DeFi Faces a Crisis of Confidence: Token Examination, Tether’s Rating Cut, and Intensified SEC Crackdowns Converge

- Edel Finance's token launch faces scrutiny as 160 linked wallets allegedly acquired 30% of its supply pre-launch, triggering a 62% price drop. - Tether's S&P downgrade to "weak" highlights risks from $12.9B gold and $9.9B bitcoin reserves, with gold holdings rivaling central banks. - SEC intensifies oversight, fining Yida Gao $4M for crypto fund misrepresentation while exchanges warn against crypto exemptions. - DeFi projects like World Liberty Financial spend $10M on token buybacks, yet WLFI remains dow

Ethereum's DeFi sector continues to face close examination as recent findings raise issues about token allocation methods and regulatory hurdles. A new report from

Regulatory scrutiny is intensifying as the U.S. Securities and Exchange Commission (SEC) ramps up its enforcement efforts.

On the other hand, certain DeFi protocols are testing buyback initiatives to restore investor trust.

As the cryptocurrency industry contends with regulatory headwinds and internal governance issues, openness and equitable distribution remain essential for rebuilding confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet Introduces Zero-Fee Feature for Its Crypto Card in Over 50 Markets

Are Big Changes in Store for the Bitcoin Price?

Secure Blockchain, Misleading Agreements: Spoofing Incidents Increase on Monad

- Monad's mainnet faces spoofing attacks as scammers use smart contracts to mimic ERC-20 token transfers, misleading users with fake logs. - Co-founder James Hunsaker clarifies the network remains secure, but external contracts exploit EVM openness to create deceptive transactions. - Over 76,000 wallets claimed MON tokens in airdrop, creating high-traffic conditions that attackers leverage through fabricated swaps and signatures. - Security experts warn users to verify contract sources and avoid urgent pro

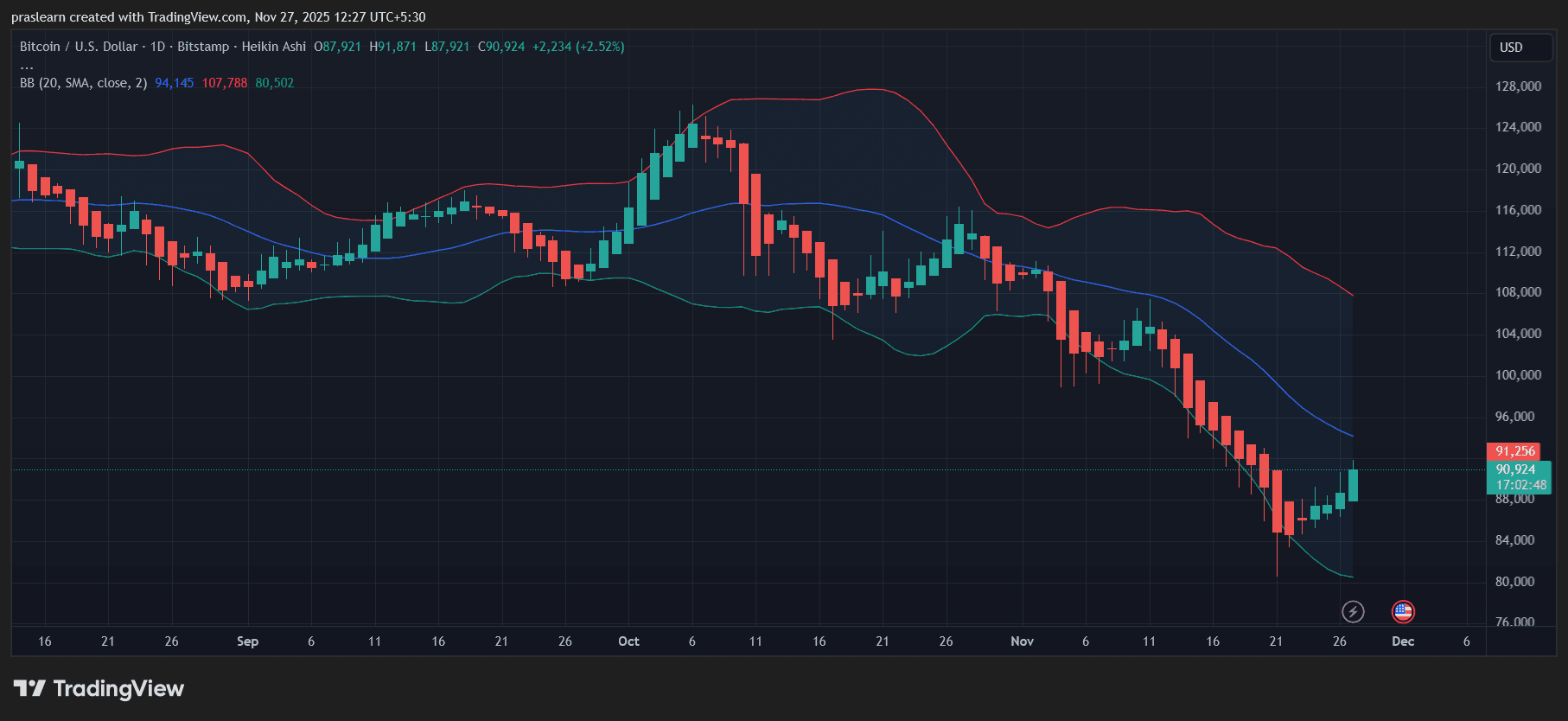

Bitcoin Latest Updates: Worldwide Regulatory Changes and Major Investors Propel Bitcoin and Brazil's Markets Upward

- Bitcoin surged to $91,500 amid institutional adoption, Fed rate cut expectations, and post-halving rebound, despite $3.79B ETF outflows and inherent volatility. - Brazil's stock market hit records after tax reforms exempted low-income households, aligning with global redistributive policies and boosting 15 million earners. - Binance delisted BTC pairs like GMT/BTC for regulatory compliance, while on-chain metrics signaled crypto market consolidation and mixed altcoin prospects. - Global macro risks persi