Ethereum News Update: Ethereum Surges Past $3,000, Bulls Eye $3,400 Target

- Ethereum (ETH) surged past $3,000 in early November 2025, with technical and on-chain data indicating potential for further gains toward $3,400 if the level holds. - Institutional inflows, including $88M into BlackRock's ETHA ETF, contrast with broader crypto outflows, while valuation models suggest a 57-90% undervaluation. - Mixed on-chain signals show recovering active addresses and a low MVRV Z-Score (0.29), historically preceding accumulation phases, but stagnant new address growth limits upside pote

In early November 2025, Ethereum (ETH) climbed past the $3,000 mark, representing a significant milestone for the world’s second-largest cryptocurrency. Both technical signals and on-chain metrics point to the possibility of additional upward movement. This price level has become a focal point for traders and analysts alike, serving as both a psychological and technical pivot. If ETH can maintain momentum above $3,000, it may pave the way for a rally toward $3,400, but repeated rejections could lead to a sharper pullback

On-chain data presents a mixed picture. According to Glassnode, active

Institutional sentiment is also evolving. U.S. spot Ethereum ETFs saw $92.28 million in inflows on November 24,

Valuation models point to considerable upside. Simon Kim’s Hashed dashboard values Ethereum at $4,747, suggesting it is currently undervalued by 57%. Models based on Metcalfe’s Law estimate a fair value of $9,583, while discounted cash flow analysis using staking returns targets $9,067

Nonetheless, there are ongoing obstacles. The creation of new Ethereum addresses has stalled,

Looking forward, Ethereum’s next moves depend on its ability to firmly reclaim the $3,000 level. A decisive breakout could set sights on $3,120 and then $3,400, while a drop below $2,850 could see a retest of $2,700.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet Introduces Zero-Fee Feature for Its Crypto Card in Over 50 Markets

Are Big Changes in Store for the Bitcoin Price?

Secure Blockchain, Misleading Agreements: Spoofing Incidents Increase on Monad

- Monad's mainnet faces spoofing attacks as scammers use smart contracts to mimic ERC-20 token transfers, misleading users with fake logs. - Co-founder James Hunsaker clarifies the network remains secure, but external contracts exploit EVM openness to create deceptive transactions. - Over 76,000 wallets claimed MON tokens in airdrop, creating high-traffic conditions that attackers leverage through fabricated swaps and signatures. - Security experts warn users to verify contract sources and avoid urgent pro

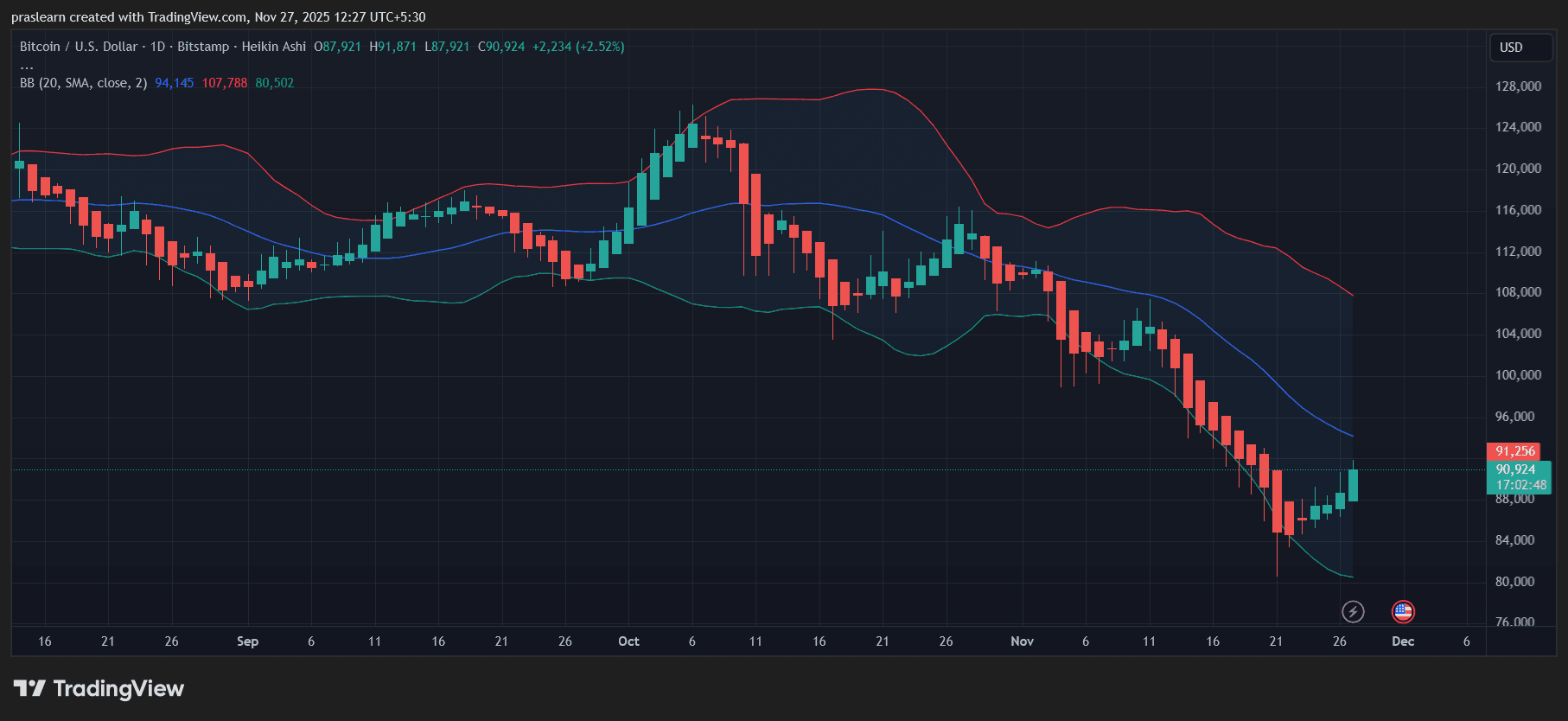

Bitcoin Latest Updates: Worldwide Regulatory Changes and Major Investors Propel Bitcoin and Brazil's Markets Upward

- Bitcoin surged to $91,500 amid institutional adoption, Fed rate cut expectations, and post-halving rebound, despite $3.79B ETF outflows and inherent volatility. - Brazil's stock market hit records after tax reforms exempted low-income households, aligning with global redistributive policies and boosting 15 million earners. - Binance delisted BTC pairs like GMT/BTC for regulatory compliance, while on-chain metrics signaled crypto market consolidation and mixed altcoin prospects. - Global macro risks persi