The real "big player" in gold: "Stablecoin giant" Tether

As of September 30, Tether holds 116 tons of gold, making it the largest single gold holder aside from major central banks.

Crypto giant Tether has become a new force in the gold market. As of September 30, Tether held 116 tons of gold, making it the largest single gold holder outside of major central banks. This year, gold prices have risen by about $2,000 in two waves, with the second rally coinciding with Tether's accelerated gold purchases. At the same time, this also means that if demand for stablecoins were to reverse sharply for any reason, the pressure would inevitably be transmitted to the large gold reserves. Tether's enthusiasm for gold may reflect its long-term bet on tokenized physical gold.

Written by: Zhao Ying

Source: Wallstreetcn

When investors flock to gold as a safe-haven asset, they may not have expected that one of the key buyers driving gold prices to new highs this year is Tether, the most controversial stablecoin issuer in the crypto world. This digital asset giant's gold purchases have at times surpassed those of central banks, reshaping the supply and demand dynamics of traditional safe-haven assets.

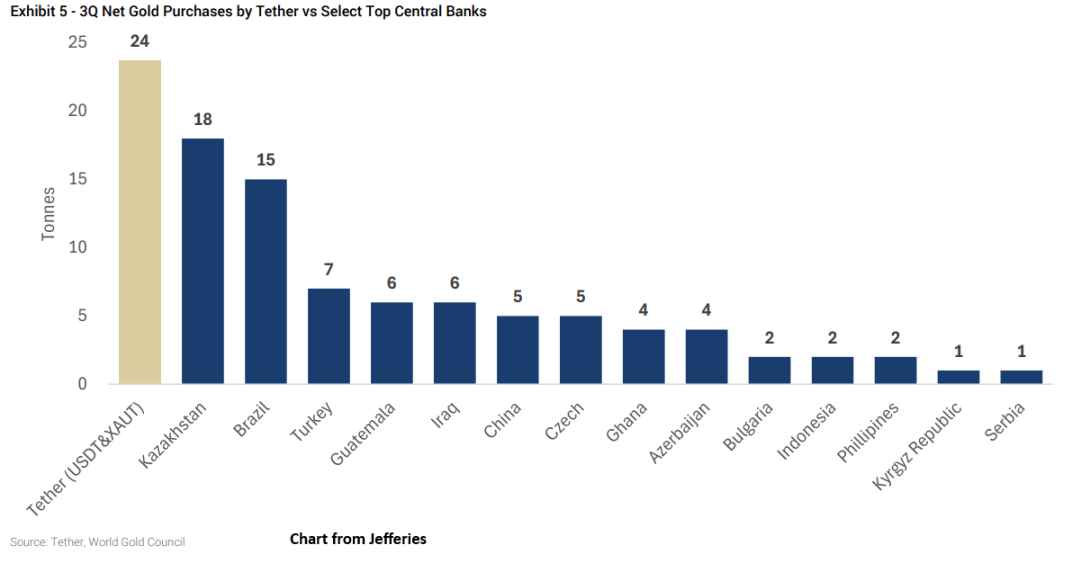

According to media reports on Thursday, investment bank Jefferies estimates that as of September 30, Tether, the issuer of the world's largest stablecoin USDT, held 116 tons of gold worth about $14 billion, making it the largest single gold holder outside of major central banks, with holdings comparable to the official reserves of countries like South Korea, Hungary, or Greece. In the third quarter alone, Tether purchased about 26 tons of gold, accounting for 2% of global gold demand for the period, equivalent to 12% of known central bank purchases.

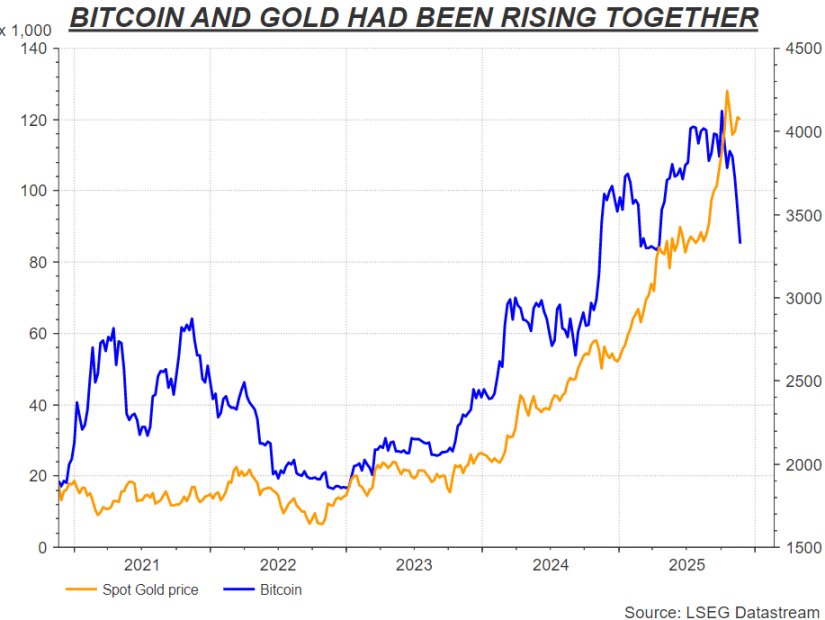

This finding reveals the hidden force behind the 56% surge in gold prices in 2025. This year, gold prices have risen by about $2,000 in two waves, with the second rally coinciding with Tether's accelerated gold purchases. Jefferies points out that Tether's demand "may have tightened supply in the short term and influenced market sentiment, thereby driving speculative capital inflows."

But this deep intertwining of crypto and traditional safe-haven assets also brings risks. If demand for stablecoins were to suddenly reverse, the gold reserves supporting their value would inevitably face selling pressure. For investors who bought gold to hedge against debt or tech bubbles, they now need to consider: has gold itself become a bubble in this process?

Crypto Giant Becomes a New Force in the Gold Market

Tether's influence in the gold market has risen significantly this year. According to Jefferies data, in the two quarters ending September 30, the digital asset company's gold purchases exceeded the scale of official central bank purchases.

The surge in gold prices this year occurred in two phases. The first wave saw an increase of nearly $1,000 in the four months before April, coinciding with tariff shocks and a 10% decline in the US dollar; the second wave was another $1,000 rise from mid-August to mid-October, but the dollar did not weaken further during this period. Central banks remain the largest buyers, with purchases of about 220 tons in both the second and third quarters, but Tether's role as a marginal buyer is more significant.

In the second quarter, Tether's purchases accounted for about 14% of central bank gold purchases; by the third quarter, this proportion rose to 12%. The Jefferies team pointed out that the timeline of the second rally closely matched Tether's accelerated gold purchases. The bank expects this scale of demand to continue—Tether plans to purchase about 100 tons of physical gold in 2025.

Given that Tether's profits are expected to approach $15 billion this year and stablecoins have remained strong amid recent crypto market volatility, this target does not seem difficult to achieve.

Reserve Allocation in a Dual-Token Strategy

Tether's gold purchases are intended to support two different tokens, which explains the complexity of its motivation for buying gold.

As of the end of the third quarter, the reserves for the USDT stablecoin, with a circulation of $174 billion, included 104 tons of gold, while another 12 tons supported the gold-backed token Tether Gold (XAUt). Each XAUt represents one ounce of gold. According to blockchain data, since early August, XAUt issuance has increased by more than 275,000 ounces, equivalent to about $1.1 billion in additional gold reserves.

However, this strategy conflicts with new US regulations. The "GENIUS Act" passed in July this year established a regulatory framework for stablecoins, explicitly prohibiting compliant issuers from using gold as a reserve asset. Tether has announced plans to launch a new stablecoin, USAT, in compliance with the Act, which will completely abandon gold reserves.

This raises a puzzling question: why did Tether increase the proportion of gold reserves for USDT after the Act was passed? Currently, gold prices have fallen more than 6% from the historical high of $4,379 set in mid-October, and Tether's gold purchase strategy seems to be more focused on long-term positioning.

The Speculative Risk of Safe-Haven Assets

The intertwining of gold and the crypto ecosystem may make sense ideologically, but in practice, the two perform very differently.

The common narrative for both is concern over the over-issuance and devaluation of major currencies. Buyers claim to hoard these two types of assets based on "store of value" considerations, as their supply is limited rather than offering fixed returns. However, while bitcoin and other crypto tokens have exploded in growth over the past decade, they remain extremely volatile and highly speculative. This autumn, even as concerns over major currencies shifted to the yen, bitcoin followed tech stocks in a "risk-off" sell-off, plunging by about a third in six weeks.

The logic of stablecoins is indeed different—their value proposition is based on being fully collateralized and instantly redeemable digital dollars. But periodic severe stress in the crypto market remains the norm. If demand for stablecoins were to reverse sharply for any reason, the pressure would inevitably be transmitted to the assets backing their pegs, which now include large gold reserves.

Jefferies expects more gold demand to emerge from the stablecoin sector. But other observers may draw a more pessimistic conclusion: the volatility of cryptocurrencies may have injected the highly speculative ebb and flow into "safe-haven" gold.

The Ambition and Reality of Tokenized Gold

Tether's enthusiasm for gold seems at odds with the regulatory restrictions it faces, but this may reflect its long-term bet on tokenized physical gold.

For most retail investors, holding physical gold is fraught with difficulties—insurance and storage costs are high, self-custody is only suitable for doomsday preppers; futures have rollover costs; gold ETFs charge high management fees and set minimum investment thresholds, and T+1 settlement brings credit risk. Tokenization promises a better way: gold-backed cryptocurrencies can be traded 24/7 with real-time settlement, no management fees, no minimum investment, and no maintenance costs.

But so far, demand remains lacking. Tether is one of only two issuers with more than $1 billion in tokenized gold, while its bridge token Alloy, launched a year ago, was quickly forgotten. XAUt token issuance shows a "concentrated large-scale issuance" pattern similar to USDT, doubling in the past six months, but relative to the physical gold market's daily clearing of about $60 billion, these amounts are still negligible.

However, for an outspoken dollar pessimist, CEO Paolo Ardoino's grand vision may be for Tether to promote a crypto value exchange system backed by gold rather than fiat currency. Before that, Tether needs to convince risk-averse investors that the best way to express concerns about currency devaluation is to buy blockchain tokens from a privately held crypto company registered in El Salvador, which claims to store over 100 tons of unaudited gold bars in an undisclosed warehouse in Switzerland.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

You may have misunderstood JESSE; this is an attempt to bring revenue to the Base chain.

A Quick Overview of the Seven Hot Topics at Devconnect 2025