-defined falling wedge, a bullish reversal pattern formed when descending support and resistance lines converge. A breakout typically occurs when the price closes above the upper trendline, often triggering a rally proportional to the wedge’s height.

Solana is currently trading around $135–$136, sitting between the KC midline and lower band. A positive MACD crossover reflects improving trend strength and rising upside probability.

Solana (SOL) Technical Price Analysis | Source: TradingView

The falling wedge projection on the SOLUSD daily price chart shows upside potential of 62.24%, targeting the $220 level, if a confirmed breakout occurs above the wedge’s upper boundary near $150. Conversely, downside risk is marked at 29.13%, referencing a potential retest of wedge support near $120.

On the upside, a daily close above $143.10 followed by a breakout above $150–$152 would complete the falling wedge structure. If this occurs, Solana could accelerate toward the $200–$220 measured-move target.

next