Switzerland Delays Crypto Information Exchange Pending International Coordination

- Switzerland delays crypto tax data sharing with foreign nations until 2027, citing unresolved CARF partner agreements. - The OECD's 2022 framework requires member states to exchange crypto account details, but 75 countries including the EU and UK face implementation challenges. - Transitional measures ease compliance burdens for Swiss crypto firms while awaiting finalized international data-sharing protocols. - Major economies like the U.S., China, and Saudi Arabia remain outside CARF due to non-complian

Switzerland Delays Automatic Crypto Tax Data Sharing

Switzerland has decided to push back the start of its automatic cryptocurrency tax information exchange with other countries, despite having established the necessary legal framework set to take effect on January 1, 2026. The Swiss Federal Council and the State Secretariat for International Finance announced that the postponement is due to ongoing discussions about which partner nations will participate in data sharing under the OECD's Crypto-Asset Reporting Framework (CARF). The authorities emphasized that agreements with these jurisdictions must be finalized before any data exchange can begin, highlighting the intricate process of aligning international standards for digital asset tax transparency.

The CARF, introduced by the OECD in 2022, is designed to curb tax evasion by mandating the exchange of crypto account information between participating countries. Switzerland, having signed on to this initiative, originally intended to commence data sharing in 2027. However, the current delay introduces uncertainty regarding when the process will actually start. This situation illustrates the difficulties countries face in coordinating regulatory frameworks, especially as 75 nations—including all EU states, the United Kingdom, and most G20 members—have pledged to implement CARF within the next four years. It is notable that significant economies such as the United States, China, and Saudi Arabia have yet to join the framework, either due to non-compliance or pending negotiations.

To support local crypto businesses during this transitional period, Swiss regulators have introduced temporary measures, including updates to domestic reporting requirements. These changes, which are part of the broader CARF rollout, are intended to give companies time to adjust to new obligations, such as compulsory registration and due diligence for crypto service providers with substantial ties to Switzerland. The government has also clarified that the legal provisions for data sharing will not be activated until agreements with partner countries are in place, reflecting the delicate nature of international financial cooperation.

This postponement has fueled discussions about the speed of global cryptocurrency regulation. While Switzerland's measured approach may help ensure stronger protections, it could also result in the country falling behind regions that have already implemented similar policies. For example, South Korea has recently broadened its anti-money laundering regulations to include smaller crypto transactions, showing a parallel effort to address regulatory gaps. Such developments underscore the challenge governments face in fostering innovation while maintaining oversight in the crypto industry.

As the OECD continues to advocate for widespread CARF adoption, Switzerland's extended timeline highlights the practical and diplomatic obstacles involved in cross-border data sharing. The Swiss government's emphasis on refining compliance processes and securing international agreements points to a deliberate, if slower, strategy for integration. Nevertheless, the lack of a definitive start date for 2027 leaves both crypto businesses and tax officials awaiting further clarity as they adapt to a rapidly changing regulatory environment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cyberscope Partners with 4EVERLAND to Fortify Secure, AI-Led Web3 Cloud Ecosystem

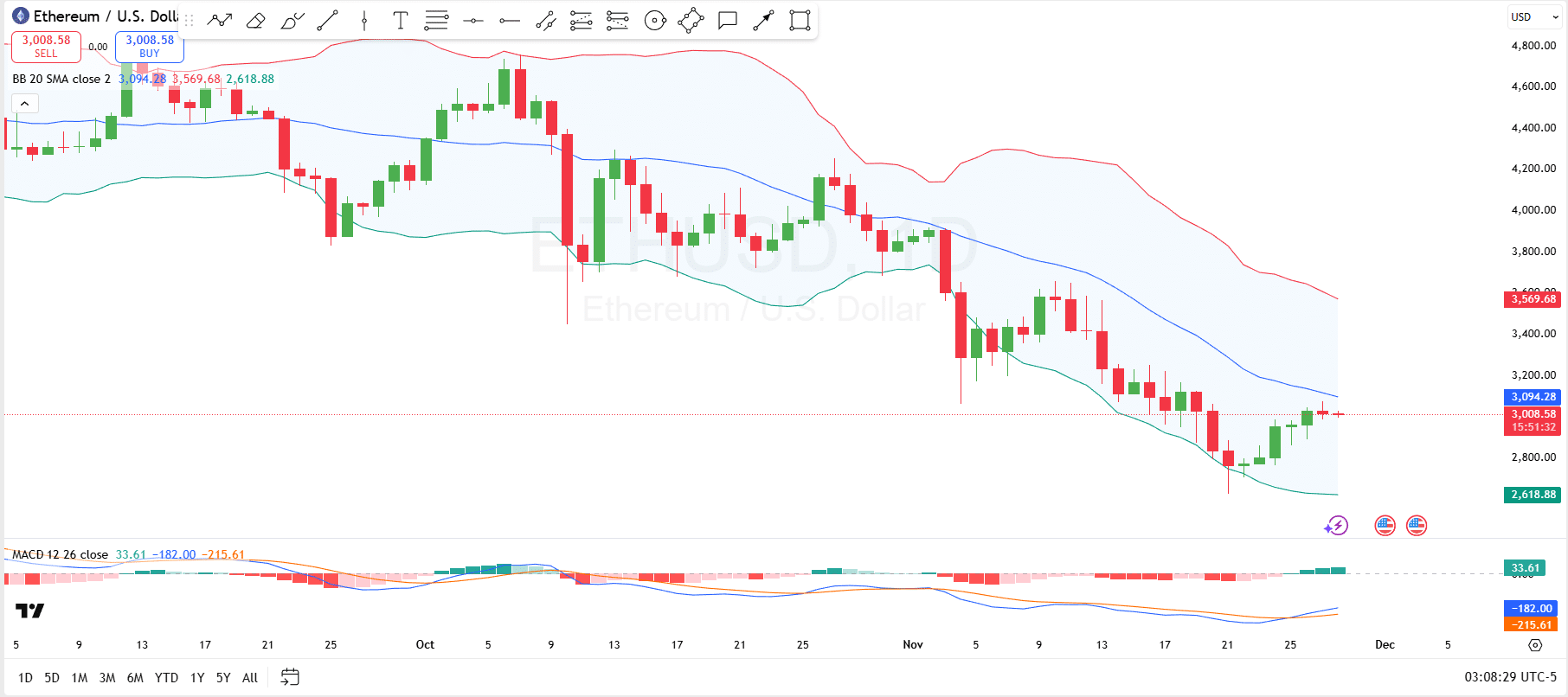

Ethereum Could Flip Resistance to Test $3,500, Here’s How

Why this analyst thinks Bitcoin’s return to $100k isn’t far away

Bitcoin Dominance Defies Pattern During 30% Decline, Dropping Instead of Climbing