XRP Price Still Holds Its Green, But One Group Is Slowly Turning Into a Red Flag

The XRP price trades near $2.20, flat on the day and up about 1.5% in the past week. On the surface, the trend still looks steady compared to the broader market. But when you dig deeper into holder behavior, one group is quietly shifting from supportive to risky. Short-Term Holders Stay Positive, But Long-Term Holders

The XRP price trades near $2.20, flat on the day and up about 1.5% in the past week. On the surface, the trend still looks steady compared to the broader market.

But when you dig deeper into holder behavior, one group is quietly shifting from supportive to risky.

Short-Term Holders Stay Positive, But Long-Term Holders Turn Risky

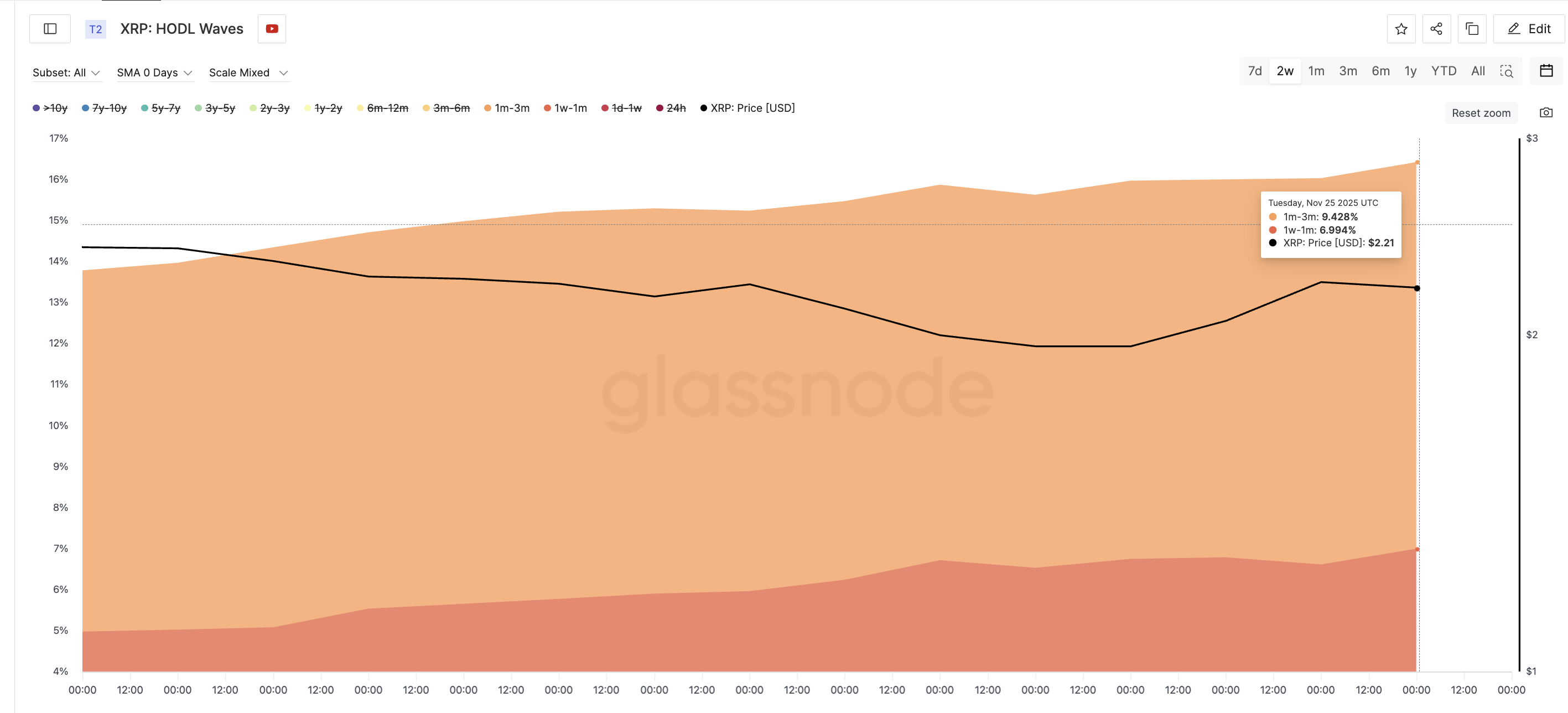

HODL Waves track how much supply sits in different holding-time bands. They show that short-term XRP holders are still steady. The one-to-three-month band has increased the stash from 8.80% to 9.48% since November 11. The one-week-to-one-month band also increased from 4.97% to 6.99%.

These groups usually sell fast when pressure hits, yet they have been accumulating instead.

Short-Term Holders:

Glassnode

Short-Term Holders:

Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

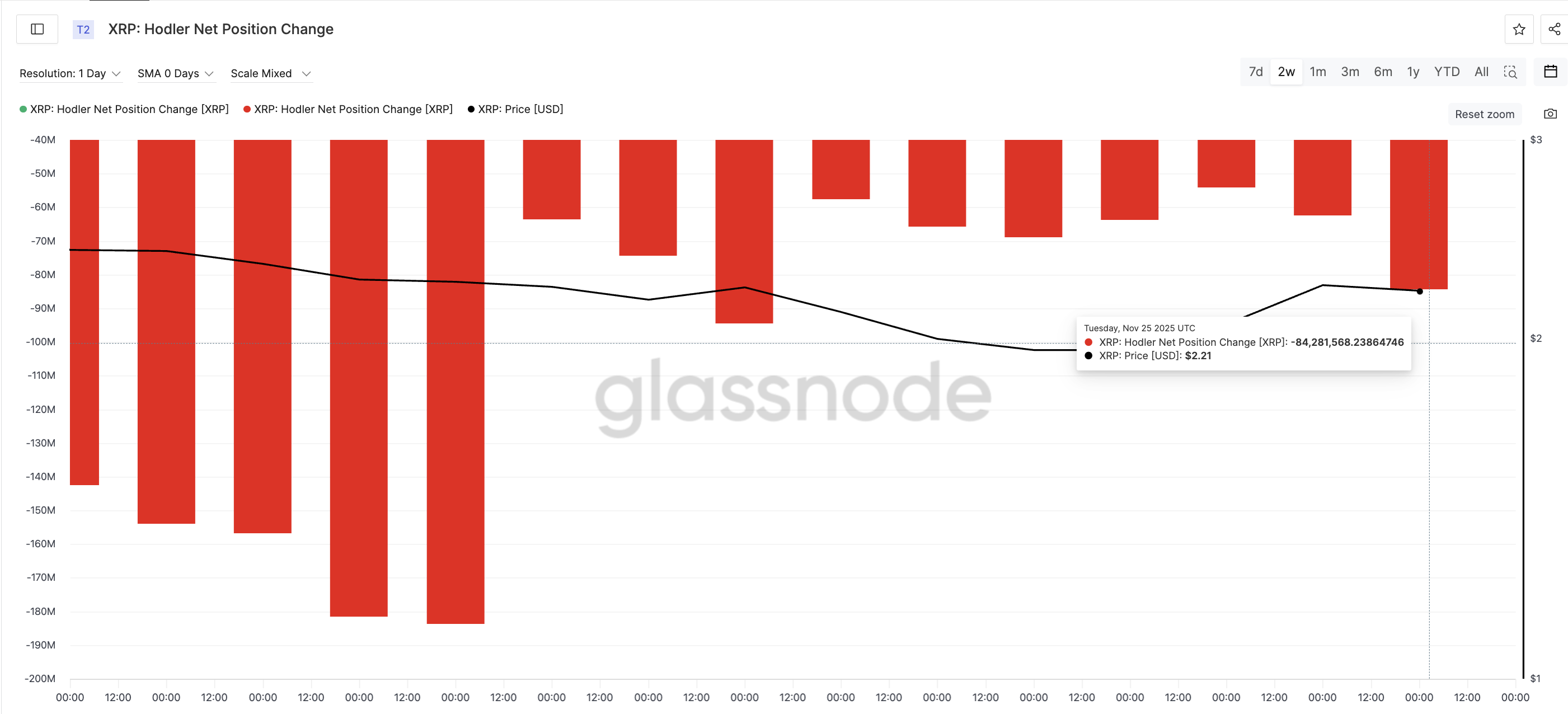

The pressure point sits with long-term holders. Hodler Net Position Change measures whether long-term holder wallets, on net, gain or lose coins.

On November 23, long-term holders were selling around 54 million XRP. By November 25, that number increased to 84 million XRP, a jump of about 56%.

Long-Term XRP Holders Selling:

Glassnode

Long-Term XRP Holders Selling:

Glassnode

This is not a random spike. A similar rise in selling happened between November 16 and 18, which was followed by a sharp drop in XRP from $2.22 to $1.96, almost 12%.

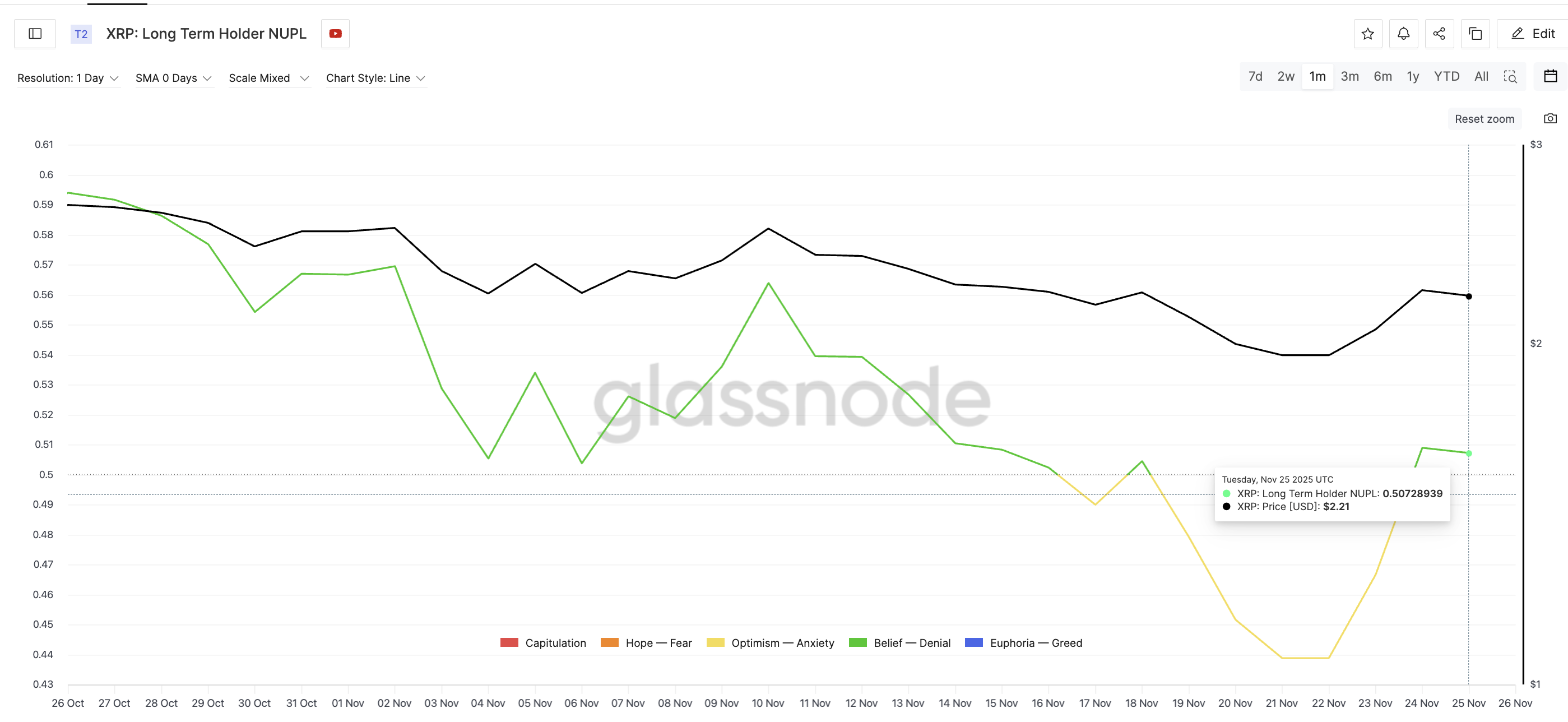

NUPL (Net Unrealized Profit/Loss) shows why. NUPL tracks how much profit or loss holders hold on paper. Long-term holder NUPL is near 0.50, which falls into the “belief–denial” region that often shows local tops. The last time NUPL hit this area on November 18, XRP corrected soon after.

High Profit-Taking Incentive:

Glassnode

High Profit-Taking Incentive:

Glassnode

So the incentive to take profit is real, and long-term holders are acting on it — this is the red flag. A sign that the XRP price is losing conviction among HODLers.

XRP Price Holds Key Levels For Now, But Breakout Confirmation Is Needed?

XRP trades between familiar levels. The first support sits at $2.06. If long-term holder selling increases and price loses this level, XRP could revisit $1.81, a recent local bottom.

To stay in its green zone, XRP needs a clean close above $2.24, flipping the short-term trend upward. That would open the path toward $2.58 and $2.69, but only if big money supports the breakout.

This is where CMF (Chaikin Money Flow) comes in. CMF measures money flowing in from large wallets. It has moved slightly above zero, indicating some inflow, but it still sits below a descending trendline. Until CMF breaks that trendline, inflows are not strong enough to fully offset long-term holder selling.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

For now, XRP price still holds its green (week-on-week), but long-term holders — backed by high NUPL and rising outflows — remain the slow-forming red flag that traders should watch closely.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea’s Naver and Dunamu Join Forces to Take On US Stablecoin Leaders Through AI and Blockchain Innovation

- Naver and Dunamu’s $6.8B merger creates a $13.6B fintech entity to boost AI/blockchain integration, targeting global financial infrastructure innovation. - The merged firm plans a Korean won-pegged stablecoin to challenge US dollar-backed tokens, aligning with national sovereignty goals but facing Bank of Korea regulatory barriers. - A $7B investment in AI/blockchain research and talent aims to position South Korea as an Asian tech leader, despite stalled legislation and global stablecoin liquidity gaps.

Bitcoin Updates: Nasdaq Brings Bitcoin Derivatives into the Mainstream by Raising Trading Limits

- Nasdaq ISE proposes expanding IBIT options limits to 1M contracts, aligning with major ETFs to boost Bitcoin derivatives liquidity. - IBIT's 44.6M daily volume and Deribit-surpassing open interest justify the increase, addressing institutional demand for hedging tools. - Experts praise the move for enabling structured products and capital allocation, with SEC seeking public comments until December 17, 2025. - The change signals Bitcoin's integration into mainstream finance, potentially enhancing market e

Reese Witherspoon: Women Should Manage Their Own Finances to Prevent Money Problems

- Reese Witherspoon advocates for women's financial literacy, sharing personal struggles with debt and divorce to highlight systemic economic inequities. - She emphasizes avoiding debt and financial dependence, urging women to prioritize careers as "life insurance" against relationship or career disruptions. - Witherspoon's $900M media company and mother's financial hardships inform her mission to empower women through practical financial education and independence. - Her advocacy aligns with global gender

Bitcoin Updates: Pressure on Bitcoin Miners Signals Potential Upward Price Shift

- Bitcoin surged to $91,950 on Nov. 26, with mining costs near breakeven at $83,873, signaling a potential price inflection point . - Miner margins fell to 4.9% as hash prices dropped below $35/PH/s, extending equipment payback periods beyond 1,200 days. - China's mining share rebounded to 14% amid cheap energy, while institutional holdings like KindlyMD's 5,398 BTC highlight growing adoption. - A declining NVT ratio below its low band suggests imminent consolidation, though macro risks like rising rates c