Ethereum News Update: Ethereum Faces $2,500 Threshold—Beginning of a Supercycle or Start of a Major Sell-Off?

- Tom Lee predicts Ethereum's $2,500 support level could trigger a buying frenzy, framing it as a structural inflection point after systematic liquidation. - BitMine's 3.63M ETH holdings and recent $20M WorldCoin investment signal institutional confidence in Ethereum's long-term tokenization potential. - While Dencun upgrades and staking yields bolster fundamentals, macro risks and $1,500 downside remain concerns amid volatile $2,900-$3,115 near-term price action.

Ethereum’s price movement has captured the attention of both investors and market observers, as Tom Lee, chairman of BitMine and former strategist at Fundstrat, predicts that the $2,500 mark could serve as a springboard for significant buying activity. Lee, a consistent advocate for Ethereum’s long-term prospects, contends that the recent decline from $4,800 to $2,800 is the result of systematic liquidations rather than a breakdown in fundamentals, making $2,500 a pivotal turning point. “This is a deliberate shakeout,” Lee stated,

Technical indicators in the market reinforce this perspective. The $2,500 level for Ethereum is being closely monitored as a crucial support area, with on-chain data and derivatives positioning pointing to potential stability if buying interest holds steady

Nonetheless, the road to recovery is not without obstacles. Ethereum’s lag behind the S&P 500—up 20 days after its peak, while ETH continues to slide—reveals some structural vulnerabilities. The market crash on October 10,

On the other hand, institutional engagement provides some support. BitMine’s recent $20 million commitment to

Long-term confidence is rooted in Ethereum’s core strengths. Forthcoming upgrades like Dencun are designed to boost scalability and lower Layer-2 expenses, while staking returns and developer engagement remain strong

In the short term, volatility persists,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates Today: Tether’s Bitcoin Investment Compared to Stability: S&P Raises Concerns Over Unstable Peg

- S&P Global Ratings downgraded Tether's USDT to "weak" due to 5.6% Bitcoin exposure exceeding its 3.9% overcollateralization threshold and limited reserve transparency. - Tether CEO defended the model, citing no redemption refusals and $10B 2025 net profit, while S&P warned Bitcoin/gold price drops could trigger undercollateralization risks. - Market turbulence saw $3.5B Bitcoin ETF outflows and $9.9B Bitcoin holdings, with Tether expanding into gold producers and crypto lending despite regulatory scrutin

Ethereum Updates Today: Blockchain’s Cleanliness Transformation: Privacy Moves from a Choice to a Necessity

- Ethereum co-founder Vitalik Buterin donated to privacy-focused projects Aztec Network and Kohaku, signaling blockchain's shift toward data protection as a core priority. - The Ignition Chain and Kohaku framework aim to address data breaches like SitusAMC by enabling private transactions via zero-knowledge proofs and protocol upgrades. - Ethereum's Fusaka upgrade (2025) and growing $1.2 trillion blockchain messaging market highlight privacy's rising economic and technical importance in decentralized syste

Australia’s Cryptocurrency Regulations Set to Unlock $24 Billion in Value While Enhancing Investor Protections

- Australia introduces 2025 Digital Assets Framework Bill to unlock $24B productivity gains while imposing strict client asset safeguards. - Legislation creates two new crypto financial product categories under Corporations Act, requiring AFSL licensing for platforms and tokenized custody services. - Exemptions for small operators (<$10M volume) balance innovation with regulation, aligning with global trends like U.S. GENIUS Act and SEC's Project Crypto. - Industry debates regulatory proportionality as Aus

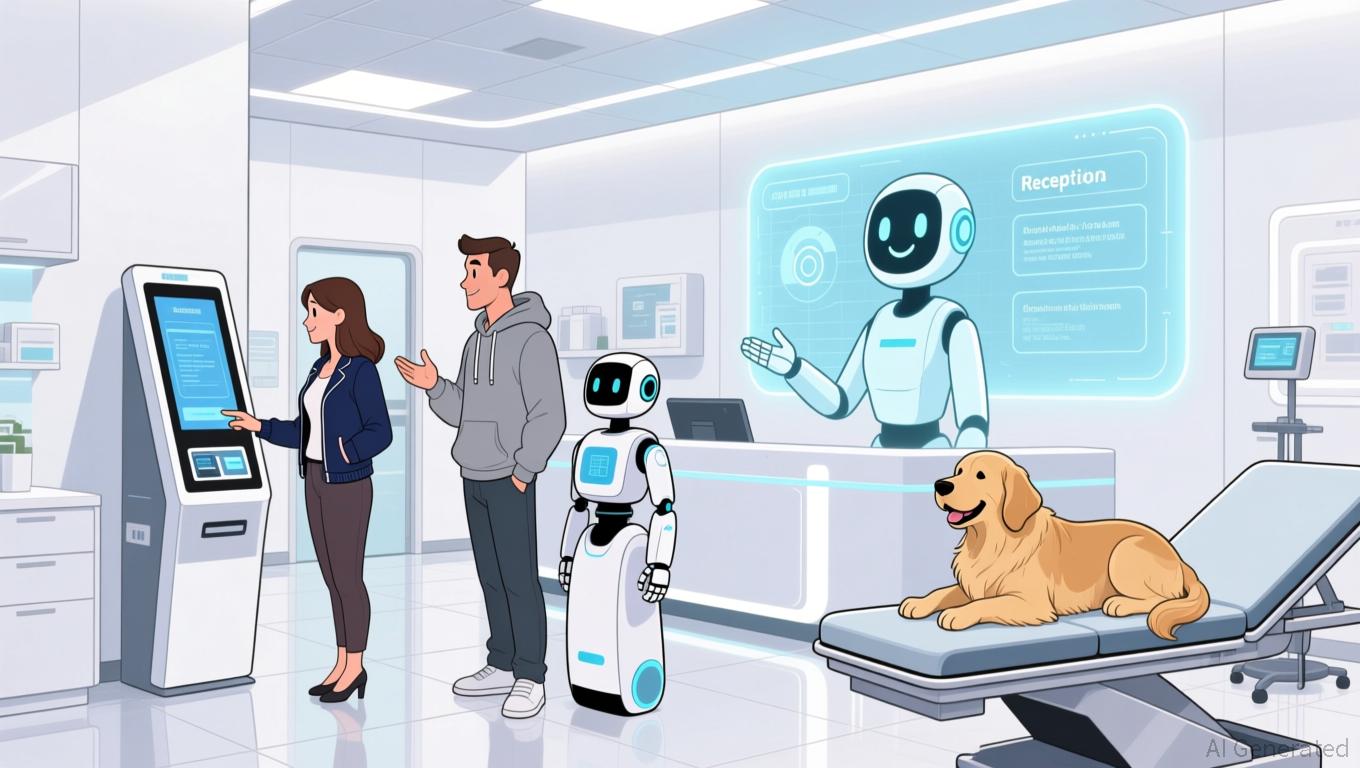

Nexton Connects Traditional Veterinary Clinics with Modern Technology Through $4M AI Investment

- Nexton Solutions secures $4M to launch PetVivo.ai, an AI platform slashing veterinary client acquisition costs by 50–90%. - Beta results show 47 new clients per practice in six months, with a $42.53 CAC—far below industry averages. - Targeting 30,000 U.S. practices, it projects $12M ARR in Year 1, scaling to $360M by Year 5 with SaaS margins of 80–90%. - Strategic AI alliances, like C3.ai-Microsoft and Salesforce’s AI CRM focus, highlight the sector’s growth potential.