Dogecoin ETF Launch Fails To Shine, Less Than $2 Million Inflows in 48 Hours

Dogecoin entered this week with expectations of a strong rebound following the launch of the first-ever Dogecoin ETF. However, the market’s reaction has been far weaker than anticipated. Instead of triggering renewed bullish momentum, the ETF rollout appears to have highlighted a lack of appetite among investors. Dogecoin ETF Fails To Impress ETF data shows

Dogecoin entered this week with expectations of a strong rebound following the launch of the first-ever Dogecoin ETF. However, the market’s reaction has been far weaker than anticipated.

Instead of triggering renewed bullish momentum, the ETF rollout appears to have highlighted a lack of appetite among investors.

Dogecoin ETF Fails To Impress

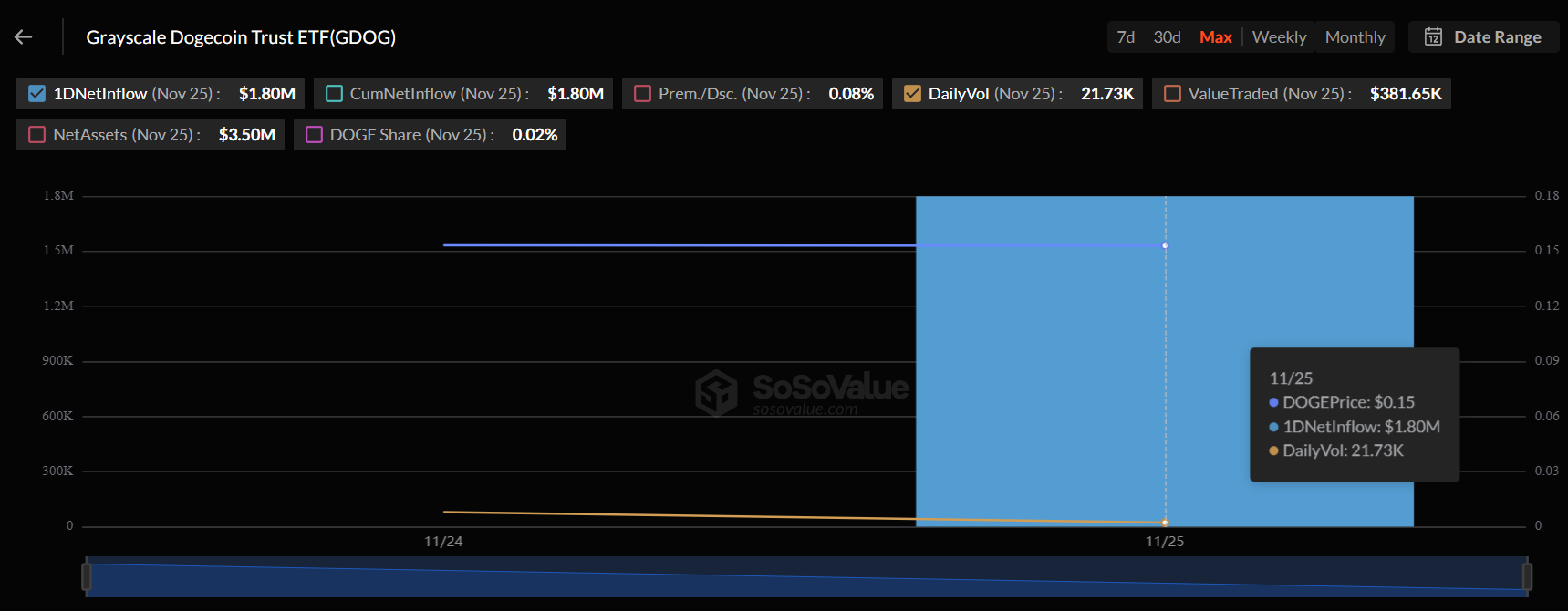

ETF data shows that Grayscale’s Dogecoin ETF (GDOG) had an unexpectedly poor debut. On launch day, GDOG recorded zero inflows — an unusual outcome for a highly anticipated spot product. By Tuesday, total inflows had reached only $1.8 million.

For context, Dogecoin has a $22 billion market cap, yet Hedera — with a far smaller $6 billion market cap — recorded $2.2 million in inflows on the first day of Canary Capital’s HBAR ETF (HBR).

The lack of demand suggests that the ETF has not ignited the enthusiasm many expected. Instead, it has revealed a mismatch between social sentiment and actual investor conviction.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Dogecoin ETF Inflows. Source:

SoSoValue

Dogecoin ETF Inflows. Source:

SoSoValue

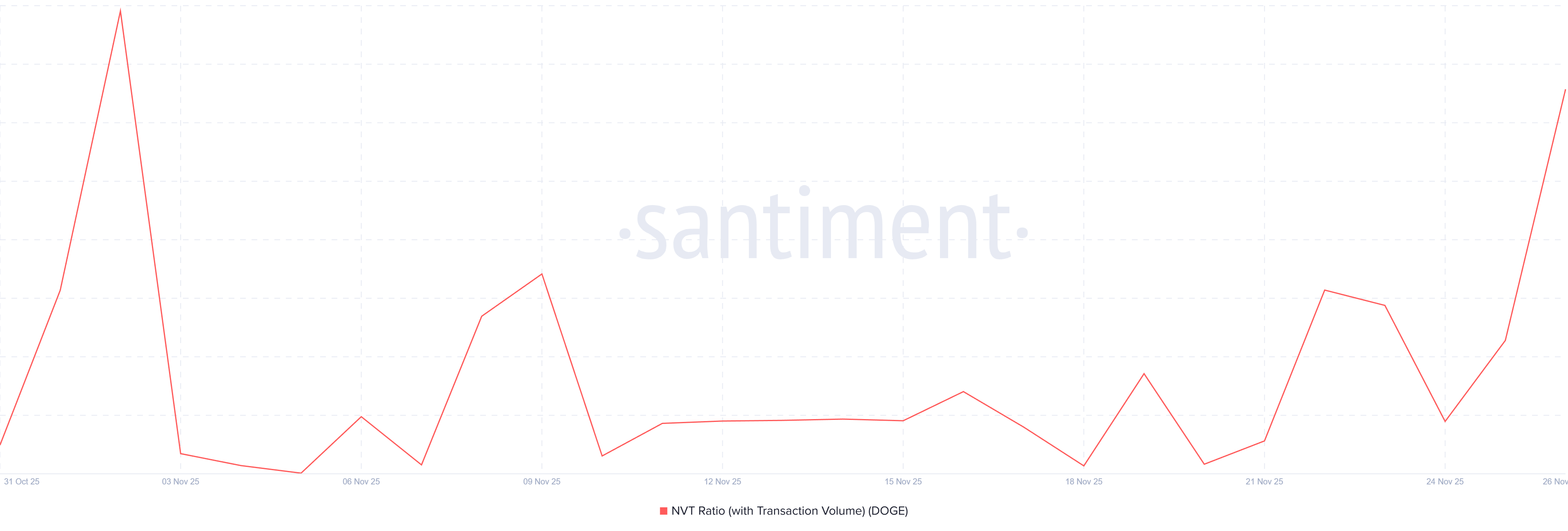

On-chain indicators reinforce the narrative of weak demand. Dogecoin’s Network Value to Transactions (NVT) ratio has surged — a bearish sign. A spiking NVT indicates that valuation is rising faster than transaction activity, meaning the asset is being hyped without corresponding network usage. While DOGE continues to trend on social media, this enthusiasm has not translated into an increase in meaningful on-chain activity.

The current NVT reading suggests that Dogecoin is overvalued relative to its transaction volume. Historically, high NVT levels precede price corrections, as they reflect declining utility amid rising speculative interest. For DOGE, this disconnect highlights the risk of further downside unless transaction activity increases.

Dogecoin NVT Ratio:

Santiment

Dogecoin NVT Ratio:

Santiment

DOGE Price Needs More To Break Out

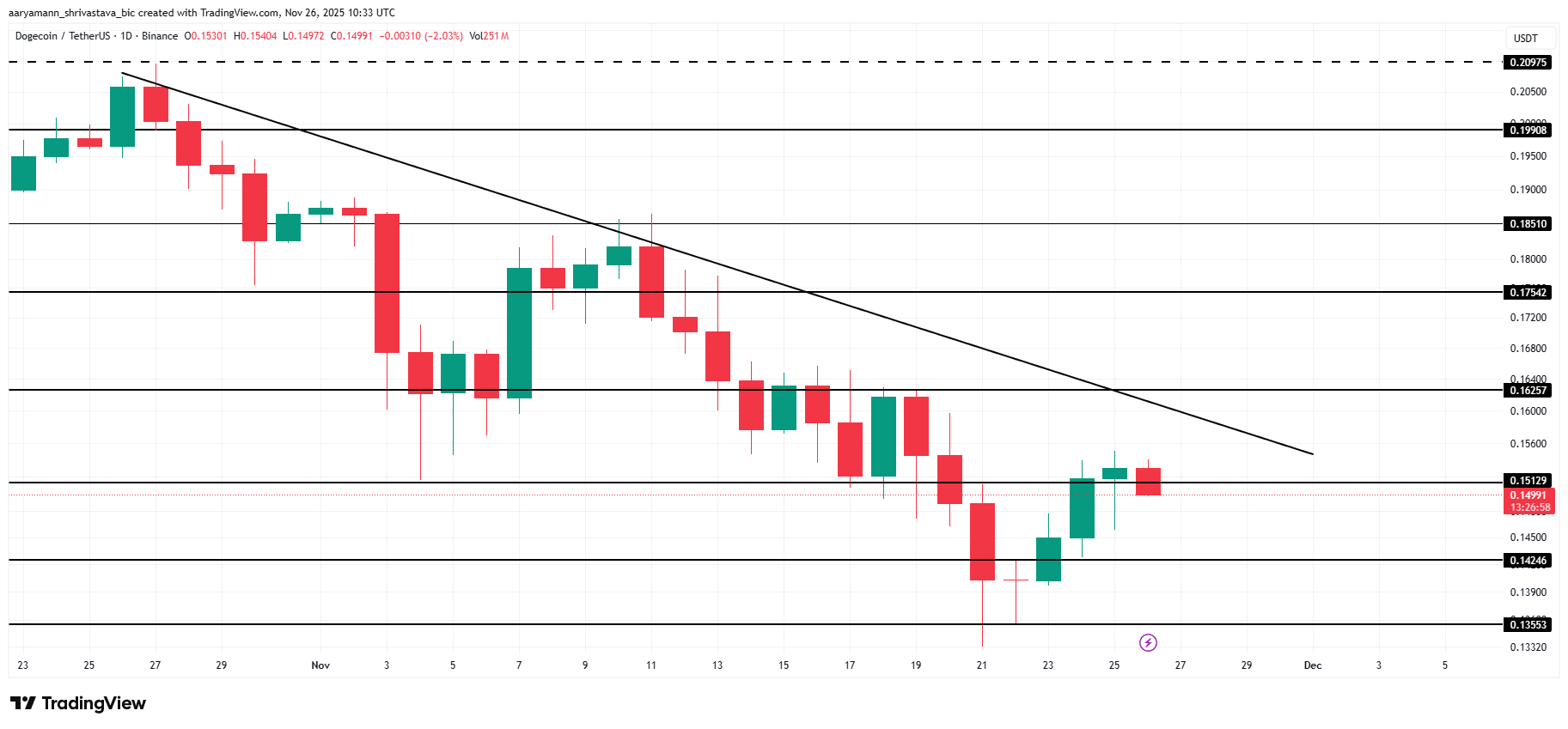

Dogecoin is trading at $0.149, sitting just below the $0.151 resistance. The meme coin remains trapped under a persistent downtrend that has lasted nearly a month, with little evidence of a breakout forming.

Given the weak ETF inflows and bearish on-chain signals, breaking above this downtrend could be difficult. DOGE may continue oscillating under the trendline and could fall toward $0.142 if selling pressure increases.

DOGE Price Analysis. Source:

TradingView

DOGE Price Analysis. Source:

TradingView

If Dogecoin manages to attract fresh demand, however, the picture changes. A decisive breach of the downtrend could push the price above $0.162 and potentially toward $0.175. This would invalidate the bearish thesis and set the stage for renewed momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CME Group halts futures trading as cooling system breaks down

Flare Network’s major upgrade is here: what’s the outlook for FLR price?

XRP price prediction: ETF inflows, CME futures, and technical pressure align

Basic Attention Token price soars as Brave Browser activity rises: how far can BAT coin rise?