With three major positive factors, can the crypto market shake off its slump in December?

Ethereum upgrade, Federal Reserve rate cuts, and the confirmation of a dovish Federal Reserve candidate.

Ethereum upgrade, Federal Reserve rate cut, dovish Fed candidate to be confirmed.

Written by: 1912212.eth, Foresight News

Bitcoin has finally rebounded from the $80,000 low to above $90,000, slightly easing market panic. Since October, two consecutive months of sharp declines have left many investors discouraged. So, will the upcoming December become an accelerator for the rebound?

December is not only packed with events, but almost every positive event points in the same direction: loose liquidity + technological leap + policy friendliness. The three driving forces are working together.

Ethereum to activate Fusaka upgrade on December 4

In early November, the Ethereum Foundation released the Fusaka upgrade announcement. The Fusaka network upgrade is scheduled to be activated at Ethereum mainnet slot 13,164,544, expected around 5:00 AM (UTC+8) on December 4, 2025.

The Fusaka upgrade aims to expand data capacity, strengthen resistance to DoS attacks, and introduce new tools for developers and users.

This upgrade could have far-reaching effects. Fusaka is not a minor patch, but a redesign of Ethereum's data availability management, blob pricing, and transaction protection mechanisms. Its success will depend on whether Ethereum can achieve scaling to meet the growing Layer 2 network demand without causing network splits or excessively burdening node operators.

This upgrade includes 11 EIPs, with three core changes:

The core feature of the Fusaka upgrade is PeerDAS, a new way of handling blobs. Each node only needs to store a portion of the blob (about one-eighth) and relies on cryptographic reconstruction technology to fill in missing data fragments. This design verifies data availability through random sampling, with an extremely low error probability, only one in 10²⁰ to 10²⁴.

The number of blobs will increase from 9 to 15 (BPO Fork1 will officially take effect on December 17), which directly means that Layer2 transaction fees will drop significantly again. Gas fees for major L2s such as Arbitrum, Optimism, and Base are expected to be cut by another 30%-50%.

In addition, ordinary EOA accounts will have "account abstraction" capabilities for the first time, allowing users to use features such as email + social recovery, delegated transactions via private key, and batch operations, providing an experience fully aligned with Web2. This will benefit user growth in high-frequency applications such as social, finance, and gaming.

Verkle Trees have been preliminarily laid out, laying the foundation for future "stateless clients", reducing node synchronization time from several weeks to a few hours, and lowering the cost for institutions and large funds to run full nodes.

This Fusaka upgrade comes at a time when the market is catching its breath after despair, so ETH price performance may be worth looking forward to.

The Federal Reserve may cut rates by another 25 basis points in December

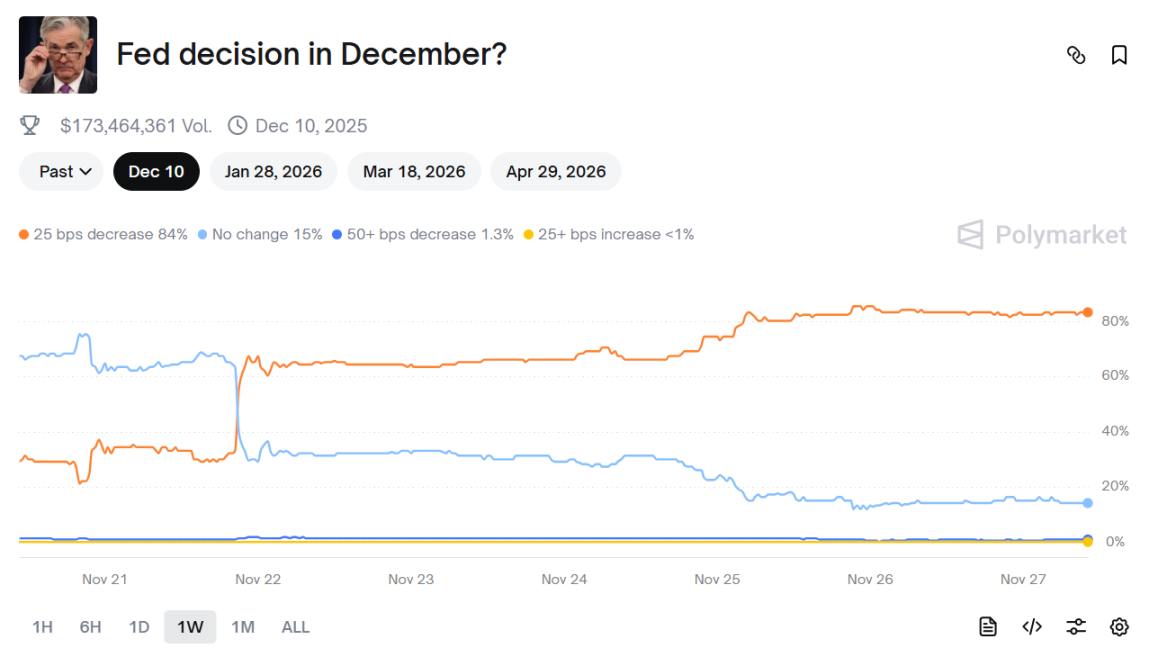

According to the latest CME FedWatch Tool data, the probability of a 25 basis point rate cut at the December 10 (UTC+8) FOMC meeting has soared to 85%, up from just 35% a week ago.

The direct reason for the sharp increase in probability is that November's PPI data was much lower than expected, and inflationary pressure continues to ease. The "tariffs + tax cuts + energy deregulation" combination implemented after Trump took office did push up inflation in the short term, but Fed officials have repeatedly stated that "soft landing" will remain the primary goal before 2026, and they will not easily turn to tightening.

A rate cut means a weaker US dollar index, lower US Treasury yields, and higher valuations for risk assets. More importantly, if there is indeed a rate cut in December, it opens the path for another 1-2 cuts in the first quarter of 2026.

The market will start trading the "rate cut trade" for 2026 in advance, which will help boost the prices of risk assets.

Currently, on Polymarket, the probability of a 25 basis point rate cut by the Fed in December is 84%, while the probability of no rate cut is 15%.

Fed Chair candidate may be announced before Christmas, Hassett leads by a wide margin

This could be the biggest "dark horse" positive in December.

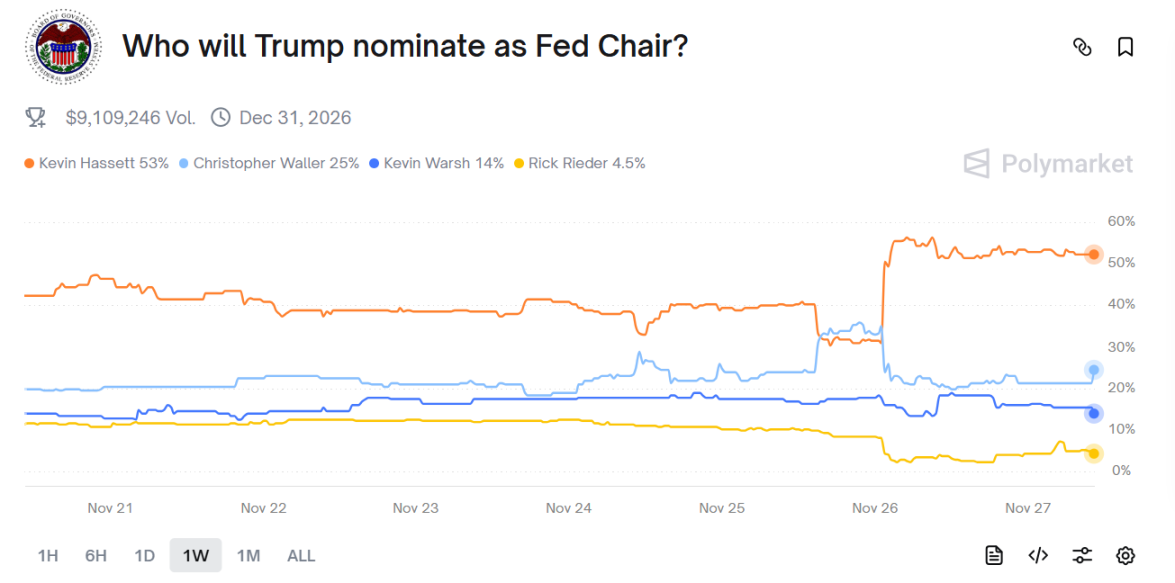

According to the latest reports from multiple media outlets, the Trump team has narrowed the list of Fed Chair candidates to five, with National Economic Council Director Kevin Hassett currently leading by a wide margin. Some sources even say Trump may announce the nomination before Christmas.

According to Polymarket data, the probability of Hassett being nominated is 53%.

Who is Hassett? He served as Chairman of the White House Council of Economic Advisers during Trump's first term and is a typical "rate cut advocate" + "tax cut advocate". He has repeatedly and publicly criticized Powell for raising rates too aggressively and believes interest rates should be much lower than the inflation rate. More importantly, Hassett is extremely friendly toward cryptocurrencies, stating multiple times in 2024 interviews that "Bitcoin is digital gold and should be included in strategic reserves."

If Hassett takes office, the Fed will most likely enter a "super-loose" mode.

Even if it's not Hassett in the end, the remaining candidates (such as Kevin Warsh, Christopher Waller) have all been personally interviewed by Trump, so it's impossible for another "hawk king" like Powell to emerge. A friendly shift in Fed policy is almost a certainty.

Mike Novogratz, founder of well-known crypto investment firm Galaxy Digital, said in a podcast that he still firmly believes Bitcoin can return to $100,000 by the end of the year, but there will be significant selling pressure at that time. Because the "1011" crash had a medium-term psychological impact on the market. At the same time, Novogratz said that as crypto policies become clearer and traditional financial giants join in, the market will become deeply differentiated in the future, and tokens that can provide value will be favored.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aspecta launches Atom upgrade: 100X potential of illiquid assets - trustless tokenization and universal liquidity

Aspecta has launched the Atom upgrade, introducing a brand-new blockchain technology architecture that establishes a non-liquidity asset trading standard based on the AMM mechanism, integrating spot and derivatives trading, all within a framework that requires no centralized trust.

From "Subscription Hell" to Precise Payment: A History of the Evolution of Internet Pricing Models

This will be the topic we will delve into next: how developers can use x402 without worrying about potential failures in the future.

4 Catalysts That Could Boost Bitcoin

Vitalik Buterin Charts ‘Targeted Growth’ as Ethereum Hits 60M Gas Limit Milestone